A no-buy year involves cutting all discretionary purchases out of your budget for 12 months. This can be incredibly helpful if you’re trying to pay off debt or save for a large future purchase.

Of course, a no-buy year can also be quite challenging – especially if you’ve never attempted something like it before. Keep reading as I share some tips for completing a no-buy year successfully.

First, though, let’s discuss why you’d want to attempt a no-buy year to begin with.

Benefits of completing a no-buy year

You’ll make incredible progress towards your financial goals

All the money you don’t spend during your no-buy year can be saved, invested, or used to pay off debt. Depending on your current spending habits, you could end up thousands (or even tens of thousands) of dollars ahead by the end of your no-buy year.

You’ll figure out which expenses actually matter to you

Over the course of your no-buy year, you’ll likely realize that much of your discretionary spending didn’t actually make you happier. After your no-buy year, you may decide to leave those categories out of your budget permanently and only bring back the purchases you missed.

You’ll learn to enjoy things you already own

It’s often hard to be content with your belongings when you’re aware of all the other shiny objects out there just waiting to be purchased. This should become much easier during a no-spend year. You’ll ultimately accept there’s no point drooling over things you won’t be buying anytime soon.

You’ll have more time to spend on things that matter

Over the course of your no-spend year, you’ll likely be surprised to discover how much time you discretionarily shopping or thinking about doing so. You can subsequently shift that time towards learning new skills, starting a side hustle, spending time with your family, or just about anything else that matters to you.

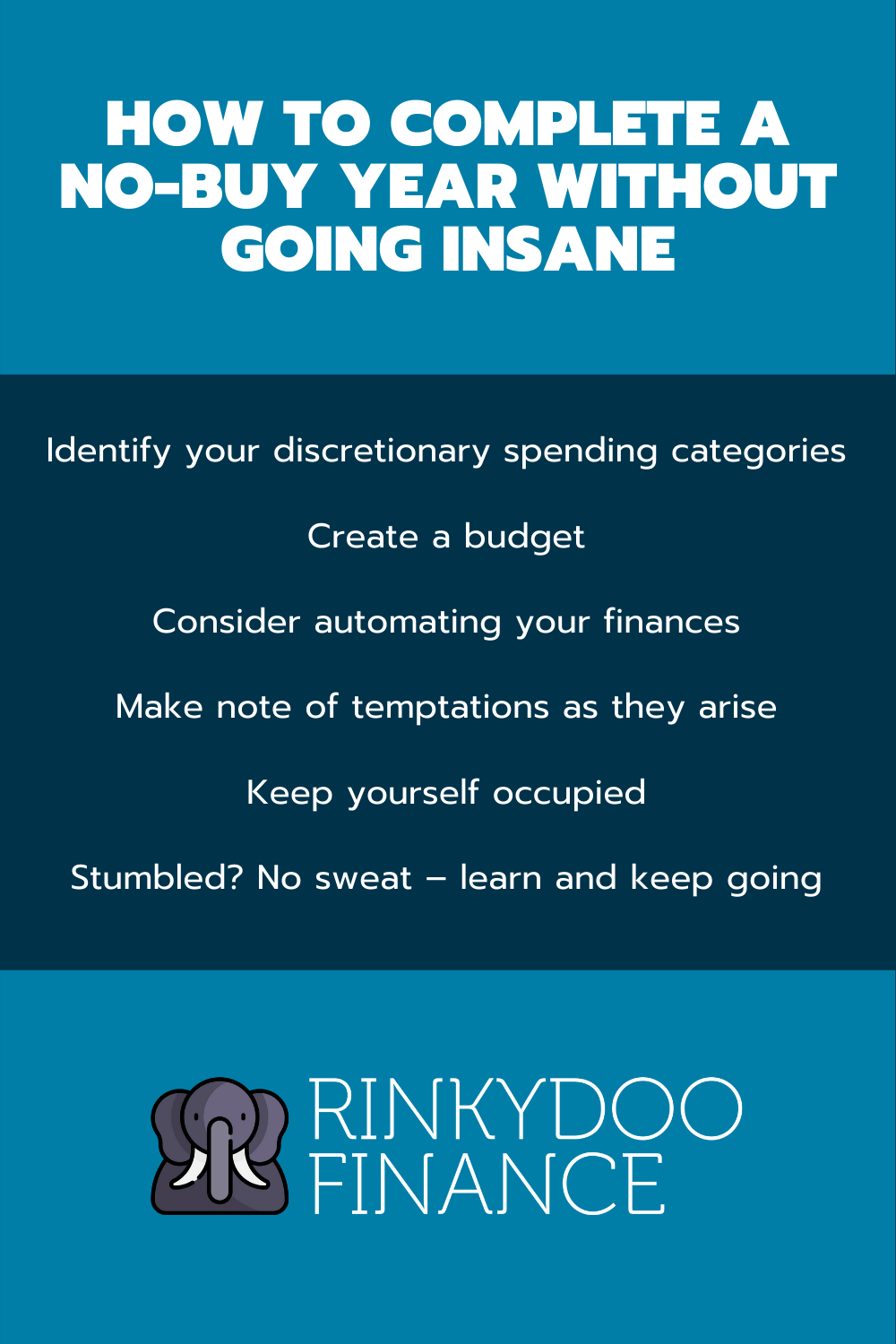

Step-by-step guide to completing a no-buy year

1. Figure out which of your expense categories are discretionary

Start by figuring out which of your expense categories are discretionary. Common examples include:

- dining out

- non-essential clothing

- non-essential subscriptions (i.e. Spotify, Netflix, etc)

- travel

- technology upgrades (i.e. buying the latest iPhone simply because you want an upgrade)

Any expense category you identify in this step will need to be cut from your budget entirely during your no-buy year. Anything outside this list of categories will constitute your essential expenses (aka things you’ll continue buying during your no-spend year).

Not sure where to find a breakdown of your expense categories?

Most major banks nowadays offer online platforms on which users can monitor their spending in various categories. If yours doesn’t, check out my third point in my article about organizing your finances. There, you’ll find some tips for getting set up with Mint, a popular financial tracking application.

2. Create a budget

Once you know which expense categories you’ll be eliminating, build a budget around that information.

Ideally, your spending in essential categories (i.e. groceries, rent, etc) should hold steady. In other words, don’t take the money you’ll save on non-essentials and put it towards essentials.

Rather, use the money to get ahead by paying off debt, saving, and/or investing. You should build those activities into your budget, allocating a percentage of each paycheck accordingly. Not sure how to prioritize? Once again, check out my article about organizing your finances. This time, refer to the second point in which I provide a sensible hierarchy of financial priorities.

3. Consider automating your finances

Completing a no-buy year successfully takes lots of willpower. Financial automation will make your life much easier by removing most of your opportunities to slip up.

Start by automating whatever you plan on doing with the money you’ll save by skipping non-essential expenses. If you plan on investing, for example, set up automatic brokerage account deposits. Plan on paying off debt aggressively? Set up automatic bill payments.

By doing this, you’ll never find yourself staring at that money in your bank account and thinking of all the different (non-essential) things you could spend it on. The money will go where it should automatically.

Learn more about how to implement financial automation (and the benefits of doing so) in my article on that topic.

4. Make note of temptations as they arise

A year is a very long time to go without any discretionary spending. At some point or another, you’ll likely find yourself tempted to call it quits. Make note of those feelings, including:

- who you were with

- what you were doing

- your mood at the time (i.e. whether you were stressed)

Before long, you should become aware of the emotional triggers that prompt you to spend discretionarily. You can then avoid those triggers in the future.

5. Keep yourself occupied

Years ago, a client introduced me to a concept I’ve remembered ever since. He called it “crowding out the bad stuff.”

His logic went that your likelihood of successfully abandoning a bad habit (even if just temporarily, as in the case of a no-buy year) is much lower if you don’t replace it (aka “crowd it out”) with something else.

For example, let’s say shopping relieves your stress and serves as a release for your impulsivity. If you stop shopping yet don’t find something else to meet those purposes, you’ll be in for a bad time.

Suitable alternative activities might include going on more spontaneous adventures (to satisfy your impulsivity) or exercising more (to relieve stress).

Whatever you choose, make sure you keep yourself occupied. You should never feel like there’s a void in your life where shopping used to be.

6. Stumbled? No sweat – learn from it and keep going

The first time you attempt a no-spend year, you’re bound to slip up once or twice. That’s okay. The goal in personal finance (and life in general) isn’t to achieve perfection. It’s to put your best foot forward, learn from your mistakes, and do better next time.

Keep in mind, you’ll still likely be far better off at the end of your no-spend year than you otherwise would’ve been. A few moments of weakness won’t make the entire experience meaningless.

Don’t get me wrong – you shouldn’t let yourself off the hook. Commit to learning from your mistakes and avoiding them next time you attempt a no-buy year. You might even want to extend your no-buy year every time you slip up.

Not sure a no-buy year is right for you? Start smaller

While completing a no-buy year successfully can do tremendous things for your finances, there’s no shame in starting smaller.

If you don’t think a full year is feasible, why not try a no-spend month? You might even choose a month in winter (assuming you go out less during that time of the year). You could even try a no-spend weekend!

Whatever your chosen length of time, the steps I’ve outlined above will still be helpful.