The idea of living below your means is often trumpeted as essential for financial success – and justifiably so. Spending far less than you earn shields you from the potentially devastating effects of unexpected expenses and high-interest debt while also allowing you to save and invest.

Of course, this is easier said than done. In fact, it may seem downright impossible if you’re currently living paycheck to paycheck or otherwise struggling to make ends meet.

It’s not impossible, though. In fact, if you take these tips to heart, you’ll find it difficult to do anything but live below your means!

The best part? As you’ll see, living below your means does not have to entail depriving yourself of things you enjoy. In fact, you’ll be able to spend in those areas without feeling guilty or as if you’re spiraling out of control.

Definition of living below your means

In simple terms, living below your means entails spending less than you earn and using the surplus to get ahead through saving and investing. This stands in stark contrast to the dominant, credit-hungry mindset that fails to recognize income as a hard limit on what one can spend.

What’s crucial to note is that living below your means is not incompatible with having fun and living luxuriously. In fact, you should absolutely strive to do those things if they align with your values.

The key is to avoid jeopardizing your financial future in the process. This means budgeting for fun activities ahead of time rather than plopping them on your credit card and dealing with the consequences later.

4 signs you’re living beyond your means

To help flesh this definition out a bit more thoroughly, let’s discuss what living below your means doesn’t look like.

Carrying a credit card balance

A substantial credit card balance is completely incompatible with the idea of living below your means. After all, if you could actually afford those purchases, you wouldn’t need to put them on credit. It’s really that simple.

Saving little to none of your income

If your lifestyle leaves you unable to save any chunk of your income, you’re very clearly living beyond your means. Remember, at some point, you won’t be able to work. It’s your responsibility during your working years to set money aside for that time.

Spending more than 28% of your income on housing

According to the United States Consumer Financial Protection Bureau, traditional mortgage lenders view 28% as the maximum portion of income one can comfortably spend on housing. If you’re spending more than that, you have too much house, which is a very common form of living beyond your means.

Living paycheck to paycheck

If your salary is the only thing preventing you from defaulting on your bills, you’re in a very bad spot. You should always have a cash buffer that can shield you from financial hardship, which is impossible to do if you’re living beyond your means.

Benefits of living below your means

Next, let’s discuss a few major benefits of living below your means.

Less stress

Living beyond your means involves borrowing from your future self. There are several problems with this. For one, there’s no guarantee the future will look like you expect. You may lose your job and, with it, the ability to make debt repayments.

The awareness of this possibility stresses many people out. Conversely, those who live below their means enjoy peace of mind since they’ll always have a buffer to fall back on.

More flexibility

When you live below your means, you retain the ability to take greater leaps of faith since failure would not result in an immediate financial trainwreck.

It’s very hard to start a business, change careers, or move across the country when doing so would mean potentially missing debt repayments since you never kept any of your income for such circumstances.

Wealth-building

Living below your means opens the door to building tremendous wealth. In fact, if you start this process early enough in life and keep at it, you’ll eventually be able to afford even greater luxuries than your current financial situation would allow.

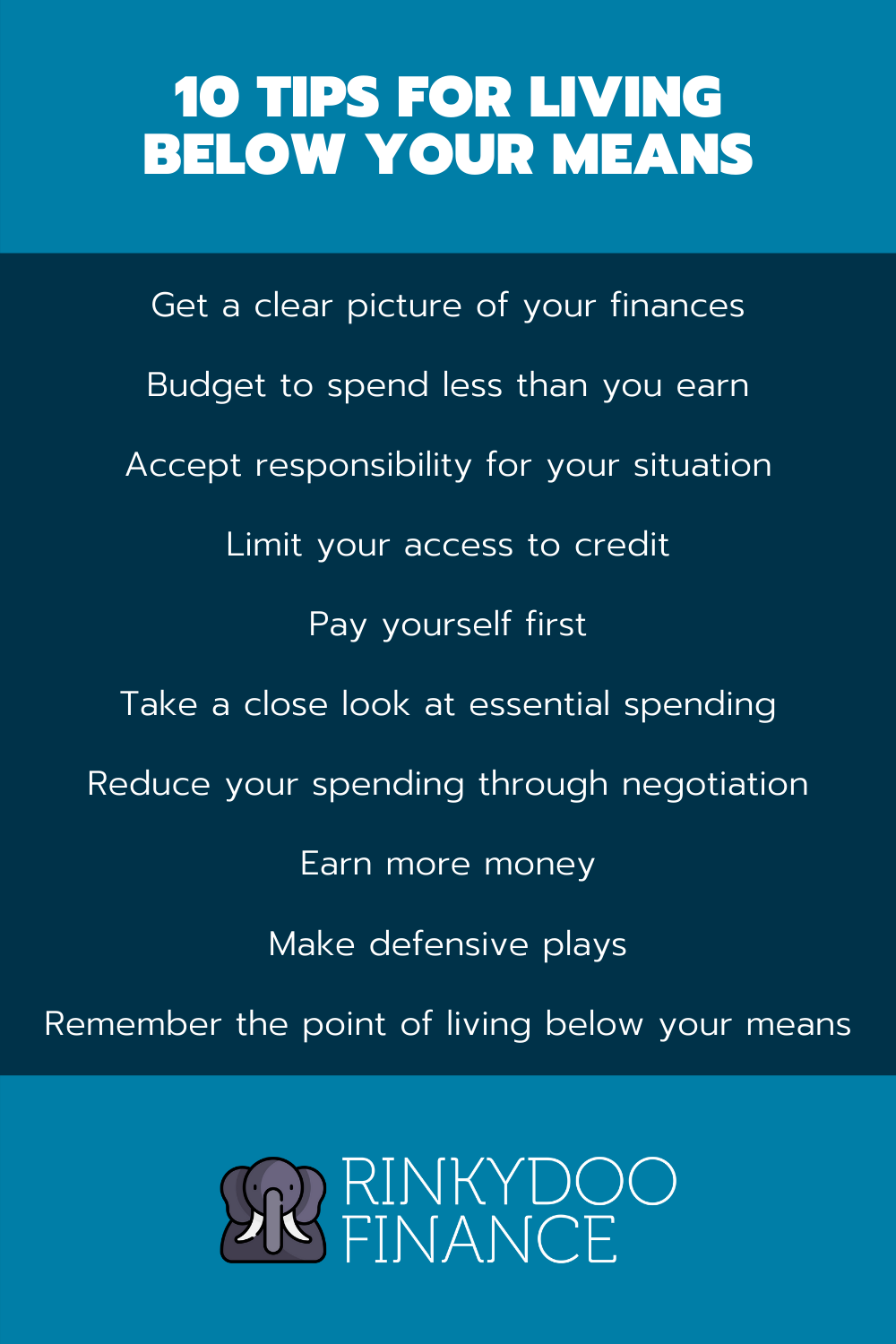

10 tips for living below your means

1. Get a clear picture of your financial situation

You can’t really live below your means if you don’t have an accurate understanding of your means, to begin with. Key metrics to figure out include the following.

Income

Your income is your financial foundation. Living below your means ultimately comes down to spending less than this amount and being wise about how you use the difference.

This perspective on income is far from the norm. In fact, entire industries rely on consumers viewing income as little more than collateral for oversized loans.

While it’s easy to simply rely on your pre-tax salary as a representation of your income, I’d argue you need to take a closer look at those pay stubs. Specifically, identify your take-home pay, which more accurately represents the amount of money you have at your disposal on a daily basis.

Debt-to-income ratio

Your debt-to-income ratio is the percentage of your earnings going towards debt repayments. You can calculate this metric using the following formula:

(all your monthly debt repayments / gross income) x 100

If you end up with a number higher than 43, you’re walking a financial tightrope by most standards. According to the U.S. Consumer Financial Protection Bureau, that’s generally the highest ratio you can have while still receiving a Qualified Mortgage from major lenders.

Any ratio in excess of this indicates that financial pressure could leave you unable to make mortgage payments. In other words, you’re living beyond your means.

Savings rate

Your savings rate is the percentage of your take-home pay you ultimately keep for saving or investing. You can calculate it using the following formula:

(amount saved / net income) x 100

According to the Federal Reserve Bank of St. Louis, the average personal savings rate in America is currently 16%. While there’s no magic number, the higher your savings rate, the better you’re doing at living below your means.

Net worth

While your debt-to-income ratio, take-home pay, and savings rate offer valuable insights into the minutiae of your financial situation, your net worth is all about the big picture. The formula for calculating your net worth is simple:

sum of your assets – sum of your liabilities

If you’re like most people, the assets comprising your net worth will ultimately be the bulk of what you have to rely on in retirement. As such, you generally want to see your net worth rising steadily throughout your working years.

If your net worth remains stagnant for years, however, this is a very clear sign you’re living beyond your means by giving too much of your income away.

It’s important to note that your target net worth shouldn’t be arbitrary, which brings me to the next crucial metric.

Financial independence number

Your financial independence number represents the amount of money that, once obtained, would allow you to retire securely. Generally speaking, it’s calculated using this formula:

annual household spending / 0.04

For example, you’d need a net worth of $1.25 million to sustain annual household expenses of $50,000 with minimal risk of depleting your retirement fund.

However, ensuring the accuracy of your financial independence number requires a more nuanced approach than relying on a generic formula. Check out this fantastic article from Retire Before Dad for a closer look.

Once you calculate your financial independence number, use it to contextualize your net worth goals. You should constantly be moving towards achieving your financial independence number. If you’re not, you’re living beyond your means.

2. Budget to spend less than you earn

Once you have a clear picture of your financial situation, it’s time to make a budget that keeps your net worth growing towards your financial independence number.

Now, many people groan when they hear the word “budget” because they assume it entails pinching pennies and cutting all joy out of your spending.

While it’s definitely possible to approach budgeting that way, most people won’t stick with it. They’ll be right back to living above their means within a matter of months.

In my opinion, it’s much more productive to approach budgeting with the objective of living a fulfilling life today without limiting your ability to save and invest towards a brighter future.

In practical terms, this means spending as little of your income as possible on things you don’t particularly care for and then splitting the difference wisely between investing for the future and enjoying yourself today. Here are the steps I take.

How to budget below your means

1. Establish a savings target

I base my savings target on major goals such as retirement and purchasing a home. Whenever possible, I save enough to stay ahead of pace. If my goal was to save $10,000 annually, for example, I’d save $1,000 per month rather than the $833 required to stay on pace. That way, if unexpected expenses left me unable to come up with the $1,000 in any given month, I’d at least have a buffer to fall back on.

By making my savings target my budget’s foundation, I leave myself no choice but to live below my means.

2. Identify areas of value to spend more in

Next, I like to identify areas in which I believe spending will substantially improve my life. Travel is a big one. This category can also include more practical things, however, such as living downtown for the sake of a shorter commute (which isn’t something I personally care about but I know many do).

3. Look at everything else

Once I’ve allocated money towards saving and high-value spending, I carefully consider everything else. For budget items that are essential yet don’t particularly excite me (i.e. my phone plan), I aim to spend as little as possible.

If something is neither essential nor of value to me (i.e. a particular item at the grocery store I buy out of habit more than anything else), I cut it out completely.

4. Adjust so all the pieces fit

Occasionally, I find that – following the previous three steps – I end up with more expenses than income. No problem; I just trim wherever needed to ensure the total amount of money I’ve allocated in my budget is equivalent to my income.

This is called zero-sum budgeting, by the way. It entails giving every single dollar a job, which limits your ability to live beyond your means.

3. Even if living beyond your means isn’t a choice, accept responsibility

Many people live above their means because they simply see no other option for covering the cost of necessities like food, clothing, and shelter. According to one study from the Urban Institute, nearly 40% of Americans (including middle-class households) find themselves in this situation.

If you’re among them, I highly recommend checking out this article. In it, I take a very detailed look at the reasons such financial difficulty is so common and propose a number of practical solutions, including:

- improving your financial literacy

- moving into a higher-paying job

- controlling your spending

- setting clear financial goals

- planning for emergencies

It’s imperative that you take your financial destiny into your own hands, even if you have no reason to feel at fault for lacking the resources required to live below your means. After all, nobody else is coming to save you; they’re too busy trying to stay afloat themselves!

4. Limit your access to credit

Credit makes it very easy to live beyond your means. With it, you can buy exuberant cars, houses, and luxury goods you wouldn’t otherwise be able to dream of owning.

This is a terrible way to live. For one, it guarantees you’ll grossly overpay for merchandise.

Let’s say you purchase a $6,000 item with your credit card and then proceed to make $200 payments towards the balance every month. Assuming an interest rate of 18%, it would take you 41 months (3.5 years) to pay off the balance.

In that time, you’d pay $2,030 in interest on top of the $6,000 you borrowed. The item you purchased, meanwhile, would probably be worth just a fraction of its original cost by then.

This behavior also sets a bad precedent. It makes you see “I can make the monthly payment” as being synonymous with “I can afford this,” which simply isn’t true.

You see, lenders can always adjust your loan terms to create the illusion of affordability, which is a very common trick among car dealers. The end result is that your income stays tied up for longer.

If, even after hearing how dangerous credit can be, you’re still tempted to abuse it, limit your access. Don’t keep more credit cards than you need. Whenever possible, you should also strive to spend with cash or debit. Leave your credit cards at home!

5. Pay yourself first

I touched on this point in the second tip but it’s worth highlighting on its own.

The concept of paying yourself first entails prioritizing saving and investing rather than giving all of your income away to retailers, salesmen, and utility companies. In other words, it’s the essence of living below your means.

Paying yourself first involves approaching your finances in a very intentional, uncompromising manner. Rather than viewing your long-term financial goals as being up for negotiation, you need to treat them as seriously as you would your bills and other fixed obligations.

I wrote about this in greater detail over here. Check that post out for some very concrete action steps you can take towards paying yourself first, every single time.

6. Take a close look at essential spending, too

Living beyond your means involves overspending on much more than just wholly discretionary things like gadgets and vacations. In fact, the most egregious examples of overspending often involve essential items such as houses and cars.

You see, while you need shelter and transportation, you don’t need an 8,000 square foot mansion with a Range Rover in the garage.

Keep this in mind as you budget your income, especially if you find you’re still overextended even after slashing discretionary purchases. Your essential spending is the next logical place to look.

“But my house is an investment!”

Many people scoff at the idea that it’s possible to overspend on a house. After all, houses are investments, right?

Well, that’s debatable. Some fairly convincing arguments have been made against the idea. Check these out:

- Wealth manager: Buying a home is ‘usually a terrible investment’

- The truth? Your house is not an investment

- Sorry, but your home isn’t an ‘investment’

- Why buying a home is not a good investment (it’s a service)

The crux of the issue is that homeownership involves many hidden fees that can easily – and silently, over the course of several decades – eat away at any gains you make from the property’s appreciation in value.

The costlier your home, the higher these costs, which include things like maintenance, property taxes, and realtor fees. Unless you’re making a substantial down payment, your mortgage will also be pretty monstrous, tying up more of your income for longer. In other words, you’re really not doing yourself any favors by biting off more than you can chew house-wise.

7. Reduce your spending through negotiation

Reducing your spending in a particular area doesn’t always have to mean getting less. Often, it’s possible to get precisely what you want at a better price. The trick is to negotiate.

This doesn’t require aggression or a confrontational attitude. In fact, you’ll often find it’s easier to get your way if you calmly explain what you want and why it’s warranted.

I use this approach all the time with my telecommunications provider.

Recently, I saw my internet rate was about to go up. I reached out to my provider and explained, very calmly, that it simply would not make sense for me to pay the higher rate given that competitors were offering substantially lower promotional rates for newcomers. The customer service representative was very understanding and promptly put together a deal that saw me paying even less than I was originally.

However you choose to negotiate, doing so can help you live below your means while still getting what you want.

8. Earn more money

There are limits to how much you can reduce your spending through negotiations and all-out slashing. No such limit exists, however, on what you can earn. In other words, if you can’t bring your spending below your means, increase your means!

There are many ways to go about this.

An obvious one is to ask for a raise. According to research by PayScale, this works for 70% of people who attempt it. As with negotiating a lower utility bill, the key is to build a strong case regarding your request. Use websites like Glassdoor to figure out what workers in similar roles are earning and frame your conversations around that data.

If a raise simply isn’t possible, you’re not out of luck. There are many other things you can do to earn more money, including:

- freelancing

- picking up a part-time job

- house hacking

- micro-tasking

Read this article for a detailed walkthrough of these and other strategies.

Whichever approach you take, make sure you don’t upgrade your spending as your income rises. Otherwise, you’ll be right back where you started before long. Let any rise in income go directly towards increasing your ability to live below your means.

9. Make defensive plays

Living below your means is not something you figure out once and then never have to worry about again. Occasionally, unexpected expenses will pop up and threaten to derail your progress.

You can mitigate this risk by making defensive plays that will allow you to keep living below your means even in the face of challenges.

What does this look like, practically speaking? Well, at the very least, you should maintain an emergency fund or some other sort of contingency you can comfortably tap into should an unpleasant surprise appear.

Check out this article for a more detailed walkthrough of how you can plan for various common financial emergencies.

Defensive plays should also entail planning ahead for discretionary purchases, too. For example, if you know you’d like to take a vacation in July, you should have a plan for coming up with the necessary funds well in advance. Otherwise, it’s possible to live below your means for months on end only to falter by paying for your long-anticipated trip with credit because you didn’t plan properly.

Often, making defensive plays entails making moves that might actually seem irresponsible at first.

For example, saving towards vacations has often meant contributing less to my retirement accounts than I’d like. I’m still ahead of schedule, mind you. Otherwise, I’d forgo vacations. However, I’d certainly love to be even further ahead.

I know myself, though. Traveling is an essential part of my life. If I didn’t save ahead, I wouldn’t be able to partake, which is a bigger downside to me than being a little less rich.

This is where living below your means meshes with enjoying a fulfilled life. The two are not mutually exclusive.

10. Remember the point of living below your means

The point of living below your means is not to become a monk with no material possessions or appreciation of worldly experiences. In fact, it’s the exact opposite. Your goal should be to enjoy the present as fully as possible without jeopardizing your ability to do the same in the future.

Keep this in mind whenever you’re uncertain whether the dedication that goes into living below your means is worth it. In short order, you’ll find it most certainly is.

Conclusion

I hope this article has shown you the benefits of living below your means and how you can ultimately do so. While the path isn’t necessarily easy, it’s not rocket science, either: spend less than you earn and use the difference wisely. Trust me, you can do it – no matter how unlikely it seems.

For more personal finance tips and walkthroughs, check out my other blog posts here.