Being unable to pay your bills can be nerve-wracking. You might be worried about losing your good credit score or even your home. Don’t panic, though. In this article, I’ll share a few tips regarding what to do if you can’t pay your bills. Spoiler: You have more options than you might think.

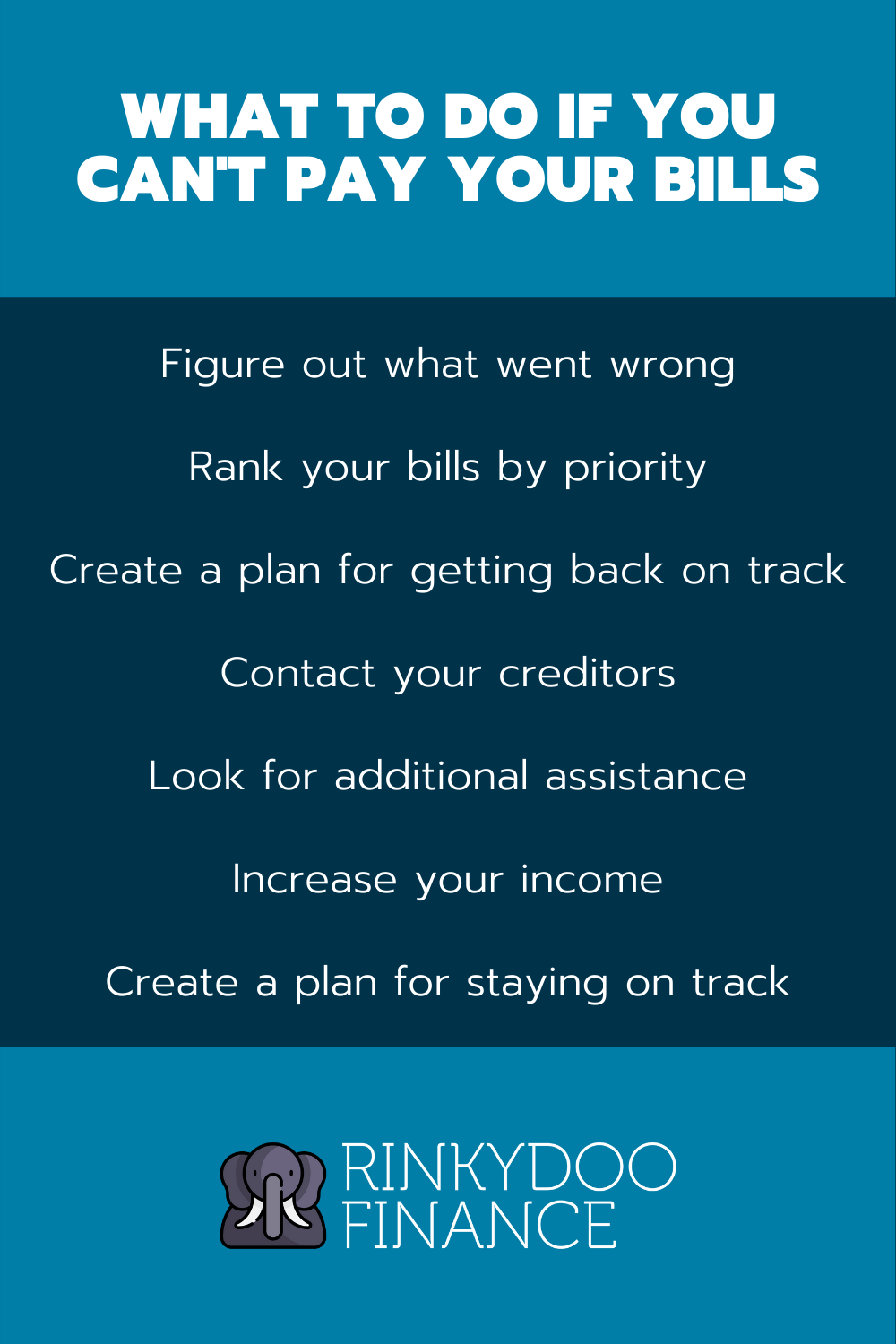

What to do if you can’t pay your bills

Disclaimer: I’m not a financial advisor. Be sure to speak with one before following any of the tips I’ve provided below.

1. Figure out what went wrong

Presumably, you were capable of paying your bills at some point. What changed?

If you recently experienced a major setback (i.e. job loss or a huge unexpected expense), this shouldn’t take long to figure out.

If the cause isn’t immediately evident, however, these financial challenges may have been creeping up on you for some time. You may have some bad financial habits to deal with. Check out the first three points of my article about organizing your finances, which will help you do some digging.

The point of this investigative exercise isn’t to beat yourself up. Rather, it’s to begin the process of reverse engineering your way back into a better financial position.

If you realize you’ve fallen behind on bills because you’ve been overspending, for example, you’ll know you need to cut back. If you realize it’s because your household income decreased, you’ll likely need to adjust your spending or increase your earnings.

2. Rank your bills by priority

Not all bills are of equal importance. Many financial experts recommend prioritizing getting caught up on essential bills (i.e. housing payments and utilities that are essential for your livelihood) before worrying about anything else.

The rationale is that falling behind on essential bills usually carries the direst consequences. Not only will your credit score take a hit but you may also have essential property (i.e. your primary residence or vehicle) repossessed.

With lower-priority bills (i.e. credit cards), on the other hand, falling behind – as unpleasant as it may be – won’t leave you without life’s essentials. You certainly wouldn’t want to prioritize getting caught up with these bills at the expense of continuing to struggle with essentials.

Check out the second point in my article about organizing your finances (linked in the previous step) for a good boilerplate hierarchy of financial priorities. Keep that hierarchy in mind as you move through the subsequent steps.

3. Create a self-sufficient plan for getting back on track with each bill

After completing the previous steps, you should have a high-level understanding of what it will take to get back on track. In this step, you’ll take that information and turn it into an actual plan for each bill.

This plan shouldn’t account for any grace on the part of your creditors. While they’ll likely be willing to help you out (as I’ll discuss in the next step), it’s worth having a self-sufficient plan. For starters, you’ll be prepared in the event they don’t offer assistance. Being able to share this self-sufficient plan with your creditors will also help them see you as a responsible borrower who’s simply hit a rough patch. They’ll therefore be more likely to help you.

Your plan should include these components for each bill you’ve fallen behind on:

- how much money you need to get caught up

- where you plan on getting that money from (i.e. a side hustle, selling excess items around your home, or cutting back on your spending in a non-essential category)

- how long you think it will take for you to obtain that money (keeping in mind the priority level of the bill in question)

- what penalties (including interest) you will incur along the way

Once you have a firm grasp on these items, you’ll be ready to approach your creditors for assistance.

Pro-tip

Not sure how to incorporate your hierarchy of financial priorities into your plan?

One easy approach would be to cover all essentials (again, this includes items such as housing and groceries) in full then divide what’s left of your disposable income among the remaining bills.

If you can’t cover essentials in full, you’d cover them to the best of your ability and not even worry about anything else until you’re in a better financial position.

This is a great time to remind you I’m not a financial advisor. Share your plan with a licensed professional before proceeding.

4. Contact your creditors

Once you’ve identified the issue and have a plan for getting back on track, contact your creditors (i.e. utility providers, lenders, landlords, etc) as soon as possible. You might be surprised by how willing they are to help you out. They may be particularly understanding if your financial hardship stems from external factors, such as economic pressure in your region or a layoff.

Steps creditors often take to support consumers in a bind include:

- waiving interest and/or late payment fees for a set period

- temporarily reducing monthly payments

- reporting missed payments as “deferred” rather than “late” (or not reporting them at all), which will spare your credit score

These steps increase your chances of getting back on track, which is why creditors are willing to take them.

For best results, the U.S. Consumer Financial Protection Bureau recommends explaining the following to your creditors:

- Exactly what financial hardships have left you unable to pay your bills

- How much you can afford to pay in lieu of the full amount

- When you expect to be capable of making full payments again (or paying the lender in full to get caught up)

- Your income and other expenses

Be sure to get any agreements your creditors make in writing.

5. Look for additional assistance

Once you know if and how your creditors are willing to help, look for additional assistance that might help you get back on track sooner.

This assistance could come in many forms, including:

- debt consolidation loans (note: speak with a financial advisor before going this route as these loans are very nuanced and only make sense in specific circumstances)

- unemployment benefits

- other economic relief programs (i.e. the U.S. Covid-19 Economic Relief initiatives)

- volunteer programs (i.e. soup kitchens that can help you save money on meals)

Any money you receive (or save) via this additional assistance should go towards getting yourself back on track financially.

6. Increase your income

The previous two steps are all about seeking help through external channels. Once you’ve done that, it’s worth looking into how you can help yourself by increasing your income. This is easier than you might think; check out this article I wrote containing 18 strategies for making money quickly when you’re in a bind.

Those strategies include:

- asking for a raise at work

- freelancing

- selling items on eBay

- babysitting

- driving for Uber

- negotiating your bills

The best part about increasing your income? It will provide benefits long after you’ve overcome your current financial difficulties. In the future, you can use that money to actually get ahead financially (i.e. by investing).

7. Once you’re back on track, make a plan to stay on track

Now that I’ve shared my thoughts regarding what to do if you can’t pay your bills, let’s discuss handling your finances once you’re back on track.

For starters, you need a budget that keeps you from spending more than you earn. One tool many people swear by for achieving this is You Need a Budget. It’s a web application designed to help you get out of debt and save more money.

Establishing an emergency fund is also an incredibly important part of staying on track. Many financial experts recommend keeping enough money in savings to cover three to six months of expenses. That way, even if your income drops to $0, you have some breathing room.

These two items (your budget and your emergency fund) will serve as a very solid financial foundation and reduce your likelihood of being unable to pay your bills again. For some tips on becoming even more resilient, check out my financial planning articles here.

Conclusion

I hope this article has given you some food for thought regarding what to do if you can’t pay your bills. The short of it is that you’ve got more courses of action than you might think. Just remember to speak with a financial advisor before acting!