The stock market can be volatile. Sometimes, it hits record highs only to plummet a few days later. This can be challenging to witness, whether you’ve been investing for a few years or just a few months. Keep reading for some thoughts regarding what to do if the stock market crashes.

Disclaimer

I am not a financial advisor. What I’m about to share is simply food for thought. Before making investment decisions, I encourage you to speak one-on-one with a licensed financial advisor. They’ll help you create a plan unique to your financial circumstances.

What is a market crash, anyway?

The phrase “market crash” describes a sudden drop in valuations across the broader market (rather than in just a single stock or sector). In March 2020, for example, the market crashed, with the Dow Jones Industrial Average shedding roughly 26% of its value in just four days.

While there’s no universally agreed-upon definition regarding how many percentage points the market has to fall for it to count as a crash, some use 10% within a single day as a rule of thumb.

Ultimately, though, the food for thought I’m about to share applies in any scenario where your stock portfolio takes a significant hit. For example, some people might find a 5% decline produces the same level of panic as a 10% drop does for others. Regardless of a crash’s size, getting through it requires historical context and level-headedness.

What to do if the stock market crashes

1. Don’t panic

When it comes to personal finance, panicking is rarely a good idea. Why? Because panic may prompt you to do irrational things, such as liquidating your portfolio (thereby locking in your losses) at an inopportune time.

Often, even if your portfolio is shedding thousands of dollars in value per day, the smartest approach is to step away, take a deep breath, and plan your next steps once your emotions have stabilized.

Of course, this is all easier said than done. Emotions are often uncontrollable, especially when your hard-earned money is on the line. That’s where removing the stimulus affecting your emotions comes in handy. In other words, log out of your investment account and don’t look until you’re in a level-headed state.

2. Zoom out for perspective

Stock market crashes tend to be relatively short-lived. According to The Motley Fool, the average crash lasts roughly six months. Further, 64% of crashes within the past 70 years have bottomed out in three-and-a-half months or less. Meanwhile, bull markets (periods in which the market delivers significant gains) have lasted an average of 3.8 years since 1982, as reported by Kiplinger.

If you’re investing for the long haul (and you should be), that’s great news. The typical market crash will amount to a mere speedbump.

Don’t believe me? Let’s look at some graphics.

First, here’s the S&P 500’s performance since 1982. Take note of how 2000, 2008, and 2020 were all blips on the radar for investors who held steady.

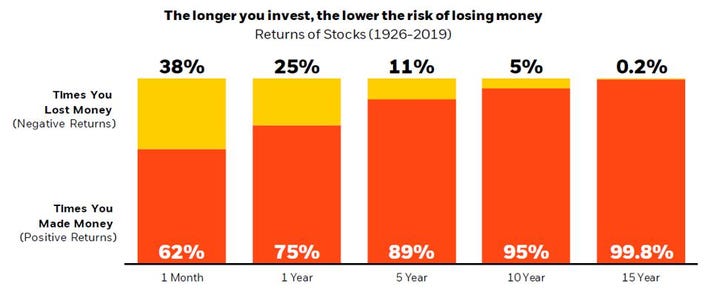

Next, here’s one of my favorite investing graphics (made by BlackRock) ever. It displays your odds of losing money in the stock market depending on how long you invest.

The longer you stay invested, the less relevant crashes become. Keep that in mind. Zoom out when the going gets tough.

3. Re-evaluate your holdings

When the market crashes, it can feel a lot like having beer goggles removed. Suddenly, you’re able to evaluate your decisions outside the context of exuberance.

This can be particularly valuable in recent times. Scores of investors have piled into stocks such as $AMC, $GME, and $BB – all of which have terrible fundamentals but are the subject of considerable hype nonetheless. When crappy stocks like those are rocketing upward, it’s easy to rationalize holding them. During a crash, though, they lose their luster. The same goes for dog-themed cryptocurrencies and other purely speculative assets.

If you suspect you’ve got some clunkers like these in your portfolio, it might be worth cleaning house.

Even if you own good, carefully chosen assets, re-evaluating your portfolio can be a valuable exercise. You might find you’re taking on too much risk and need a larger cash allocation, for example. You might even find managing your own portfolio is a bad idea and decide to switch to something like a robo-advisor instead.

4. Stick to (or establish) the plan

I respond to market crashes by continuing to make my regularly scheduled (and automated) investment account contributions. Every time I get paid, a portion of my paycheck goes into the market. That way, I don’t even have to log into my portfolio to trigger buys (and see my losses in the process). This plan works for me. It’s possible a different approach might help you stay on track through a market crash.

If you don’t have a plan, the midst of a market crash is a good time to make one (ideally with the help of a financial advisor) since you’ll likely have some thoughts regarding what you wish you’d done.

Here are a few items your plan should take into account:

- How long you’re investing for

- Your risk tolerance

- Whether you have an emergency fund

- Your job security

The goal of factoring these items into your investment planning is to ensure a few things:

- You’ll have money to cash out when you need it (i.e. when you plan on retiring)

- You’re not taking on a level of risk you won’t be able to handle during a crash

- You have enough of a cash buffer to cover the cost of emergencies (including job loss) without selling stocks at a loss

5. If you have extra money to invest, do it

Sometimes, you get lucky and the market crashes just as you get an influx of extra discretionary income (i.e. your tax refund). History shows people who invest such funds in a lump sum see their portfolios perform better on average than people who wait to pile in at the bottom. That’s where the famous saying, “time in the market beats timing the market” comes from.

After all, as we discussed earlier, crashes don’t typically last very long. Some people stay stuck “waiting for the bottom” only to see the market turn around and start rocketing upward, erasing any advantage they previously had. Don’t be that person.

It’s worth noting, however, that historical data doesn’t support the idea of setting cash aside in preparation for a crash. Almost no one is able to time things accurately enough for that to be a feasible investing strategy. When you have the money, invest it (or at least start dollar-cost-averaging in).

What to do if the stock market crashes: Conclusion

A market crash isn’t the end of the world. I hope this article has given you some valuable food for thought regarding how to rationally respond to a market crash. To summarize, keeping a level head, maintaining a long-term view of investing, and carefully evaluating your portfolio are all winning strategies in the long run.

Click here for more of my articles on the topic of investing.