It’s no secret that rich people tend to have fundamentally different views than poor people. And while beliefs aren’t the only determinant of one’s financial situation, they play a major role.

But wait. What makes someone rich or poor? Is it a specific salary or bank balance?

In my opinion, no. While you certainly need a decent chunk of change to be considered rich, the exact amount isn’t all that relevant. Of far greater importance is whether your money affords you the freedom to think and act in productive ways.

You’ll see what I mean as we dive into this list of differences between the rich vs. the poor.

There are two important caveats worth mentioning first, though.

For starters, when I talk about rich people, I’m primarily referring to those who obtained status through diligence and effort rather than, say, nepotism or an inheritance. Someone who was handed their wealth is less certain to have positive financial attitudes.

Second, there’s obviously a degree of generalization with this list. Not all rich people possess productive attitudes. Conversely, not all poor people possess unproductive ones.

Still, thinking positively is never going to hurt your chances of becoming wealthy, just as holding onto negative beliefs will never help you. So while the following differences between the rich and the poor don’t tell the whole story, together they comprise a very important chapter.

Rich vs. poor: 10 key differences

I settled on these differences based on research as well as my observations, having been around plenty of poor and rich people. This list is in no particular order.

1. How they use money

Rich people use money as a wealth-building tool. Poor people spend most of their money paying for essentials.

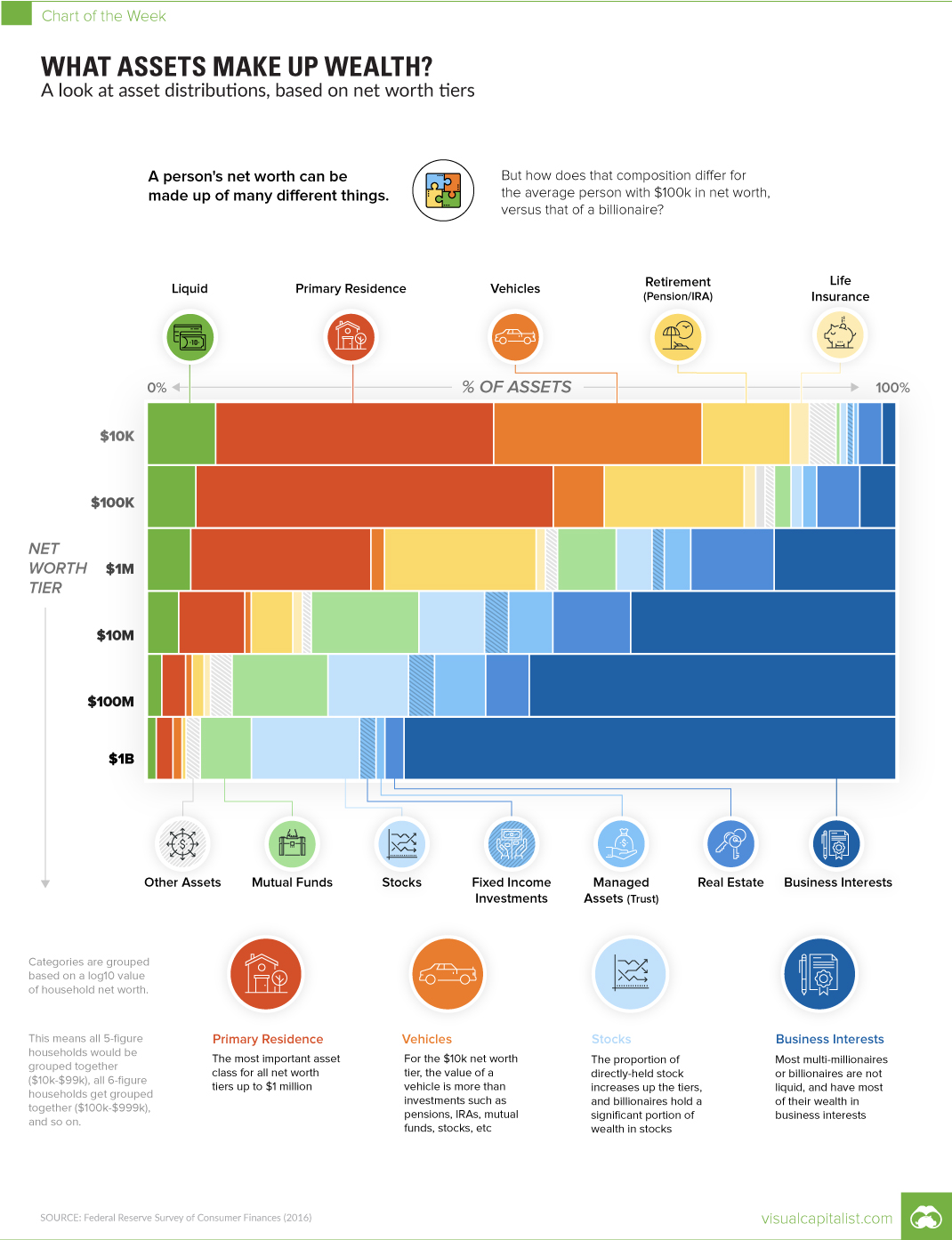

Take a look at this infographic from Visual Capitalist, which shows how people at different levels of wealth use their money.

Now, the $10,000 net worth individual’s distribution may be more the product of circumstance than a mindset. If you only have that much money, a decent and safe car will naturally eat up a good chunk of it.

But notice what happens in the higher net worth sections of the chart. From $100,000 upward, the amount of money tied up in cars plummets as people dedicate more of their cash to retirement accounts, investments, real estate, and business interests.

This is very powerful from a wealth-building perspective because those things are assets that can generate more money whereas cars are liabilities.

Keep in mind that someone worth $100,000 could easily find a car that eats up a larger portion of their wealth. Heck, even someone worth $1 million could buy something like a Mercedes G-Wagon valued at 20% of their net worth.

They usually don’t, though – and you know why? Because they probably wouldn’t have such a high net worth if they used their money that way.

Additionally, they probably don’t have an interest in spending so recklessly. Investing in the stock market, real estate, and their own businesses is more exciting.

Check out this article from my friend Stephen at mywealthymoney.com for further exploration of how the rich spend their money.

2. How they think about debt

Rich people use debt to seize wealth-producing opportunities at low interest rates. Poor people use high-interest debt to buy consumer goods.

In late September 2020, Donald Trump’s tax returns were released, revealing that the U.S. President is $400 million in debt. Many people on Twitter promptly mocked Trump for having such a large amount of debt despite having portrayed himself as a shrewd businessman for decades.

This, in my opinion, hints at a poor general understanding of how debt works when you’re rich vs. poor.

To rich people, debt makes large investments possible. Someone like Trump can receive millions of dollars in loans and use the money to purchase income-producing assets (i.e. properties) they couldn’t otherwise afford.

Indeed, non-partisan financial experts speaking with the Associated Press have thrown cold water on the idea that Trump’s financial situation is evidence of impending bankruptcy.

When you’re poor, on the other hand, debt is typically of the consumer variety. Rather than using loans to purchase large assets, poor people amass depreciating liabilities and then pay exorbitant interest rates on them.

This type of borrowing destroys the seeds of wealth before they even have a chance to sprout. Trump’s type of borrowing, on the other hand, is like fertilizer for those seeds.

2b. How they repay debt

A subtler debt-related difference between rich and poor people lies in how they make repayments.

Rich people look at the interest rate associated with their debt and determine whether investments are capable of producing a higher percentage return.

If the answer is yes, rich people will typically make minimum payments on the debt and invest any excess funds they would’ve otherwise repaid.

This is why I plan to take my time repaying the loan on my Toyota Corolla. Even though I could write a check today, the debt’s interest rate of 1.09% gives me plenty of incentive to keep that money invested instead.

You see, the stock market generates an average annual return of 10%, which is obviously much higher than my loan’s interest rate.

In other words, I’d actually be robbing myself of financial growth by paying the loan off early.

This rationale is also probably why Trump doesn’t just sell a few of his properties to repay the $400 million he owes. Those ventures are likely earning him far more than he’d save on interest by eliminating the debt.

Poor people don’t think about debt this way, though. They try to get rid of all debt as quickly as possible, which comes at a high opportunity cost in the case of low-interest loans.

Disclaimer

Of course, Trump’s properties are assets whereas my Corolla is a depreciating liability. The rationale of prioritizing higher returns still applies, though. I have little incentive to repay my car loan faster than required by the terms I signed.

This logic does not apply with all car loans, though. I chose my terms very carefully based on factors that go beyond the scope of this article. Speak with a financial advisor before proceeding.

3. Their patience regarding wealth creation

Rich people generally understand that wealth grows over time. Poor people fall for get-rich-quick schemes.

Another key difference between the rich vs. the poor lies in how both parties view wealth creation.

Poor people are often obsessed with the idea of getting rich as quickly as possible. They turn to everything from pyramid schemes to over-leveraged trading in hopes of achieving this. More often than not, they lose a ton of money.

I’ve seen people fall for this over and over again. They never learn because the idea of getting rich without much effort is simply too alluring.

Financially savvy people, on the other hand, are content with playing the long game. That might mean investing in index funds or other assets that seem boring to those looking for quick riches.

But you know what? The “boring” strategies that allow you to grow little by little every year will actually make you rich in the long run. In fact, you’d arguably be better off investing with little money over the course of several decades than you would be trying to turn $100,000 into $1 million overnight.

Fun fact

One study of several self-made millionaires found it took them an average of 32 years to reach the million-dollar mark. The vast majority of them didn’t even become wealthy until after the age of 50. We’ll take a closer look at this study in the seventh point.

4. Their standards

Rich people strive for excellence in even the most mundane tasks. Poor people settle for mediocrity in everything.

Successful people put an extraordinary amount of effort into achieving excellence.

It’s usually not just limited to work, either; the richest person I know spends an absolutely insane amount of effort assembling plates of sliced fruit whenever he has guests over for lunch. His handiwork lasts all of a few minutes before the fruits are devoured. He does it anyway, though, because simply slapping the fruits on a plate would go against his ethos.

Meanwhile, many of the poorest people I know handle even the most important tasks recklessly. They always assume it’s someone else’s responsibility to complete their work. Few employers or clients would ever consider such people for higher-paying jobs requiring self-regulation, which means they never progress.

At the crux of this difference between the rich vs. the poor is an understanding of how even small things affect one’s reputation, which ultimately determines the opportunities they receive and the wealth they can obtain.

5. Accountability

Rich people are held to higher levels of accountability – and behave accordingly.

One reason rich people have such high standards is that they’re often subject to a great deal of accountability in their various roles.

Think about how things work in a typical company. Higher-level managers and executives create processes that determine how lower-level workers complete their tasks. So naturally, when systemic issues appear, these higher-ups bear the brunt of the criticism.

The higher an individual’s rank, the worse this backlash usually is. For example, CEOs often have their names publicly dragged through the mud in response to major failures at their companies.

Lower-level employees don’t have to endure this. In larger organizations especially, they’re able to focus on completing their specific tasks well in accordance with the strategies created by higher-ups.

As one moves up in their career, they encounter greater accountability but also greater pay. Conversely, those who spend their entire careers in low-level jobs with little accountability often stay poor.

6. How they view their circumstances

Rich people see themselves as being in control of their lives. Poor people see themselves as victims of circumstance.

Another crucial difference between the rich vs. the poor lies in how members of either class interpret their circumstances.

Rich people tend to see their status as evidence of personal greatness. This is understandable.

Even if the odds were stacked in their favor from the get-go via a large inheritance, they still had to possess some degree of intelligence and financial savvy to make good use of their golden ticket. After all, 70% of wealthy families squander everything by the second generation.

Rich people who started from scratch are even more justified in taking credit for their positive circumstances.

Conversely, poor people often view their status as being the result of external factors. This, too, is understandable.

When you’re poor, you may barely have money to keep up with bills, let alone save or invest. High-interest, compounding debt may actively suppress your net worth with no end in sight. You may be unable to afford nice, reliable things that don’t require expensive repairs every few months.

Poor people who see themselves as having no control whatsoever over these and other financial factors are more likely to stay broke forever.

7. Who they hang out with

Rich people have productive friends that motivate them. Poor people have friends that drag them down.

A man by the name of Thomas Corley conducted a five-year study of more than 170 self-made millionaires. One interesting finding was that rich people tend to be pickier about who they hang out with than the average individual.

Writing in Business Insider, Corley notes that long before his research subjects became wealthy, they made conscious efforts to hang out with rich, successful people.

This makes sense when you consider the countless studies confirming the influence friends have on one’s career, relationships, and other important aspects of life.

By choosing their friends carefully, people on the path to becoming wealthy ensure this influence is a positive one.

Poor people, on the other hand, often choose friends without much thought. As a result, their social circles tend to consist of whoever is around them and has similar attitudes about life. If those attitudes are negative and unproductive, becoming rich may be next to impossible.

8. What they talk about

Rich people have empowering, relevant conversations. Poor people gossip and discuss things they have little to no control over.

Another interesting trend Thomas Corley discovered while comparing the rich vs. the poor concerns conversations members of either group have.

Specifically, Corley reports that 79% of poor respondents engaged in gossip regularly while 94% of rich participants avoided it.

The boomerang effect is one scientific explanation for this correlation. When you attribute negative traits to someone (as is common during gossip sessions), listeners will often mentally attach those same characteristics to you.

It’s not hard to see how this can have devastating consequences at work. Say you have a habit of insisting a certain coworker is lazy and undeserving of their role. People within your organization will start to think that of you, which can severely limit your opportunities.

Rich people recognize gossip’s destructive nature and focus on more productive topics such as investing, hobbies, business ideas, travel, industry news, family, health, life goals, and activism.

Conversations centered on these things allow participants to network and exchange valuable ideas, which is infinitely more helpful than gossip.

9. How often they say no

Rich people say no to almost everything. Poor people lack the confidence for this and consistently agree to things they shouldn’t.

In my opinion, this is one of the most important differences between the rich vs. the poor.

Don’t just take my word for it, though; Steve Jobs and Warren Buffett have both been quoted as suggesting that success depends greatly on how often you say no. Research has also found that rich people are less agreeable than the poor.

This is noteworthy for a number of reasons.

First, it shows rich people have the confidence to make decisions that protect their interests. They aren’t afraid to turn down requests that don’t align with their goals, even if it means upsetting people.

It also explains why rich people tend to be better negotiators. Rather than acquiescing to unfavorable terms, they push back until a suitable agreement is reached – and walk away if that never happens.

Poor people, meanwhile, cave to the demands of others, often at their own peril. Employers overwork them, salesmen overcharge them, and “friends” routinely take advantage of their low confidence. They spend their lives giving value to others without keeping any of it for themselves.

10. Excuses

Poor people look for excuses to avoid doing things that would be beneficial. Rich people will endure plenty of inconveniences if it means achieving a desirable outcome.

The final difference I’d like to highlight between the rich vs. the poor concerns either group’s thought processes when it comes to making excuses.

Poor people love excuses. They always have some explanation for why they can’t invest, save money, or perform some other financially beneficial activity.

Of course, they offer no such resistance when it comes to financially detrimental things like racking up thousands of dollars in consumer debt. It’s just the beneficial things they resist.

Rich people, on the other hand, will endure tremendous amounts of hardship to get what they want. I’ve seen entrepreneurs lose thousands of dollars for months in a row because they believed in their vision and knew profitability was just around the corner.

It’s not that rich people don’t have reasons to quit or give up. It’s that they, unlike poor people, are willing to look past those reasons if the perceived potential reward is great enough.

Conclusion

The rich and the poor think differently for a variety of reasons. I explore some of those reasons in my article about why the average person finds it so difficult to save money.

As for this article, I hope it’s given you some insight into the positive attitudes rich people have about life. I believe anyone can adopt these ways of thinking and improve their financial situation as a result.

It may not be easy or quick – but it will be worth it.