Recessions are an unfortunate part of life, with one happening roughly every four years in the United States since 1900. While it’s impossible to achieve total immunity from these downturns, these “recession-proof” jobs are the next best thing. In this post, we’ll explore 25 such jobs, what makes them special, and the steps you can take towards obtaining them.

Qualifying “recession-proof” jobs

Before I go further, I’d like to make sure we’re on the same page concerning what “recession-proof” means. The definition I’ve used to curate this list is perhaps the most universally-accepted, entailing a reduced likelihood of being laid off amid hard times.

Of course, being laid off is just one of many miseries that threaten workers during recessions. Others include stagnant wages and heightened tension in the workplace. I’ve factored these additional pressures into my analysis as much as possible. However, job loss is naturally weighted more heavily given how much easier it is to find relevant statistics on it for most professions.

I mention this because I’d rather not have anyone scream at me about how my inclusion of their job on this list minimizes the hardship they went through during the last recession. Economic turmoil sucks for everybody, including those who stay employed. It just tends to suck less for people who hold the jobs on this list.

Key characteristics of recession-proof jobs

Now, let’s quickly look at why some professions fare better than others during recessions.

Two notably absent traits are growth and accessibility. That’s because, as you’ll see shortly, there are plenty of recession-proof jobs out there in industries that are neither expanding rapidly nor open to workers lacking extensive training and experience.

Consistent demand

Even in the depths of economic turmoil, workers in these roles rarely have to worry about demand for their services dwindling. The subsequent characteristics of recession-proof jobs provide additional context as to why that is.

Necessity

Workers in recession-proof roles almost invariably provide vital products and services rather than discretionary ones.

Specialization

Highly-specialized workers are very difficult and expensive to replace. As such, they are often unlikely to end up on the chopping block when companies look to slash expenses.

Government support

When governments recognize certain industries and roles as vital to society’s functioning, they will often provide support in the form of friendly legislation and funding. This assistance can keep those jobs recession-proof even when market forces are not in their favor.

Of course, not all recession-proof jobs enjoy government support. But the ones that do are particularly resistant to downturns.

Top 25 recession-proof jobs

Unless otherwise noted, I found the educational requirements for these recession-proof jobs on the U.S. Bureau of Labor Statistics website. The relevant page is always linked in the first section of each item.

1. Healthcare Worker

Healthcare workers include doctors, nurses, technicians, administrators, and other professionals.

The U.S. Bureau of Labor Statistics projects employment in healthcare to grow 14% from 2018 to 2028, equating to more new jobs than any other field.

Professionals in the healthcare sector typically have highly recession-proof jobs for several key reasons.

Firstly, their services are among the most vital in society. Without healthcare workers, the elderly, sick, and injured would be left to fend for themselves. Immeasurable death and suffering would follow.

Secondly, healthcare workers actually see demand for their services rise during a recession. Increased stress among the general population has detrimental effects on physical health that only professionals can address.

Thirdly, healthcare workers benefit from governmental support through programs like medicare in the United States and Canada.

Research by the U.S. Bureau of Labor Statistics found the Great Recession of 2008 did not have any major negative impacts on healthcare. In fact, the sector saw 6.6% employment growth during the downturn compared to the overall job market’s 6.9% decline.

There’s an important exception to mention here, though. Practitioners providing elective treatments tend to fare poorly during recessions as patients become anxious about money as well as the professional ramifications of taking time off work for something non-essential.

How to get a recession-proof job in healthcare

Healthcare is, of course, an incredibly broad field. The most appropriate path for finding work in it all depends on what role you’re after. While becoming a doctor takes upwards of 10 years, other jobs are much easier to get into. They include:

- Certified Nursing Assistant

- Phlebotomist

- Paramedic

- Medical Records Technician

- Pharmacy Technician

- Radiologic Technologist

Once you complete the necessary training and licensing for your healthcare job of choice, you shouldn’t have much difficulty finding work.

Pro-tip

While strong demand exists for many healthcare workers in the United States and Canada, local needs can vary drastically. If you decide to pursue a recession-proof job in healthcare, first look at what is needed in your area. You can also consider relocating to wherever a need for your ideal role exists.

2. Pharmacist

Retail pharmacists fill medical prescriptions and provide patients with proper guidance on usage. Industrial pharmacists research and develop new medications.

Although employment in this industry is very stable, the U.S. Bureau of Labor Statistics expects little to no employment growth through to 2028.

According to Medscape, 44% of Americans take prescription medications. That’s more than 143 million people as of writing. For many of those people, refilling prescriptions is non-discretionary, which means retail pharmacists have a fairly steady stream of customers even as people lose insurance coverage. These pharmacists can also benefit from selling cheaper generic versions of drugs that patients often switch to if they lose coverage at work or need to tighten their budgets for some other reason.

Industrial pharmacists that research and develop new medications fare particularly well during recessions. According to the Conference Board of Canada, the country’s pharmaceutical industry actually grew during the 2008 recession. During the COVID-19 pandemic, pharmaceutical companies involved in testing and vaccine development saw no shortage of work. In many cases, these companies also saw their share prices skyrocket.

Here’s how Moderna’s stock performed:

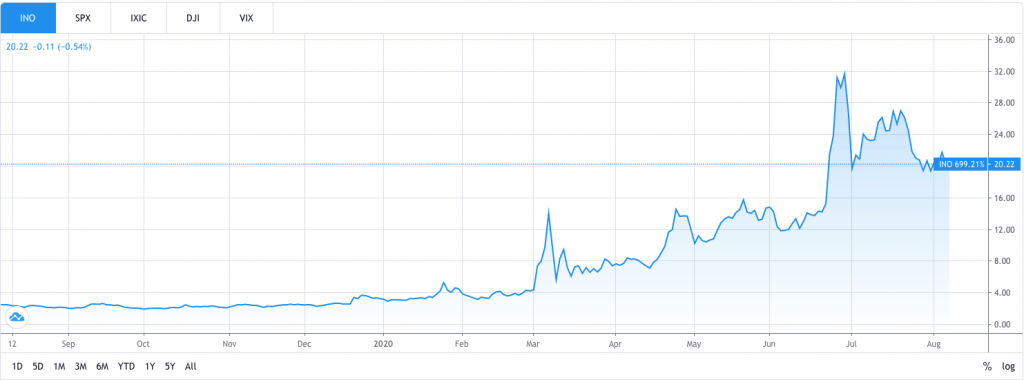

And here’s Inovio:

Note: Stock performance can be a very valuable indicator of which industries perform well during recessions. Check out this article to learn more about what stocks are and how their prices are determined.

How to get a recession-proof job as a pharmacist

Pharmacists must have a doctorate of pharmacy, which takes at least four years to obtain. You’ll also need to pass multiple examinations and become licensed. Subsequently, many entry-level pharmacists complete additional training via residencies at hospitals or community practices.

Potential employers for pharmacists who excel up to this point include local pharmacies, hospitals, long-term care facilities, regulators, and research institutions.

Pro-tip

While recessions aren’t an existential threat to the pharmaceutical industry, retail pharmacists face significant competition from online dispensers. These companies still require pharmacists (including as consultants), though, so they’re not all bad news.

3. Veterinarian

Veterinarians diagnose and treat illnesses in animals. Additionally, they provide guidance regarding proper animal care.

The U.S. Bureau of Labor Statistics projects an impressive 18% growth in employment for veterinarians from 2018-2028 – much higher than the national average of 5% for all occupations.

While Americans are having fewer children, pet ownership rates have either remained steady or risen depending on which statistics you look at. According to Forbes, pet spending was also climbing at a rate of 4.6% annually as of 2018, three times faster than overall consumer spending.

This growth has continued through several recessions as well, proving the industry’s resilience. After all, pets – like humans – don’t stop needing healthcare just because the economy has taken a nosedive.

How to get a recession-proof job as a veterinarian

You’ll need a Doctor of Veterinary Medicine degree to obtain the most recession-proof jobs in this field. This can take about six years at a minimum.

Once you’ve passed that hurdle, however, you’ll have plenty of career options. While many veterinarians work in private animal clinics, others pursue research, government, and teaching positions that can provide additional stability.

Pro-tip

Veterinarians often work on-call, which can be very demanding. Additionally, while you need to be a compassionate person to succeed in this role, you should also be able to handle seeing animals suffering on a regular basis.

4. Mental Health Counselor

Counselors assist patients facing mental health challenges such as anxiety, depression, and drug addiction. Work settings include schools, clinics, and their own private practices.

The U.S. Bureau of Labor Statistics projects a 22% growth in employment for mental health counselors through 2028.

A substantial shortage of mental health professionals in America means those in the field enjoy some of the most recession-proof jobs around. The shortage is particularly dire in rural counties, where there are just 9.1 psychologists per 100,000 people, according to the previously-linked source.

Mental health counseling is typically covered by insurance plans – or government funding, in the case of counselors working at schools or as part of some other public health initiative. As such, a recession and its effects on individual wealth are not necessarily death knells for professionals.

How to find a recession-proof job as a mental health counselor

You’ll need at least a bachelor’s degree in counseling to become a mental health counselor. Those with a master’s degree, however, can offer a wider range of services and have an easier time finding work at stable institutions. Additionally, many states and provinces require that mental health counselors be certified.

Pro-tip

Mental health counselors experience high rates of burnout and compassion fatigue. As such, they often need counseling themselves in order to stay healthy while working in this industry. Read more about this here.

5. Information Security Analyst

Information security analysts are responsible for maintaining and monitoring computer networks.

The U.S. Bureau of Labor Statistics expects a staggering 32% job growth in this field from 2018-2028.

While many IT workers are at risk of having their jobs shipped overseas during a budget crunch, security analysts are at a substantial advantage. Many companies are (justifiably) trepid about entrusting foreign firms with their data security, which means in-house analysts can typically count on stability, even during a recession.

In fact, smart companies recognize the heightened importance of data security amid economic downturns. Breaches can add additional financial pressure by deflating stock prices and costing an average of $3.86 million to clean up. Those effects can spell death for companies already struggling because of a recession.

How to get a recession-proof job in information security

Information security analysts typically need a bachelor’s degree in computer science or a related field. Larger companies often prefer candidates with MBAs.

If you’re unable to commit to full-time schooling, there are also plenty of online information security courses you can work through at your own pace. Check out this article from TechRadar for recommendations.

Even after completing formal education, you’ll want to demonstrate that you’ve kept up to date on the ever-shifting cyber threats out there. Achieving certifications like CISSP is a great way to ensure you stay competitive in the field.

Pro-tip

If you’re looking to establish an ultra recession-proof career in IT security, consider the healthcare sector. According to IBM, healthcare data breaches are the most expensive, which gives companies in this sector additional incentive to prioritize security. Plus, as mentioned earlier, healthcare fares very well during economic turmoil.

6. Cloud Systems Administrator

Cloud systems administrators develop, maintain, and provide support for digital infrastructure.

The U.S. Bureau of Labor Statistics does not list data specific to cloud technicians. However, it projects a 5% growth in employment for the closest match (computer network architects) from 2018-2028.

Cloud systems administrators benefit from working in a rapidly-expanding industry that sees heightened demand during periods of economic downturn. During 2020’s pandemic-fueled recession, 82% of IT leaders responding to a Snow Software survey indicated an increase in their cloud usage.

If you worked in any computer-related field around March 2020, you probably witnessed this spike in cloud usage firsthand. As companies transitioned to working from home, a huge demand arose for software solutions that facilitate remote collaboration.

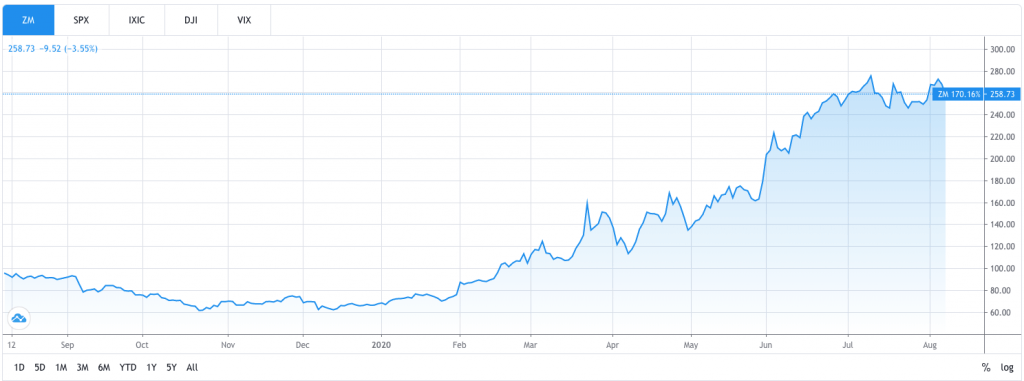

This increased demand was reflected in the markets as well. Just look at how cloud-based video chat software company Zoom’s stock performed throughout the year:

That’s outstanding growth, especially considering the overall U.S. market was taking a nasty hit right around the time Zoom rocketed upwards. Here’s the S&P 500’s performance during that period – note the plunge in March:

Of course, the economic turmoil during this period was fueled by public health risks, which made it a bit different than your typical recession. However, cloud computing’s ability to save companies lots of money arguably makes it attractive even in scenarios where its use is not mandated by stay-at-home orders.

How to get a recession-proof job in cloud computing

To become a cloud systems administrator, you need a bachelor’s degree in computer science, IT, or a related field.

You’d also be wise to consider obtaining certifications such as the Microsoft Certified Solutions Expert (MCSE): Cloud Platform and Infrastructure, Amazon Web Services Certified Solutions Architect, and IBM Certified Solution Architect – Cloud Platform Solution V2. These certifications will demonstrate your ability to work with industry-standard technology.

Pro-tip

With anything software-related, you never want to rest your laurels after becoming adept with a particular language or technology. The landscape is always shifting, so be prepared to update your skills on a regular basis if you want to compete for the most recession-proof jobs in the industry.

7. Database Administrator

Database administrators store and maintain an organization’s data, keeping it secure and accessible.

The U.S. Bureau of Labor Statistics projects a 9% employment growth in this field from 2018-2028.

It’s often said that data is the new oil, given its importance in driving the global economy. Database administrators benefit from this reliance on data because their services are vital for keeping information secure and accessible regardless of economic conditions.

It also helps that companies in recession-proof industries like insurance, education, and finance are among the biggest employers of database administrators.

How to get a recession-proof job as a database administrator

As you can probably tell by now, IT is a very attractive field in large part because attaining a job within it is not particularly arduous. While other recession-proof jobs (i.e. in healthcare) might require more than 10 years of expensive schooling, IT is much more accessible.

To become a database administrator, you’ll typically need a bachelor’s degree in a computer-related field along with knowledge of a database programming language like SQL, which you can learn online.

Individual companies may require that you obtain certifications specific to the products they sell but this is often provided via on-the-job training.

Once you have the necessary qualifications and knowledge, finding a job is relatively easy given the high demand for competent database administrators.

Pro-tip

As mentioned in the previous section, knowledge of a single programming language or technology is not necessarily going to carry you for the rest of your career in IT. People who know a variety of languages often have access to the most recession-proof jobs in IT so keep learning!

8. Accountant

Broadly speaking, accountants are responsible for analyzing and maintaining financial records on behalf of their clients.

Depending on the type of accountant, work may also include conducting payroll, preparing tax returns, and making managerial recommendations based on financial data.

Accountants enjoy stability during recessions because their roles are essential for clients’ legal and practical operations. Whether the economy is growing or not, individuals and businesses need to file taxes. Businesses in particular often rely on accountants to identify financial inefficiencies that can be eliminated – a particularly useful service in hard times.

The U.S. Bureau of Labor Statistics predicts a 6% growth in accounting employment from 2018-2028, pretty much in line with the national average across all occupations.

How to get a recession-proof job in accounting

Technically, you can obtain entry-level accounting jobs like bookkeeping with merely a high school diploma. However, candidates with bachelor’s degrees have more mobility in the industry, as you would expect.

Many accountants enter the field with a bachelor’s degree and then benefit from on-the-job training before pursuing higher qualifications such as a Certified Public Accountant (CPA) license. This license opens doors to some of the highest-paying and most stable jobs in the industry.

Pro-tip

As mentioned in the previous section, knowledge of a single programming language or technology is not necessarily going to carry you for the rest of your career in IT. People who know a variety of languages often have access to the most recession-proof jobs in IT so keep learning!

9. Revenue Officer

Revenue officers pursue tax delinquents and attempt to collect the government’s dues.

The U.S. Bureau of Labor Statistics expects a slight decline in employment for revenue officers through to 2028.

Tax evasion is a very prevalent problem. It costs the U.S. government an estimated $450 billion annually. Canadian authorities, meanwhile, lose about $45.6 billion to tax fraud each year. That’s a lot of money – especially considering spending in both nations far outpaces revenue. Revenue officers are tasked with recovering as much of that money as possible.

Tax authorities in many countries (including Canada and the United States) are actually racing to catch up with changes in how cheats operate. This all means revenue officers have their work cut out for them and are unlikely to become unemployed solely due to economic conditions.

How to get a recession-proof job as a revenue officer

You’ll typically need a bachelor’s degree in accounting or a related field to become a revenue officer. Additional training happens on the job.

Revenue officers can find work at the local and federal levels.

Pro-tip

While recessions don’t necessarily send revenue officers packing, budget cuts have been particularly fierce. The IRS has seen its budget fall by roughly 20% over the past 10 years. Research local demand as well as related career opportunities in case you decide to relocate to a better opportunity or switch paths.

10. Funeral Service Worker

Funeral service workers wear many different hats. They comfort and advise bereaved family members, prepare remains for the service, handle administrative tasks like filing death certificates, and much more.

The U.S. Bureau of Labor Statistics pegs growth in this sector at a respectable 4% from 2018-2028.

As the famous idiom goes, nothing in life is certain save for death and taxes. While accountants handle the latter, funeral service workers are all about the former.

People are constantly dying, even if in slightly lower numbers during a recession (as counterintuitive as that might seem). Some people even plan and pay for their funerals years in advance to ease the burden on loved ones. Investment analysts like Bank of America’s Joanna Gajuk have described the latter revenue stream as central to the funeral service industry’s “recession-resistant” nature.

How to get a recession-proof job as a funeral service worker

Many funeral homes seek candidates with degrees in mortuary science or a related field. You can enter the industry with an associate’s degree but many employers prefer those with bachelor’s degrees.

It goes without saying that this job is not for everyone. Aside from being well-versed in the biological aspects of their work (read: handling a body), funeral service employees need to be adept grief counselors. Clients are going through one of the most traumatic experiences the average person faces in life. Being able to comfort them while keeping the business side of things in mind is central to the job. If you’re able to handle that, you’ll find a very fulfilling career.

Pro-tip

Ownership of the funeral home sector is becoming increasingly consolidated as smaller companies struggle with adapting to changing traditions. As such, while this industry provides essential services and enjoys consistent demand, those looking to thrive within it still need to be capable of navigating the tricky landscape.

11. Contract Lawyer

Contract lawyers, as you can probably guess, create and revise legal agreements. They also advise clients participating in transactions and disputes.

The U.S. Bureau of Labor Statistics predicts a 6% growth rate for all lawyers between 2018 and 2028.

Contract law is widely seen as being one of the most recession-resistant practice areas for lawyers, with Law.com identifying it as having performed quite well during 2020’s turmoil.

First Legal theorizes that this is because companies make a point of reviewing their contractual obligations when the economy takes a hit. The site also states that companies in industries such as healthcare, technology, and financial services provide steady work for contract lawyers during recessions.

How to get a recession-proof job in contract law

As you might expect, becoming a contract lawyer requires a law degree and regional licensing. Once you have the necessary qualifications, you can find work at banks, insurance companies, and government agencies, among many other employers.

Pro-tip

If your goal is to specialize in corporate contract law, you’ll likely need to also have skills in accounting and finance. Depending on the law school program you choose, these may be a requirement for acceptance.

12. Bankruptcy Lawyer

Bankruptcy lawyers guide clients through the legal process of declaring insolvency. They can also sit at the other end of the transaction, advising creditors of individuals or companies that have gone bust.

As mentioned in the previous entry, the U.S. Bureau of Labor Statistics projects a 6% growth in employment for all lawyers by 2028.

It shouldn’t be hard to comprehend why bankruptcy law is recession-proof. During the 2008 recession, bankruptcy filings rose a staggering 74% in the United States. In 2020, companies as varied as Virgin Atlantic and Lord & Taylor went bust. It’s simple, really; when there’s less money to go around, many companies and individuals lose vital income and go under.

Bankruptcy lawyers definitely benefit from the specialization factor I mentioned in the “Key Characteristics of Recession-Proof Jobs” section. Even individuals generally won’t risk filing for bankruptcy on their own given that the process can be a minefield.

Another key advantage is that bankruptcy lawyers can count the insolvent as well as creditors among their clientele. That’s very valuable flexibility.

How to start a recession-proof career in bankruptcy law

The general path to becoming a bankruptcy lawyer doesn’t differ from that of specializing in contracts. You’ll need to obtain a law degree and pass your region’s bar exam. Once certified, you can find work at a practice that specializes in bankruptcy or has a department that does.

Pro-tip

Bankruptcy law can be very fast-paced, according to Above The Law. Lawyers who thrive in this field enjoy the variety of available tasks and cases.

13. Police Officer

Police officers enforce laws, which entails activities such as responding to emergency calls, monitoring traffic, conducting patrols, and assisting court proceedings.

The U.S. Bureau of Labor Statistics projects a 5% growth in employment among police officers from 2018-2028.

Public safety remains a major priority during recessions. As such, law enforcement officers enjoy stability even though crime rates typically fall amid hard times.

Police officers also benefit from government funding, which is increasingly shifting to the federal level. This reduces the impact of municipal shortfalls on police budgets, which adds to the recession-proof nature of law enforcement.

How to get a recession-proof job as a police officer

One advantage of moving into policing is that the educational pathway is not as intense as that of other recession-proof jobs on this list. You can enter a training academy with a high school diploma, although some police departments will give preference to applicants that have a bachelor’s degree.

Once you’ve gone through training and screening, you can get a job as a junior officer working alongside someone more experienced.

Pro-tip

While becoming a police officer doesn’t require as long of an educational path as some other fields on this list, the training and screening are very rigorous. You’ll need to be both mentally and physically apt.

14. Correctional Officer

Correctional officers supervise prisoners to ensure their compliance, safety, and health. They also complete administrative tasks associated with holding and transferring patients.

The U.S. Bureau of Labor Statistics projects a 7% decline in employment for correctional officers by 2028 but some states are in dire need.

Despite crime being on the decline, the United States maintains one of the highest incarceration rates of any country on earth. Those prisoners need to be monitored and looked after, even during a recession. This provides correctional officers with substantial employment stability.

While the U.S. Bureau of Labor Statistics projects a decline in employment for correctional officers, it also points out that this will depend on state and local needs. This makes sense in a country as diverse as the United States.

A public prison’s source of revenue is fairly obvious. Private facilities are government-funded as well, however, receiving stipends typically based on the number of prisoners housed. This adds to the sector’s recession-resistant nature.

How to get a recession-proof job as a correctional officer

The requirements to become a state or provincial correctional officer vary by region. Generally, you’ll need to have a high school diploma and complete training at an academy. The requirements are a bit stricter in federal prisons, where you’ll often need a bachelor’s degree and work experience.

Pro-tip

The prison industry has notoriously high turnover rates. It’s not hard to imagine why; correctional officers deal with substantial stress by virtue of coming into contact with some of society’s most violent and defiant individuals. As such, it’s one of the most stressful recession-proof jobs out there.

15. Firefighter

A firefighter’s primary role should be pretty self-explanatory. In addition to putting out fires, they inspect buildings, respond to emergency calls alongside EMTs and police officers, and maintain equipment.

The U.S. Bureau of Labor Statistics estimates the profession will see a 5% growth in employment by 2028.

Firefighters fall into somewhat of a weird category because roughly 70% are volunteers in the United States. That said, larger cities tend to utilize hybrid forces that rely more heavily (if not entirely) on paid staff members. If you are able to land paid work as a firefighter, you’ll enjoy a stable income given the role’s necessity for public safety.

According to Fire Engineering, fire departments were generally among the last organizations in America to feel the effects of the 2008 recession. Municipalities took a “business-as-usual” approach before eventually implementing hiring freezes and suspending development programs when things really started to get tight. The overall message was “make do with less” rather than “we don’t need you, bye!”

How to get a recession-proof job as a firefighter

Formal education-wise, you’ll need a high school diploma to become a firefighter. You’ll also need to complete training at a fire academy and hold an emergency medical technician (EMT) certification. Some departments prefer firefighters who are also licensed to serve as paramedics, which requires its own certification.

Once you’re ready for the workforce, you’ll typically complete a probationary period at your first department job. There’s plenty of opportunity for growth in the firefighting industry, with the subsequent ranks (in order, according to Fire Rescue 1) consisting of:

- Firefighter (Non-Probationary)

- Engineer

- Lieutenant

- Captain

- Battalion Chief

- Assistant Chief

- Chief

Pro-tip

I almost excluded this one from the list given how common it is for departments (particularly in rural regions) to rely on volunteers. However, the fact remains that firefighting in larger municipalities is a stable, recession-resistant source of income. Just research the demand in your area very thoroughly.

16. Actuary

Actuaries use complex formulas to calculate the risks associated with various activities, such as investing, operating a motor vehicle, and managing a business.

The U.S. Bureau of Labor Statistics expects employment in this sector to grow by 20% through to 2028.

Actuaries provide vital risk management services to businesses, most commonly in the insurance and financial sectors. Depending on the industry, an actuary’s calculations can help clients decide who to lend money to, what accidents are worth insuring against, which assets make suitable investments, and much more.

These services are all highly valuable during tight economic periods, which means actuaries have some of the most recession-proof jobs in the world. Without them, companies (particularly in the insurance sector) would take on an absurd level of risk, which can be devastating even in the best of times.

How to get a recession-proof job as an actuary

To become an actuary, you’ll need a bachelor’s degree in mathematics or a related field. By the end of your educational journey, you should have a strong grasp of math, statistics, and economics. You’ll also need to complete examinations to receive your actuary certification before you can work in the field.

Once qualified, your first job will typically entail working on a team with more experienced actuaries. You may also spend time learning about the company and how the actuary process affects its various components.

Pro-tip

In addition to learning the math and statistics behind actuarial work, you’d be wise to obtain experience in computer programming since that factors heavily into the role.

17. Claims Adjuster

Adjusters review insurance claims to determine liability and negotiate payouts as needed.

The U.S. Bureau of Statistics projects a 4% decline in employment for adjusters through to 2028 but also lists healthcare as a sector that might see growth.

The insurance industry would simply not function without adjusters, who determine a claim’s validity and which party is liable (i.e. who is at fault in an accident) then calculate a fair settlement. Without these services, insurance companies would overpay for claims and fall victim to fraud much more often than they do.

It’s worth pointing out that algorithms are starting to compete directly with traditional adjusters. However, according to the U.S. Bureau of Labor Statistics, demand for adjusters remains high in the healthcare sector amid rising costs and numbers of claims.

The bureau also identifies the auto and property sectors as potentially rife with future opportunities for adjusters.

How to get a recession-proof job as a claims adjuster

You can obtain an entry-level position as a claims adjuster with a high school diploma. The most recession-proof jobs in this sector, however, often go to those with a bachelor’s degree or work experience.

Some employers also prefer those with a lawn enforcement background since being an adjuster involves lots of detective work and even interrogation.

Pro-tip

You need very thick skin to be happy as an insurance adjuster. Clients won’t necessarily be easy to deal with, especially since some of your work will entail investigating their claim’s truthfulness.

18. Social and Community Service Manager

Social and community service managers coordinate programs that support the general public.

The U.S. Bureau of Labor Statistics expects a 13% growth in employment for this role through to 2028.

There is always a need for programs that support public health and wellbeing, particularly during a recession. Social and community service managers working for employers like non-profit organizations and government agencies coordinate these programs and monitor their efficacy.

These programs target food insecurity, substance abuse, and mental health issues – all of which can be especially prevalent when the economy takes a slump.

People in this role typically supervise social workers that implement the programs. In smaller organizations, they may be responsible for filling that role as well, however.

Social and community service managers benefit from public funding, which is more resilient than other revenue streams during periods of economic distress. Even when this funding is cut, social and community service managers hold some of the most recession-proof jobs at their organizations.

While you may be able to find work with a bachelor’s degree in social work, counseling, or a related field, some positions require a master’s degree. You’ll also typically need experience working in a field such as social work before you can attain the status of social and community service manager.

Pro-tip

In addition to being an empathetic person who likes helping people, social and community service managers need strong persuasion skills. Convincing others that your programs are successful is key to thriving in the role.

19. Postsecondary Teacher

Postsecondary teachers provide academic training at colleges, universities, and other educational institutions beyond high school. Some may also conduct research projects.

The U.S. Bureau of Labor Statistics projects an 11% growth in employment for postsecondary teachers.

As much as entrepreneurs love to proclaim that degrees are useless, there will always be professions (like most of the recession-proof jobs on this list) that require them. This is a large part of why postsecondary educators enjoy phenomenal job security.

Additionally, data shows that people typically head back to school in larger numbers during a recession. Stanford economist Caroline Hoxby explains this by pointing out that the “opportunity cost” of going to college drops substantially during a recession. In other words, it’s much harder to find a solid job or obtain a promotion during hard times, so people aren’t really losing out by upgrading their credentials instead.

Public colleges and universities tend to be very well-funded. Some also have substantial endowments. As a result, postsecondary institutions weather financial storms remarkably well.

How to get a recession-proof job as a postsecondary teacher

It should come as no surprise that becoming a postsecondary teacher requires a degree. Whether that’s a doctorate or master’s degree depends on the institution and field you want to teach in. Some positions may also require work experience in the field and/or industry certifications.

Although there is a strong demand for workers in this field, getting hired is not easy by any means. There are tons of qualified candidates competing for tenure track roles, which are the most desirable as they lead to employment that cannot be terminated without just cause.

Prepare to work in a less-secure capacity (i.e. adjunct professor) for years until a tenure track position becomes available. Check out this article for some additional insight on how adjunct professors make the transition to tenure track roles.

Pro-tip

While postsecondary educators enjoy some of the most recession-proof jobs out there, you definitely want to get hired (ideally on the tenure track) during a boom. Institutions typically won’t lay educators off in large numbers during a recession but stable roles may be even harder to come by than usual.

20. Remedial Teacher

Remedial teachers help people acquire basic knowledge in areas like math and English. Students in these scenarios are often those who did not graduate from high school or received education of very poor quality.

The U.S. Bureau of Labor Statistics expects remedial teachers to see a 10% decline in employment rates but states that it can be reliable part-time work.

The vast majority of recession-proof jobs on this list are expected to see their employment rates grow (often quite substantially) over the next few years, which is intuitive. After all, why would you want to enter a dying industry during hard times?

I’ve decided to include remedial educators on this list nonetheless for two reasons.

First, as the U.S. Bureau of Labor Statistics points out, it’s a decent opportunity for people seeking part-time work. If you already have the necessary qualifications (see next section) it can be a great side hustle. Second, the 2008 recession saw many people entering adult learning programs to obtain General Education Development (GED) certificates, which can greatly improve job prospects. Remedial teachers saw impressive growth in employment rates as a result.

As a side note, economic conditions are not to blame for declining employment rates in remedial teaching. Rather, factors include an increase in traditional high school graduation rates and new tests being notoriously difficult. Check out this article to learn more.

How to get a recession-proof job as a remedial teacher

You can become a remedial teacher with a bachelor’s degree, although some community colleges prefer hiring those with master’s degrees. People often enter this field with an English as a Second Language (ESL) degree and experience teaching. Additionally, some states and provinces require specific licensing for adult educators.

Pro-tip

This job’s requirements and part-time nature make it perhaps most worth considering for traditional teachers looking to add a source of revenue during a recession.

21. Postsecondary Administrator

Postsecondary administrators support students and staff at educational institutions. Depending. on the role, they may handle admissions, conduct outreach, or analyze student data, among many things.

The U.S. Bureau of Labor Statistics expects a 5% growth in employment growth in this field.

Postsecondary administrators are vital to the functioning of college and universities. The roles can be quite varied but all involve supporting the institution’s growth.

As mentioned in the previous list item, enrollment rises at postsecondary institutions during a recession. That can mean lots more work for administrators, particularly those handling admissions and related roles.

How to become a postsecondary administrator

You’ll typically need a master’s degree to become a postsecondary administrator but some roles are open to candidates with a bachelor’s degree. Many institutions also require past work experience in educational administration.

Pro-tip

This job can be very high-stress due to the demands of students and teachers. You’ll need solid organization and communication skills.

22. Librarian

Librarians organize resources at libraries and museums. In the case of the former, they also oversee the issuing of those resources.

The U.S. Bureau of Labor Statistics projects a 6% increase in employment for librarians by 2028.

This one might come as a surprise. I mean, when’s the last time you visited a library? Whatever your answer (it’s been years in my case), you can probably remember visiting the library a lot more before internet use became as widespread as it is today.

Contrary to anecdotal observations, however, librarians do enjoy some of the most recession-proof jobs out there. Once you take a closer look at their role, it’s not hard to see why.

In addition to containing books, public libraries contain DVDs, newspapers, magazines, reference materials, workspaces, training, family activities, and access to the internet, among many other things. These resources are very valuable in low-income communities, members of which might not be able to afford them otherwise. Librarians also often function as archivists, maintaining important historical records.

There’s also a lot more to the librarian profession than working in a public library. There are also corporate, legal, and medical libraries which require specialized researchers and archivists.

The bottom line? Don’t underestimate the recession-proof nature (or importance) of librarians.

How to find a recession-proof job as a librarian

You’ll usually need a master’s degree in library science, which offers research skills crucial to success as a librarian. If you want to work in a specialized library, you may also require industry-specific training and knowledge.

Pro-tip

Because libraries are typically funded municipally, regions with small property tax bases (namely, sparsely-populated areas) offer the least recession-proof jobs. A larger city definitely has its advantages here.

23. Air Traffic Controller

Air traffic controllers coordinate access into, around, and out of airports. They also use technology to monitor the weather and other important factors that need to be communicated with pilots.

The U.S. Bureau of Labor Statistics expects a 1% growth in employment for air traffic controllers through to 2028.

While experts predict it will take years for the air travel sector to fully recover from the COVID-19 pandemic, air traffic controllers remain crucial to national security and safety.

Additionally, the cost to lay off air traffic controllers in large numbers (read: dish out severance pay) then find, train, and screen new ones can be quite prohibitive given the role’s specialized nature. As such, layoffs on any large scale tend to be quite rare (except when Ronald Reagan gets mad).

One additional benefit air traffic controllers enjoy is that they are unlikely to be replaced by computers. While companies always look to cut costs amid a recession, air traffic control is a matter of life and death. As humans, pilots make errors and find themselves in situations that can only be resolved with another human’s guidance. Check out this post for a more detailed look.

How to get a recession-proof job as an air traffic controller

While the role of air traffic controller is often hailed as one you can obtain without a degree, that’s not exactly true. While some positions are available to those with work experience and no degree, the field is quite competitive. As such, according to Indeed, those with associate or bachelors degrees from an Air Traffic Collegiate Training Initiative program are best-positioned for success.

Given how much of an impact air traffic controllers can have on national security, the screening involved with becoming one is naturally intense. In America, you’ll need to go through a very thorough biological assessment and training procedure. You’re also required to have a medical checkup each year and pass drug tests. Canada has very similar requirements.

Pro-tip

Being willing to relocate can also enhance your desirability as an air traffic controller.

24. Auto Mechanic

Auto mechanics inspect and repair vehicles to ensure their optimal functioning.

The U.S. Bureau of Labor Statistics expects little change in employment for auto mechanics through to 2028.

Auto mechanics enjoy economic stability for a few reasons.

First, their services are not discretionary. When you need a mechanic, you need a mechanic. Secondly, when you’re experiencing this need, it’s likely that instead of shopping around for a cheaper deal than usual, you’ll just stick with the mechanic you trust and have built a rapport with.

The general caution surrounding large purchases during a recession (car sales took a hit in 2008 and 2020) benefits mechanics as well. People are more likely to keep – and maintain – their vehicles, which means trips to the shop instead of the dealership.

How to launch a recession-proof career as a mechanic

Automotive repair is among the few recession-proof jobs out there that do not explicitly require a degree. Rather, you can become a mechanic by completing hands-on vocational studies after high school and receiving state or federal licensing (depending on where you live). Some employers (i.e. manufacturers and dealerships) also often send their workers for regular training throughout their careers.

Pro-tip

According to US News, most mechanics work at dealerships or dedicated repair shops as opposed to auto accessory stores.

25. Clergy

Clergymen and women hold official roles in religious institutions. Pastors, priests, and bishops fall under this umbrella.

The U.S. Bureau of Labor Statistics does not provide growth estimates for clergy but you can check out some employment data here.

Religion, although waning in popularity, remains a core aspect of life for billions of people. Institutions like the Catholic Church maintain immense wealth and are constantly generating more via tithes and donations from people who see those contributions as a key part of their spiritual journey.

Clergy working in wealthy areas have particularly recession-proof jobs since contributions won’t necessarily drop off during a recession.

Of course, churches are also economically advantaged in many ways. Most notably, they’re tax-exempt in the United States and Canada, which alleviates at least one financial burden.

How to find a recession proof job in a clergy

Your exact path will vary depending on which religion and denomination you belong to. Within Christianity, you’ll need to obtain a degree and become ordained before you can work. Courses will include theology and counseling.

Pro-tip

Being an authority on religion is just one of many roles the clergy fulfill. They lead their congregation in all aspects, resolving conflicts, supporting people during times of bereavement, and handling administrative tasks.

What to consider before changing jobs

Now, before you hand in your resignation and pursue one of these recession-proof jobs, it’s worth pointing a few things out.

First, there are things you can do (or perhaps have already done) in your current role to make it recession-resistant even if your industry is not inherently so.

When times are good, you should be actively demonstrating your indispensable nature by being reliable, quick to learn, and versatile and establishing a good rapport with key figures (including important clients). At many companies, this means playing office politics well – identifying the real shot-callers and currying their favor in some way or another.

Getting along well with decisionmakers goes beyond keeping your current job. When a layoff is unavoidable, you can leverage those connections into a new position elsewhere.

I say all of this to point out that you can build a recession-proof career in an industry that may not be inherently impervious to hard times. In fact, doing this can be fun if you have good people skills and a knack for thinking several steps ahead.

Secondly, you need to consider your entire financial picture before making the leap to a new career. Having to dip into your cash reserves – or worse, investments (read more here) – while you pursue training and look for new employment can weaken your overall ability to weather a recession. It may be wiser to wait before leaping, particularly during a recession.

Lastly, you should never choose a career solely because you believe it’s recession-proof. Choose something you’re genuinely passionate about. That way, you’ll have the drive and determination to keep pushing through the challenges that will inevitably appear during hard times.