Do you find yourself unconsciously spending thousands (or perhaps even tens of thousands) of dollars on random junk every year? Keep reading as I share some tips regarding how to stop buying things you don’t need. I’ll cover simple yet proven strategies for eliminating impulse spending and becoming more intentional with your money.

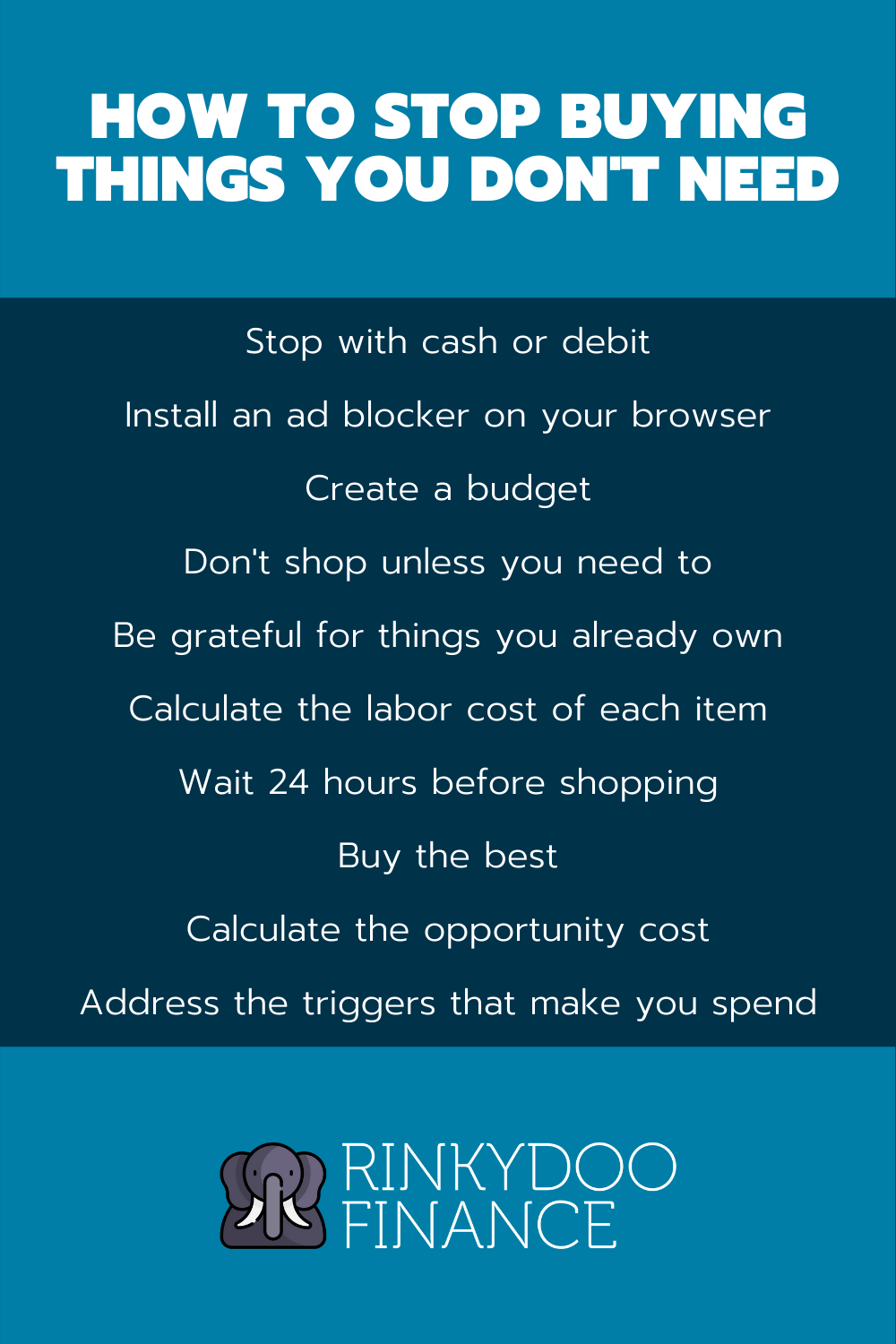

How to stop buying things you don’t need: 10 tips

1. Shop with cash or debit

According to a famous study published in Marketing Letters, consumers spend up to 100% more when shopping with credit versus cash or debit. It’s not hard to see why.

For example, imagine you go shopping for a new pair of shoes. The only payment method you’re carrying is $200 in cash, which is what you’ve budgeted for the purchase. Even if something else catches your eye at the store, you’re physically incapable of buying it. You’re forced to play within your budget of $200. If you don’t, you risk embarrassing yourself at the cash register when the total comes up to more than you have.

Now imagine you go shopping for shoes with a credit card in your wallet. The limit on that card is likely much higher than $200. Consequently, if a second (or third, or fourth) pair of shoes catches your eye, you’re fully capable of purchasing it.

Another problem with credit is that spending with it typically doesn’t produce immediate consequences. Most credit card companies offer an interest-free grace period that lets consumers buy now and pay weeks later (I wrote about this here). When you spend with cash or debit, meanwhile, you’re immediately conscious of the fact you have less money. In the case of cash, your wallet will literally feel lighter.

This is powerful information when you’re trying to cut back on impulsive spending. Leaving your credit cards at home and instead shopping with cash or debit is a very easy way to make tremendous progress overnight.

2. Install an ad blocker on your browser

Online advertising is very powerful. Companies spend billions of dollars analyzing thousands of data points – all for the purpose of figuring out which ads are most likely to make you pull out your wallet.

“But Brandon,” you might be thinking. “I basically never click on advertisements. Surely they aren’t what’s prompting me to buy things I don’t need.”

Here’s the thing, though. While you may not buy a product the first time you see an advertisement for it, repeated exposure increases the likelihood of you giving in. When you finally crack, you may even forget about the advertising you’ve been hammered with and instead insist you made an independent purchasing decision. That’s how you end up with a bunch of random junk.

Check out this article from Media vs. Reality for a more in-depth look at how powerful this aspect of advertising can be.

The only way to really escape advertising’s influence is to escape advertisements themselves. This is challenging in the physical world yet effortless online thanks to browser plugins like Ad Block. I highly recommend installing such a plugin if you have trouble buying things you don’t need. You’ll likely be surprised by how effective it is at reducing your spending.

3. Give every dollar you earn a purpose

If an idle mind is the devil’s workshop, an idle dollar is his hammer. In other words, unless you give every dollar in your possession a purpose, you’ll never stop buying things you don’t need.

This is my fancy, philosophical way of saying you need a budget.

Many people (especially those who like to be spontaneous and are therefore more likely to spend impulsively) get scared by the word “budget.” They think budgeting is solely about setting cumbersome restrictions.

In reality, budgeting is about telling your money where to go. Done right, it provides a framework through which you can not only meet your financial obligations but also let loose from time to time. The end result is that you’ll spend less money on things you don’t need yet retain enough flexibility to make such purchases here and there without breaking the bank.

Check out my article about organizing your finances for some tips on creating and maintaining a solid budget.

4. Don’t go shopping unless you need to

Window shopping (and its online equivalents, such as browsing on Amazon or eBay during your spare time) can be a means of relieving stress. It’s a terrible idea, however, if you find yourself constantly buying things you don’t actually need.

After all, the people who design e-commerce platforms and physical stores are experts at turning casual shoppers into paying customers.

For example, have you ever noticed how easy it is to buy something on Amazon? You’re only ever one click away from having something new and exciting on its way to you in the mail. What’s more, you can bet that as soon as you land on Amazon’s homepage, it will bombard you with items it knows you’ll find exciting. This is a recipe for disaster if you’re trying to stop buying things you don’t need.

As with online advertising, it helps to remove the temptation. Simply don’t go shopping unless you have a specific item in mind – and enough room in your budget to purchase it.

5. Learn to be grateful for things you already own

Have you ever stopped to think about why you buy things you don’t actually need? If you dig deep enough, you’ll likely find it’s at least partially because you don’t fully appreciate the things you already own.

Something known as the hedonic treadmill is at play here. This concept describes how positive experiences (including acquiring new things) excite us only temporarily; we typically return to a base level of happiness sooner or later. At that point, we begin looking for the next high.

Going through life like this can leave you with a mountain of meaningless possessions, each of which seemed like the key to happiness at one point. To break out of this cycle, you must learn to appreciate the items you already own.

One way you can achieve this is by starting a gratitude journal. Every day, look around your home and identify one object you’re grateful to own. Write down any positive associations you have with that object (i.e. fond memories of taking it somewhere with you or happy thoughts about the person who gave it to you).

You might be surprised at some of the sentimental treasures lying around your home. You might also be surprised at how long it takes you to work through all of the items in your home.

The point of this exercise is to show yourself that you already own lots of cool things (which you almost certainly do as a consumer living in a first-world country in the 21st century). You don’t need to buy shiny new things.

6. Calculate how many hours new purchases would cost you

Another way to sober yourself up and stop buying things you don’t need is to consider how many hours that new item you’re craving would cost you.

For example, let’s say you earn $30 per hour and are thinking of buying a $5,000 stereo system for your car. Is that system really worth more than 166 hours of your time? To be fair, maybe the answer is yes. More often than not, though, you’ll likely find this line of thinking dissuades you from making the purchase.

7. Wait 24 hours before making any major non-essential purchase

There are very few non-essential products you could possibly want to buy that won’t be available in 24 hours. Consequently, it never hurts to sleep on any major non-essential purchase.

“But Brandon,” you might be thinking. “What if I spot a great deal on Black Friday? Surely it makes sense to act quickly then, right?”

I’d argue otherwise. If an item is actually important to you, having to spend 20% more on it tomorrow shouldn’t matter much. Further, the item’s importance shouldn’t have dawned on you while you were shopping. You should’ve been aware of your desire (giving yourself enough time to research the items, consider alternatives, and sleep on it) for a while by that point.

I’d venture to say you’ll likely find yourself shying away from most frivolous purchases if you implement this 24-hour waiting period.

8. Save up for the best version of any non-essential item you want to buy

I don’t know about you but whenever I purchase the low-budget version of a non-essential item I’m craving, it’s only a matter of time before I start shopping for something nicer.

This is an easy way to end up blowing ludicrous amounts of money on junk. Avoid this by saving up for the absolute best version of whatever you’re after.

By doing so, you’ll enjoy two major benefits. First, you’ll probably enjoy the item a lot more. Second, you’ll have weeks (perhaps even months) to think carefully about your purchase. As you see how long it takes to save up for the item, you may even decide it’s not worth it.

As a bonus, you’ll get in the habit of saving!

9. Calculate the opportunity cost of every purchase

The term “opportunity cost” describes the potential benefits you give up by making a particular financial decision over another.

For example, every time you spend money frivolously, you’re incurring an opportunity cost equivalent to the gains you could’ve reaped by investing that money instead.

Let’s look at some numbers.

Fred and John are both (imaginary) 25-year-olds with $10,000 in annual disposable income (aka money left over after paying bills). Fred spends his $10,000 on random junk while John invests his money in index funds.

If we assume John’s index funds return an average of 10% annually (which is the U.S. stock market’s average return, according to NerdWallet), he’ll have more than $166,000 after 10 years. Fred, meanwhile, will have a pile of junk sitting in some corner of his apartment.

In other words, the opportunity cost of Fred’s decision to spend all of his disposable income is $166,000.

Once I started looking at money this way, my desire to buy random junk decreased substantially. Now, I always think about how much that money could turn into if I invested it instead. If the concept of opportunity costs is new to you, I hope it has the same effect.

10. Figure out what triggers you to shop impulsively, then create a plan for addressing it

Lastly, if you want to stop buying things you don’t need, it’s worth doing some soul searching. Specifically, figure out whether there are any emotional triggers that prompt you to spend recklessly, then create a plan for mitigating that effect.

Anxiety is a major driver of frivolous spending for me. Whenever I have a rough day, I’m tempted to spend. My solution? I’ve made a point of incorporating healthier stress-busting strategies (i.e. hiking) into my daily routine.

You can take a similar approach. Start by noting the circumstances (i.e. emotions, people, and places) associated with your urges to spend recklessly. If any of those factors are net negatives in your life (i.e. an acquaintance who does nothing but encourage you to behave against your own best interest), consider removing them.

If escaping the trigger altogether isn’t an option, create a plan for mitigating its effect that doesn’t involve spending recklessly.

How to stop buying things you don’t need: Conclusion

I hope this article has left you with some valuable food for thought regarding how to stop buying things you don’t need. It all boils down to addressing your financial habits head-on and changing them for the better.

Check out some of my other articles about spending money wisely here.