Not sure how to organize your finances – or what that even looks like? Fear not. In this article, I’ll be providing a detailed breakdown of 10 simple steps that will help you get a handle on your cash in no time.

Benefits of organizing your finances

Research indicates that 33% of Americans and 46% of Canadians lack a financial plan. This is pretty wild to think about; it means a substantial chunk of the population is more or less “winging it” financially.

It’s especially baffling once you realize that organizing your finances into a comprehensive plan isn’t rocket science. With some due diligence and the right tools, you can tackle the task within a weekend.

Once you do this, you’ll enjoy a number of benefits, including:

- Reduced stress: No more waking up in the middle of the night wondering if you’re on the right track.

- Substantial savings: Once you see where your money is going and have a gameplan, you’ll notice all sorts of ways to cut back and keep more of your money each month.

- Accountability: Organizing your personal finances forces you to face the numbers, which increases your likelihood of making wise decisions that reflect your true situation.

- Increased awareness: You’ll be able to spot fraud and take defensive action much easier when your finances are organized.

- More control: Organizing your finances is the crucial first step to telling your money where to go. If you neglect this, your money will very quickly develop a mind of its own.

That all sounds pretty good to me, especially in light of how easy it ultimately is to organize your money. If you agree, keep reading.

How to organize your finances: 10 straightforward tips

As always, please remember that everyone’s financial situation is different. The following tips are fairly conservative but you should still speak with a financial advisor before following anything I say.

With that said, let’s dive in!

1. Make a list of bills to pay every month

Most adults have fixed bills that need to be paid on a monthly basis. These expenses typically include things like:

- Mortgage/rent

- Car loan payments

- Car insurance

- Utility bills

- Minimum debt repayments

Creating a list of bills to pay every month is a foundational step in your journey towards financial organization. Why? Well, there are a few reasons.

For one, you may uncover some surprises when creating your list – especially if you set your bills to autopay and haven’t looked at them in years. In this scenario, there’s a good chance your bills have risen. Telecommunications providers, in particular, are notorious for doing this.

You can always call and negotiate those bills back down – but only if you’re paying attention, which is where your list will come in handy.

Another benefit of creating a list is that you’ll never have to worry about missed payments as long as you look at the list regularly. Providers often charge fees when you don’t pay on time. You may even get hit with an insufficient funds fee from your bank.

Save yourself the trouble by taking half an hour or less to write down your fixed monthly expenses. Refer to that list every month to make sure you’ve got your bases covered.

2. Get your priorities straight

Another essential aspect of organizing your finances concerns setting the correct priorities. Generally speaking, a sensible hierarchy looks something like this.

| Priority | Strategy |

|---|---|

| 1 | Covering essential, everyday purchases (i.e. groceries, housing, debt repayments, etc) |

| 2 | Building an emergency fund that allows you to cover first-priority expenses for three to six months if you become unemployed |

| 3 | Aggressively paying off high-interest debt (i.e. credit cards that come with double-digit interest rates) |

| 4 | Making contributions to employer-sponsored retirement accounts that offer a match |

| 5 | Contributing to your own tax-advantaged brokerage accounts |

| 6 | Aggressively paying off low-interest debt (i.e. your mortgage, car loan, or anything else with a single-digit interest rate) |

| 7 | Investing in taxable accounts |

| 8 | All other expenses (i.e. vacations, luxury purchases, etc) |

Of course, you’ll need to customize this list (ideally with the help of an advisor) to suit your financial situation. It’s a good starting point, though, because it will help you avoid devastating financial errors.

For example, if you purchased a luxury vehicle (priority level eight) without establishing an emergency fund (priority level two), you’d find yourself in very deep poo when that car inevitably broke down and required a multi-thousand dollar repair.

No advisor in their right mind would tell you to do something like that. However, they might suggest moving aggressive low-interest debt repayments down on the list if you meet certain criteria.

This is the sort of nuanced advice a professional can give you based on your situation.

3. Use an expense tracking app

After you’ve determined your fixed monthly costs and financial priorities, start tracking your expenses to ensure you don’t go off-course.

Now, personally, I find tracking to be somewhat of a pain if I have to manually write everything down or type it into a spreadsheet. Thankfully, there are apps that can streamline and automate much of the process.

My tracking app of choice is Mint. It syncs with your various bank accounts and records transactions as they happen. If you exceed your budget in a particular category, the app will alert you, which may just be the negative reinforcement you need to get your spending under control!

There’s plenty of positive reinforcement in Mint as well. You’ll see little graphical celebrations whenever you hit a particular savings goal, which is a nice touch.

No matter which tracking tool you choose (even if it’s a spreadsheet, which works for many people), I recommend setting time aside each month to review the data and see where you might be able to save more or put additional funds towards your goals. More on this shortly.

How to start tracking your expenses with Mint (tutorial)

Here’s a step-by-step approach to tracking your expenses using Mint.

- Visit mint.com.

If you already use an Intuit product (i.e. TurboTax or QuickBooks), click “Sign in.” Your existing account will work with Mint. If you’re new to the Intuit universe, however, click “Sign up.”

- If you’re creating a new account, enter all of the requested information.

Mint will use your phone number to secure your account. If someone ever guesses your password, they’ll still be unable to get into your account unless they also have access to your phone. I’ll show you how to activate this and one other security measure in a future step. For now, just enter your phone number where prompted so Mint can save it.

- Input your country and postal/zip code on the next screen.

This will determine which bank connections show up by default in a second.

- Choose your main bank on the next screen.

If you don’t see your institution, use the search bar to type its name or input the sign-in URL.

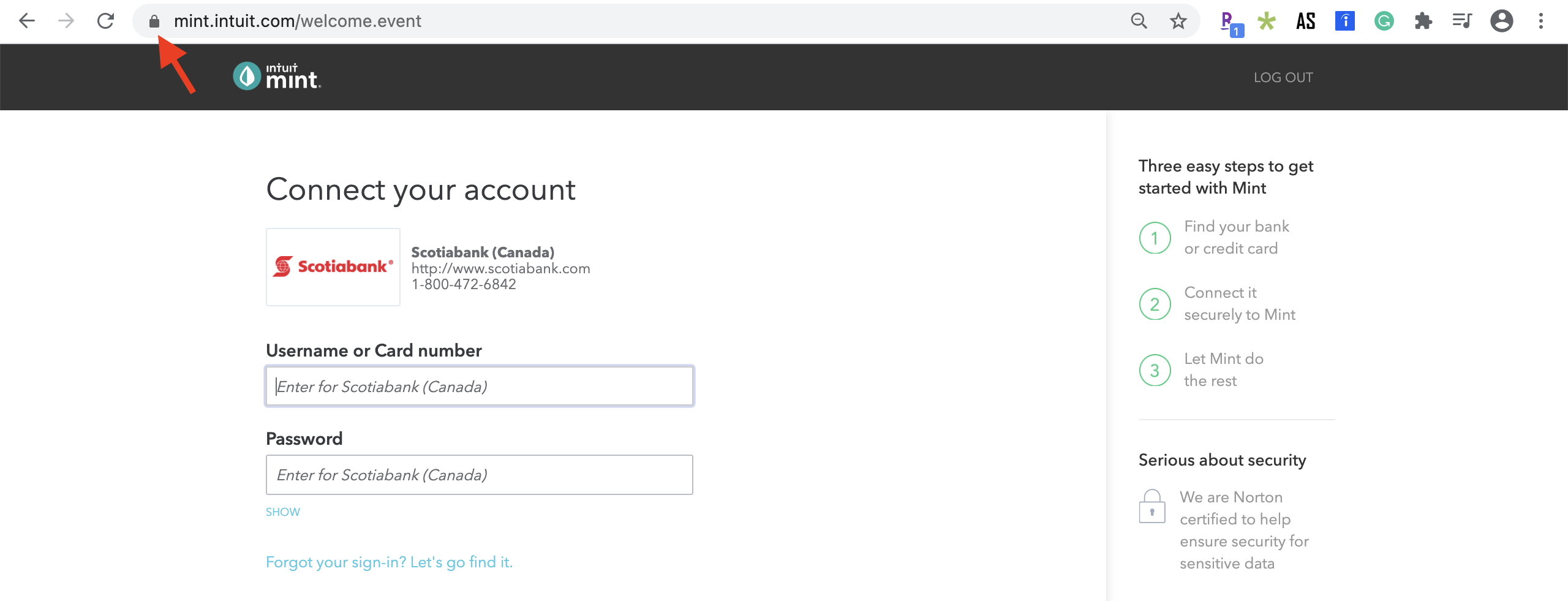

- Enter your banking credentials on the Mint website.

Mint automatically creates a secure connection before you even reach this screen. However, if you want to verify your secure connection, click the lock to the right of Google Chrome’s reload button.

This will reveal a popup with some details about your connection. All common browsers have this functionality. Just look for a lock somewhere near the URL field and click it. As long as the browser confirms you have a secure connection, you’re good to go. After you input your information, Mint will display a loading icon for several minutes. Let it sit. It’s accumulating all of your transactions and categorizing them automatically. - Skip the tour (optional).

On the next screen, you’ll see a welcome message along with an invitation to take a tour. If you’re in a hurry, you can skip the tour. Either way, it won’t affect your ability to follow these next few steps so do whatever you want.

- If you use other bank accounts, click the “ADD ACCOUNTS” option from the top menu.

You’ll be able to add new accounts using a similar process as what you’ve already seen.

- Once you’ve added all the necessary accounts, head to the “TRANSACTIONS” tab.

This is where we’ll start training Mint to categorize your transactions properly.

- Under the “Type” heading on the left hand side of your screen, make sure “Cash & Credit” is selected.

This is where 99% of your transactions (expenses and income) will be.

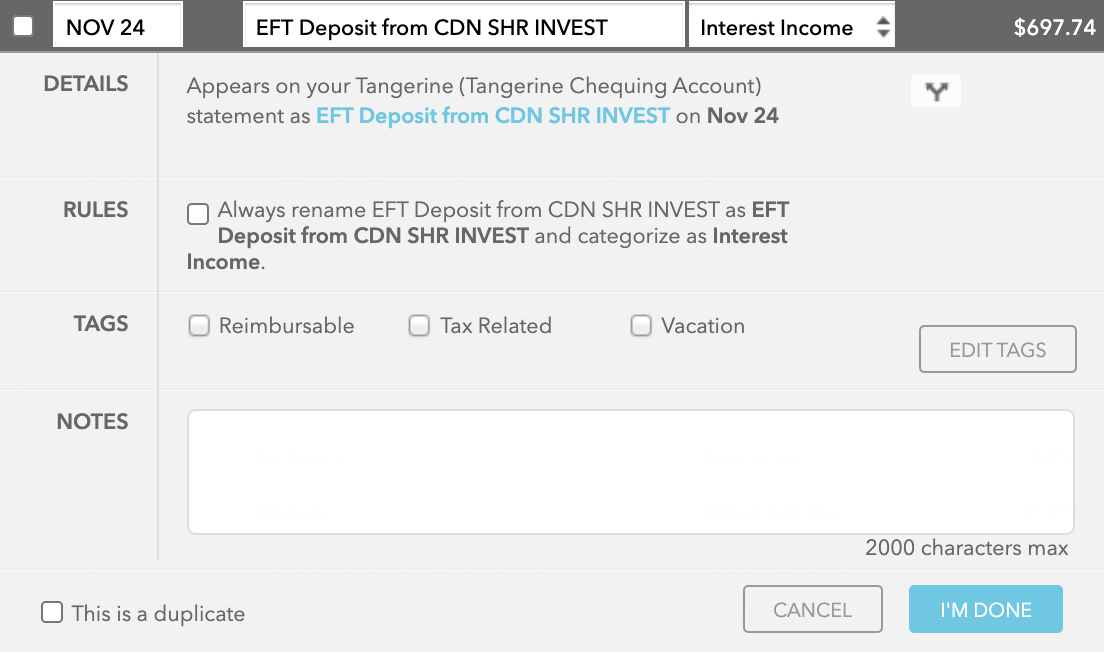

- Look through each of your transactions and correct any that Mint improperly categorized.

Mint’s algorithm has gotten much better than when I started using it a few years ago but you’ll still occasionally see some miscategorized expenses. If you see several identical miscategorized expenses, recategorize one and then click the “EDIT DETAILS” tab. You’ll see a dropdown that looks like this.

Check the box beside “RULES” to tell Mint all transactions with the same description as this one should be categorized the same way. The app will make that change and remember the correct categorization going forward. - Congratulations – you’re now tracking your expenses!

These 11 steps shouldn’t take you too long. Mint is pretty good right out of the box. The only thing left to do is secure your account.

- Visit accounts.intuit.com and sign in.

Enter the same credentials you used to create or log into your Mint account in step one.

- Navigate to “Sign in & security.”

- Select “Two-step verification.”

If you didn’t enter your phone number in step two, Intuit will prompt you to do so now. This is essential for enabling two-step verification, which will keep your financial records secure.

- On the next screen, click “Turn on Authenticator app.”

Select your type of phone on the next screen. This is simply so Intuit can give you a link to the appropriate app store page for Google’s authenticator app. That app has terrible reviews, though, so ignore the link.

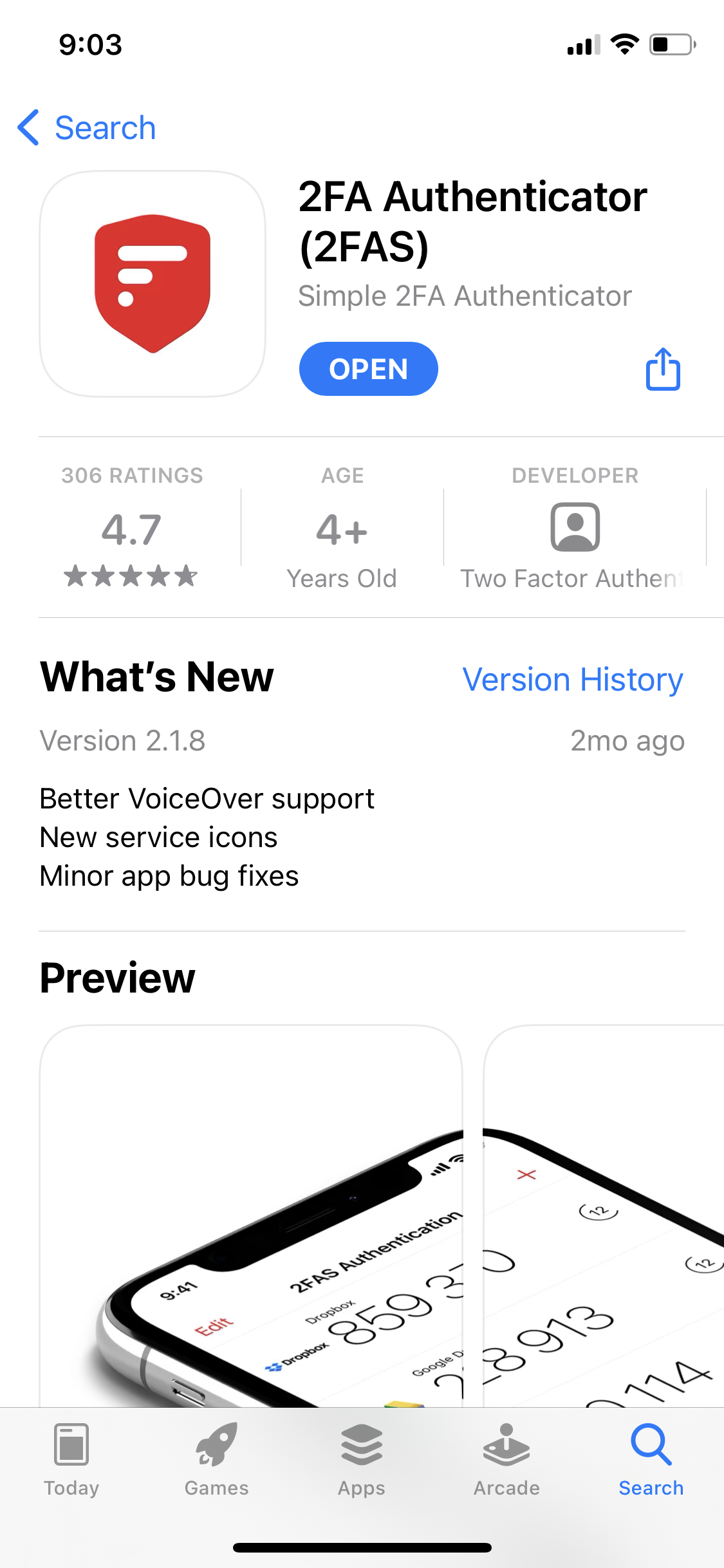

- Next, grab your phone, open the app store, and search “2FA Authenticator (2FAS) by Simple 2FA Authenticator.”

This is a highly-rated two-step verification app that integrates seamlessly with Intuit. Download it.

- Open 2FA Authenticator (2FAS), tap the “+” icon, and select “Scan QR Code.”

Your rear-facing camera will activate. Hold it up to the QR code on the Intuit website. Your phone will then present you with a six-digit code. Enter this on the Intuit website. Now you’ll have two-factor verification activated on your Intuit account. Whenever you try to log into Mint, the site will prompt you for a code that can only be accessed from your physical phone.

- You’re good to go!

You’ve done everything you need to do with Mint for now. The app will continue to pull your transactions in and categorize them on an ongoing basis, allowing for very easy tracking of expenses across all of your accounts! To really make the most of Mint, explore other features such as goal-setting and assigning specific spending limits to each category.

Pro-tip

If you’re going to be syncing your bank accounts with an app, make sure it’s made by a reputable company! Mint is developed by Intuit, which produces various industry-standard accounting applications. I’d recommend staying away from apps made by little-known companies as you may have little recourse in the event of a breach.

4. Figure out your net worth

Many people seem to think net worth calculations are only for the rich. In reality, they’re key when looking into how to organize your finances.

You see, figuring out your net worth can drastically reframe your entire mindset when it comes to money. Whenever you’re in the process of making a major purchasing decision, you’ll begin to think of it in the context of your overall wealth, which is important.

For example, you might start to ask yourself whether it really makes sense to purchase a luxury vehicle for $60,000 when you have a net worth of just $40,000 (hint: it doesn’t).

This mindset shift is one of many things that separate the rich from the poor. Wealthy people are constantly making decisions that increase and protect their net worth. Poor people, on the other hand, have no idea what they’re worth and, as a result, take on oversized debt burdens that keep them broke forever.

Calculating your net worth is easy. Just add up the value of your assets (property, savings, investments, etc) and then, from that number, subtract your liabilities (amounts owing on a mortgage or car loan, consumer debt, etc).

Whether the number is high, low, or even negative, you’ll end up with a decent big-picture view of your finances. Your net worth, after all, is what you’ll ultimately rely on in retirement. Tracking that number (and its movement, which should ideally be a steady climb upward throughout your working years) is a crucial part of organizing your finances.

5. Have honest conversations about money with your partner

I’m not a relationship counselor. In fact, if we’re being honest, I’m usually the last person you want to take relationship advice from.

However, I do know that it’s important to be on the same page as your partner when it comes to money.

In fact, I’d venture to say that knowing how to organize your finances is useless if your partner isn’t on board. Because, newsflash, any long-term partner’s finances will affect yours tremendously, especially if you have major shared obligations (i.e. a house or children).

It may not be easy or comfortable but you need to organize your finances together. That means following every step on this list not just by yourself but with your partner as well.

Also, while no couple likes to hear this, your joint financial plan also needs to account for the possibility that you may split up at some point. It’s much easier to have these conversations and organize your finances as a couple when you’re still in love rather than bitter and lawyered-up.

Ramit Sethi, one of my favorite personal finance authors, had an interesting conversation about all this with Tim Ferris. Check it out here.

6. Set regular check-in dates

Organizing your finances isn’t a one-time thing. You’ll need to periodically review your plan.

During these check-in sessions, you should be able to clearly see whether you’ve been keeping on track with your budget. If you realize you’ve been slipping, treat it as a wakeup call and course-correct.

If, on the other hand, you notice you’ve been doing a fantastic job, don’t be afraid to have a little celebration. This doesn’t even have to cost money; you can simply give yourself a day to relax from an arduous chore or other obligation.

I like to assess my finances on a monthly basis. It’s not an intensive process; just about 20 minutes of scanning through the previous month’s transactions to ensure I’m still on the right track.

At the start of every year, I’ll do a slightly deeper dive into my finances to ensure I start off on the right foot.

Whatever intervals you decide make sense, stick to them! Set a reminder in your phone’s calendar in case you forget.

7. Use proven strategies to eliminate debt

Eliminating debt is undoubtedly one of the most complicated aspects of organizing your finances – especially if you have multiple loans. In this scenario, it’s easy to get confused about which debt you should prioritize.

Thankfully, there are two proven strategies you can use to eliminate this guesswork.

The first is called the debt snowball method. It involves making minimum monthly payments on all of your debt while making additional aggressive repayments towards the loan with the smallest balance. Once you’ve eliminated that debt, you’ll move on to the next highest balance, and so on.

The “snowball” part comes in via the fact that your debt repayment gradually gets more aggressive. Whenever you finish paying off one debt, its minimum payment gets added to your stockpile for eliminating the next debt, and so on.

The debt avalanche method is similar but involves prioritizing loans with higher interest rates rather than lower balances.

I prefer the debt avalanche approach because it means paying less interest in the long run. However, the debt snowball method is great for building momentum, which is what some people need to stay motivated.

Truth be told, either method is better than repaying debt without a concrete strategy, which often leads to failure and excuses.

However, speak with an advisor before settling on any particular method; how you approach debt repayment can make or break your financial future.

8. Be careful about automated bill payments

I’ll be honest – I’m not a huge fan of automated bill payments. There’s too much room for error (i.e. my direct deposit landing later than expected, triggering an insufficient funds fee).

Plus, I like to review each bill before paying it because I often catch things that require action, such as an error on my telecommunications bill.

Of course, you can decide how to organize your finances, including whether automatic bill payments make sense for you.

If you decide to use them, just make sure you occasionally check in on your account balances to avoid any issues. You should also still be looking at your bills on a monthly basis to ensure everything looks right. Incorporate these checks into the schedule described in tip number six!

9. Use multiple savings and investment accounts

By organizing your nest egg across multiple bank accounts, you take advantage of something known as mental accounting. This is a phenomenon through which your brain thinks of money differently depending on factors such as where it came from and what account it’s sitting in.

It explains why some people blow through bonuses and tax refunds yet are more conscious about their regular income. While a dollar is always a dollar, mental accounting makes it easier to justify spending some dollars more recklessly than others.

I harness this power by setting up accounts for various goals and types of spending. For example, I have accounts dedicated to saving for retirement, one meant for a downpayment on a house, another for emergencies, and one account for covering day-to-day expenses.

Money pretty much never jumps from one dedicated account to another because, thanks to mental accounting, I view each bucket as being fundamentally different.

10. Hire a professional tax preparer

Taxes, as all working adults know, are very important. You don’t want to be making mistakes when it comes to your annual return.

Thankfully, it’s very easy to avoid errors and stay organized when you hire a professional tax preparer. I use TurboTax Live Full Service, which costs just $130 but results in a return that’s far more organized and accurate than what I’d be able to create on my own.

It also comes with what TurboTax calls “Audit Defence,” which means they’ll be in my corner if the Canada Revenue Agency ever raises a stink about my return.

Before I started using the service, I was always struggling to keep my various receipts and invoices organized. Now, they all just live in the TurboTax portal.

I’m not paid to promote TurboTax, though. Use whatever you want! I’d just recommend going with a professional that helps you stay organized.

How to organize your finances (conclusion)

Organizing your finances doesn’t have to be a huge chore or involve hours spent sorting through messy folders on your desktop (or worse – in physical form). I hope this article has given you some valuable ideas for streamlining things.

Click here to check out my other personal finance articles, including tips for investing and saving.