Many people view money as little more than a means of paying for products and services. In reality, it’s actually the greatest wealth-building tool out there. In this article, I’ll discuss how to make your money work for you using a variety of tried and true methods.

Overview

I believe money should work for you in three important ways:

- Giving you peace of mind

- Helping you build a better future

- Broadening your personal and professional horizons

Every point I’ll be discussing in the next section relates to one of these three goals.

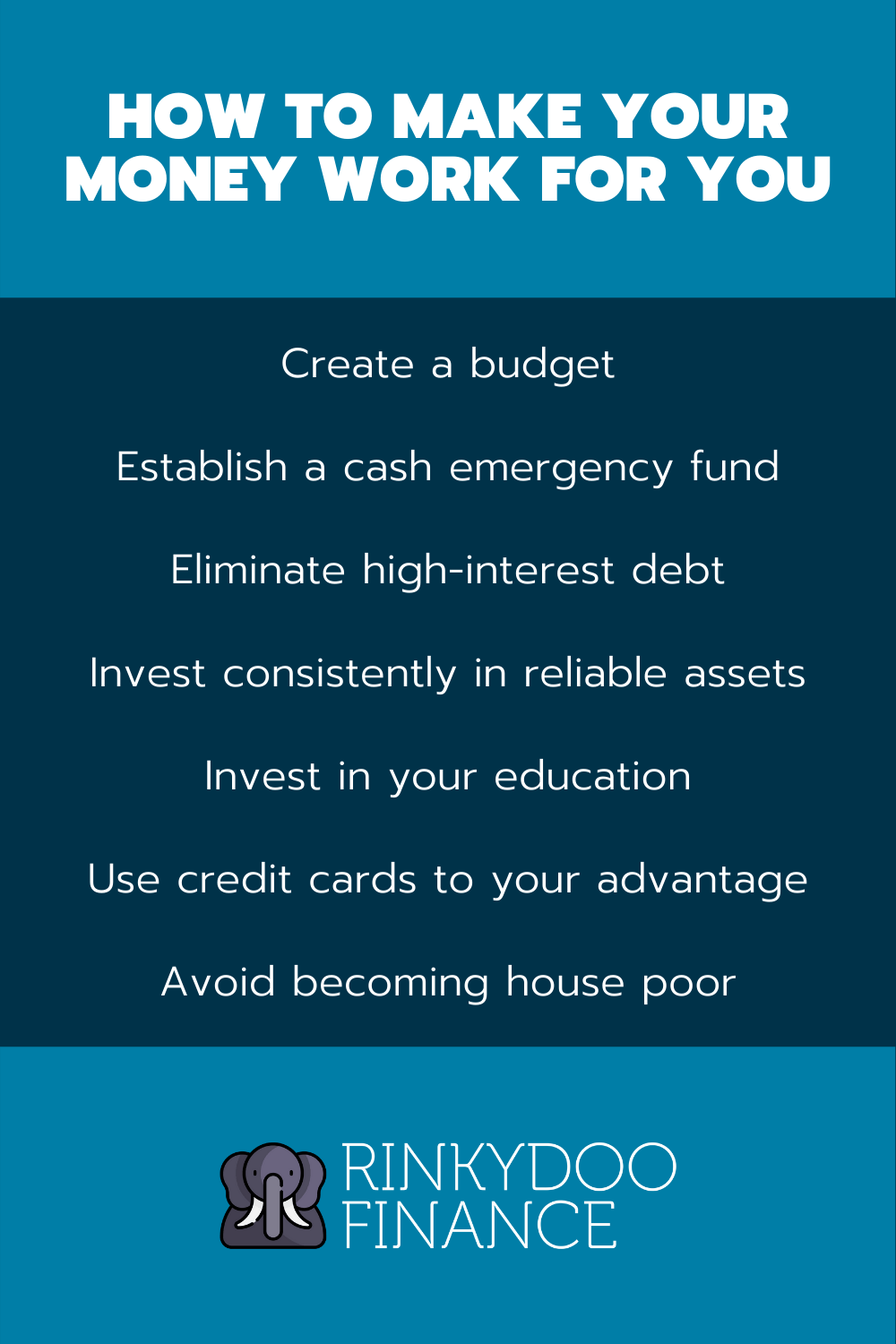

How to make your money work for you

Create a budget

Every dollar you earn has the potential to be a fantastic employee. You can’t harness this potential, however, without knowing what each “employee” is doing under your watch. That’s where budgeting comes in.

A good budget essentially tells each dollar where to go, much like management professionals in a company direct employees. Check out this article I wrote on the topic of creating an organized budget centered around sensible financial priorities.

Keep in mind that budgeting (and, really, every activity on this list) is something you’ll need to revisit periodically (i.e. as your income and expenses change). The goal should be to always ensure your budget leaves you spending less than you earn and investing the difference.

Pro-tip

Paying yourself first should be a key component of your budget. You can achieve this by allocating a specific portion of your monthly income towards long-term savings and investment goals. Check out my first point in this article for some advice on making this happen.

Establish a cash emergency fund

Sticking with the employee analogy, every dollar you keep in an emergency fund is like a stable, trustworthy employee working for you. Such employees may not be the most productive. They certainly won’t drive high growth for you (after all, you should be keeping these dollars in cash). However, they comprise the financial foundation that will help you sleep well at night and comfortably pull off riskier maneuvers (i.e. investing, which I’ll get into shortly) with other funds.

Most financial experts recommend keeping an emergency fund capable of covering your essential expenses for three to six months. This should cover you in the event of job loss or some major unexpected expense.

Eliminate high-interest debt

Dollars you have tied up in high-interest debt are like toxic employees stealing from you. That’s why eliminating high-interest debt is among the most powerful ways to make your money work for you.

Look at it this way.

When you invest in the U.S. stock market, you’ll earn an average of roughly 10% annually. That’s great – in fact, I’ll discuss investing in my next point. However, paying off your credit card will produce a return equivalent to that card’s interest rate, which is likely much higher than 10%.

This is why financially savvy people (such as Mark Cuban) typically recommend eliminating credit card debt before even thinking about investing.

The same logic applies to any other loan with an interest rate near or above the stock market’s average. You simply can’t beat the guaranteed returns that come from eliminating such debt. It’s like eliminating toxic employees from your workforce.

Invest consistently in reliable assets

The strategies I’ve highlighted so far will help you build a solid financial foundation. To really get your money working overtime for you, however, you need to invest.

Among the most productive investment vehicles on earth is the U.S. stock market. As I mentioned earlier, it generates an average return of roughly 10% annually. Over time, that can translate into serious financial growth.

For example, let’s say you start investing $500 each month in the U.S. stock market. If you keep that up for 30 years, you’ll end up with more than $1 million. That’s much more than what the average American in their 60s has saved for retirement ($182,100, according to Investopedia).

Of course, stocks are just one of many asset classes. Other productive examples include real estate and private businesses (i.e. your own physical or online store).

To learn more about the various forms of investing, check out my beginner’s guide here.

Whichever approach you choose, stick with it and tap into as long a compound growth curve as possible (read more about what I mean here).

Pro-tip

Investing in tax-advantaged accounts is a great way to make your money work even harder than usual for you in the stock market. This is especially true if your employer matches your retirement account contributions up to a certain amount.

This essentially amounts to free money. Many financial advisors will therefore implore you to take advantage of it unless you have significant high-interest debt.

If you live in the United States, click here to learn more about the various types of investment accounts (including the plethora of retirement accounts out there) and how they work.

Bonus pro-tip

If you have lofty financial goals (i.e. retiring early or becoming a multi-millionaire), consider investing outside of tax-advantaged accounts as well.

Having investments in regular (taxable) brokerage accounts can provide extra flexibility in that you won’t be subject to any penalties as a result of making withdrawals on your own schedule.

Taxable brokerage accounts are also great because they don’t come with deposit limits. This comes in handy for situations in which you have the capacity to save more than your tax-advantaged accounts would allow.

Invest in your education

Investing in the stock market and other tangible assets is great. In fact, it’s an essential part of getting your money to work for you.

However, don’t discount the importance of investing in your education as well. This can ultimately help you earn significantly more money. You can, in turn, put those dollars to work for you and make even further progress.

While many people in online personal finance circles disparage college, it can actually be a great means of investing in your education. Check out this article I wrote for a rundown of the numbers. You might be surprised to learn just how much more those with bachelor’s degrees earn on average compared to people with high school diplomas (or even associate’s degrees).

Of course, the internet has made it possible to learn without traditional college, too. Sites like Coursera offer hundreds of certificates from institutions such as Duke University and Stanford University.

Use credit cards your advantage

Credit cards have a terrible reputation among most financially savvy people.

Here’s the thing, though. Most of us use credit cards anyway. It’s a convenient means of spending and also often comes with some consumer protections. If you’re going to be spending money on plastic anyway, you might as well do it in the most financially efficient way possible.

The most straightforward way to do this is by using a credit card that rewards your existing spending habits.

For example, do you spend lots of money on gas? Look for a credit card that offers rewards points for every dollar spent at your favorite station.

The key here is to avoid spending simply for the sake of racking up rewards points, which defeats the purpose. Your goal is to monetize your existing financial behavior.

Don’t spend too much money on your primary residence

Few financial decisions carry as much weight as purchasing a primary residence. After all, it’s the most expensive purchase most people make in their entire lives.

One major mistake many people make is that they spend way too much on their homes and end up house poor. This means their money, instead of working hard for them via reliable assets, goes towards owning and maintaining their home – a massive, illiquid asset, the value of which is subject to a variety of unpredictable external factors.

“But Brandon,” you might be thinking. “Houses are great investments! They only ever rise in value!”

Wrong.

Sure, houses in North America generally rise in value. People do lose money on them more often than you might think, though. A full 10 years after the 2008 financial crisis, some property valuations still hadn’t reached pre-recession levels. Affected homeowners who needed to sell (i.e. finding work meant relocating elsewhere) within that decade lost money.

Some analysis (see this article from Money Under 30) even suggests those who rent and invest the money they’d have otherwise spent on homeownership (i.e. home insurance, property taxes, and maintenance) end up richer in the long run.

My point? Buying a house doesn’t automatically constitute a sound investment. In fact, spending too much money on a primary residence is actually a terrible decision that will keep your money from working hard for you.

Conclusion

Money is more than just a means to an end. It’s also an incredibly powerful tool you can use to obtain peace of mind, build a better future, and broaden your horizons.

I hope this article has given you some ideas for achieving this! Check out some of my other articles here if you’d like more financial food for thought.