If you spend enough time reading investing-related content on social media, you’ll inevitably bump into forex traders. They tend to be very aggressive in showing off their profits and recruiting new traders. But what’s the deal? Is forex a scam? Or is there legitimate money to be made in this space? Keep reading to find out.

What is forex, anyway?

The term “forex” is short for “foreign exchange,” which is the practice of trading currencies. It’s an essential function in our globally connected economy. For example, forex is the mechanism Japanese companies would use to convert their yen into dollars when buying goods from the United States.

Individual forex traders (such as the ones you’ve likely seen bragging about their “sick gains” on social media) use this same concept in an attempt to profit from fluctuations in currency valuations.

So, is forex a scam?

Forex itself is not a scam. It’s a legitimate mechanism that facilitates cross-border business transactions. However, the forex trading “opportunities” we’ve all seen on social media are almost invariably scams.

These scams take many forms. Keep reading as we run through them.

Types of forex scams

Multi-level marketing schemes

This is the most common type of forex scam I’ve encountered online. Perpetrators lure new recruits in with the promise of some algorithm or trading signal chat group that supposedly helps ordinary people make millions through forex trading.

It’s all smoke and mirrors, though. The true objective of everyone in these organizations is to recruit as many new members as possible and collect referral bonuses. Money from new recruits is used to create an image of wealth within the organizations. This subsequently attracts even more people looking to get rich quickly.

Eventually, recruitment numbers start to fall and disgruntled “investors” begin posting warnings on social media. At that point, perpetrators often shut the companies down or rebrand to escape scrutiny.

Signal selling schemes

Another common forex scam entails perpetrators selling access to private forex trading signal groups. Investors buy in expecting to receive information that will help them get rich quickly. In reality, the perpetrators are just looking to make money through subscription fees. They don’t care about providing value.

The lack of any multi-level marketing component often fools investors into thinking these scams are legitimate. In fact, it can be very difficult to convince participants they’ve been ripped off since savvy signal sellers obscure their track records.

Algorithmic trading schemes

This scam is very similar to the previous one in that it entails perpetrators selling grossly misrepresented services. Investors believe they’re paying for some fancy forex algorithm that will trade their deposits and produce out-of-this-world gains. In reality, the “algorithm” is often either incredibly basic or nothing more than a group of people trading manually.

Perpetrators often artificially boost reported profits with sign up fees from new recruits to make participants believe the algorithm is delivering results.

As with signal selling schemes, forex algorithm scams can be particularly deceptive in the absence of aggressive multi-level marketing antics.

Price manipulation

Before I explain the concept of price manipulation in forex markets, let’s talk about brokerages. These are the platforms that facilitate forex trading. They handle the computer logic that pairs both ends of any trade (i.e. an American customer looking to trade his dollars for a Japanese customer’s yen).

There are legitimate forex trading brokerages out there. However, there are also many fraudulent ones. Price manipulation is one strategy these shady brokerages use to defraud customers.

For example, they might initiate substantial trades with no intention of completing them. Rather, their intention would be to manipulate the price of currencies at make money at the expense of their customers.

Front-running

Large market participants (those transacting significant amounts each day) can influence currency valuations with their trades. This is completely legal when there’s no malicious intent.

What’s not legal, however, is front-running. This is when shady forex brokers capitalize on their advance knowledge of a large customer’s intentions and trade accordingly.

For example, let’s say a broker notices one of their large clients is about to sell $10,000,000 worth of a particular currency. They run the numbers and conclude this will likely decrease the valuation of that currency. Front-running would be the act of selling their own holdings before putting the client’s order through. The broker would be spared from the losses. Anyone who lacked that insider information would not be.

Why are there so many forex trading scams?

Next, let’s discuss why there are so many scams out there involving forex trading.

Issue #1: The forex space is filled with unregulated brokers

Many brokerages operating in the forex space are unregulated. Some of these unregulated brokerages ignore (or even condone) unethical and illegal behavior, which makes their platforms havens for scammers.

For comparison, stock brokers are heavily regulated. Firms in the space must register under the Securities and Exchange Commission’s Broker-Dealer provision. Running afoul of these rules can lead to swift and harsh punishment.

In other words, bad actors flock to forex rather than the stock market because the risk of facing legal consequences is much lower.

Issue #2: Interest in forex trading is near all-time highs

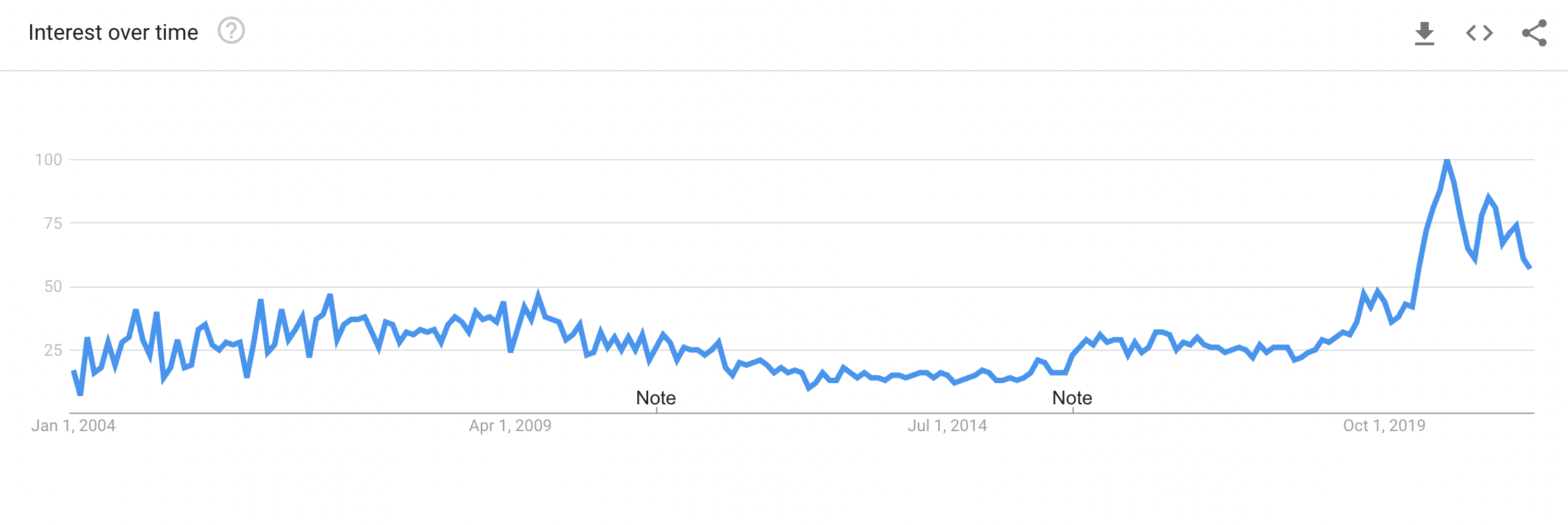

Here’s what the Google Trends chart for the query “forex trading” looks like:

Unfortunately, any space with this much interest is bound to see an influx of bad actors hoping to make a quick buck. Forex is no different.

Issue #3: Scammers capitalize on the fact forex seems legit

Out of curiosity, I once attended a group presentation for an obvious multi-level marketing scheme masquerading as a forex trading algorithm product demo. A large part of the presentation was dedicated to highlighting two points:

- the forex market is massive

- banks make billions of dollars trading currencies

Both of those statements are true. That doesn’t mean forex will make you as an individual rich, though. In fact, it almost certainly won’t (more on this later). To inexperienced investors, however, those two points sound convincing.

How to avoid forex scams

Now that you know about the various types of forex scams and why they exist, let’s discuss how you can avoid falling victim to them.

Don’t engage in forex trading

I have yet to meet a single person who has been able to demonstrate that forex trading is a feasible and sustainable means of building wealth as an individual. I’m convinced that’s because it simply isn’t.

For starters, most currencies typically move by a fraction of a percentage point at a time. Banks make money on those movements because they transact billions of dollars and charge customers fees for each conversion. The Average Joe with a few thousand dollars to invest isn’t going to get very far unless they take on leverage, which could just as easily work against them.

That’s why my primary tip for avoiding forex scams is to avoid forex altogether. Instead, try some of the legitimate investing strategies I discussed in this post.

If you want to try forex trading, be sensible about it

If you decide to ignore my above advice and try forex trading because it seems entertaining or whatever, be sensible in your approach. That means taking the following steps:

- only investing money you can afford to lose

- staying away from leveraged trading (unless you can afford to dig yourself out if the trade moves against you)

- using a regulated brokerage

- taking advice (particularly if it was given to you unsolicited) with a grain of salt

- staying away from any platform or person offering you “guaranteed” high yield

- thoroughly researching any opportunities you come across before putting money in

Do your own research

Before you act on any piece of information regarding forex trading, find at least three independent and reputable sources to confirm it. Any single-sourced piece of information is biased at best. At worst, it’s an outright scam meant to mislead you.

Don’t be greedy

A desire to get rich quickly is your worst enemy when it comes to investing. Most get-rich-quick strategies (including many forex trading schemes) are scams. Heck, even the ones that aren’t scams don’t always have your best interests in mind. Often, even legitimate actors (i.e. regulated forex brokerages) are little more than vendors selling shovels during a gold rush – opportunists capitalizing on the ever-present human desire to make a quick buck.

Don’t be a sucker. Accept there are no free lunches and building wealth is a long game. You may find the allure of forex trading fades away pretty rapidly.