Drowning in debt is easily among modern life’s most unpleasant experiences. It’s also incredibly common, with 33% of Americans having debt that’s currently in collections.

The good news is that you don’t have to stay trapped in debt’s vicious cycle forever. Keep reading as I share some tips for breaking free and reclaiming your financial well-being.

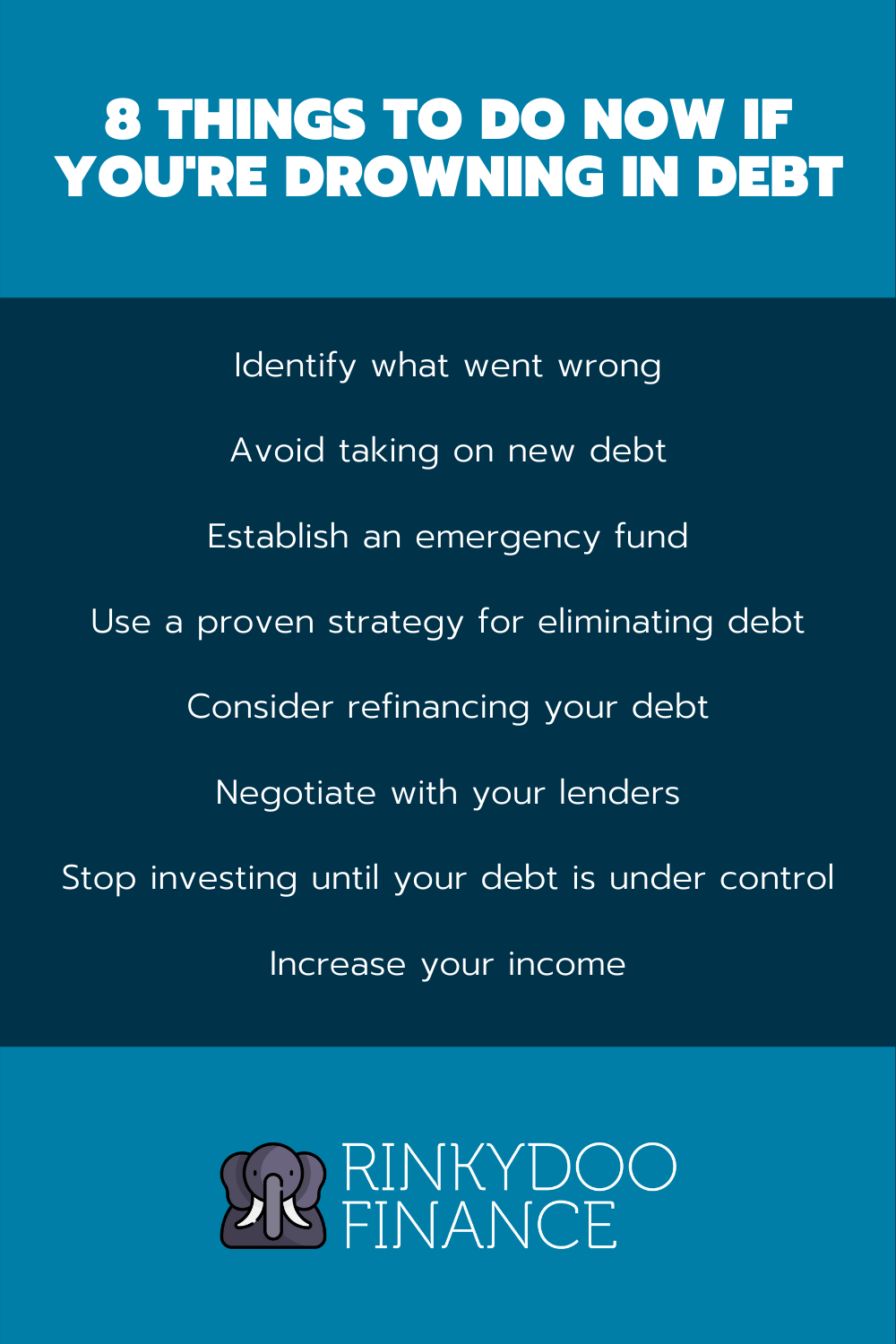

8 things to do NOW if you’re drowning in debt

1. Identify what went wrong

I was initially tempted to start this list off with “avoid taking on new debt.” However, you probably didn’t end up in this situation by virtue of wanting to take on piles of debt. Rather, it happened for a reason. Common reasons include not just financial irresponsibility but also challenges that aren’t entirely your fault, such as losing your job or experiencing a costly medical emergency.

Whatever the case may be, start your journey back into the black with a careful analysis of why you’re currently in the red. This will be crucial in the subsequent steps.

Check out my article on organizing your finances if you need some help figuring out why you’re drowning in debt. The first three points should be particularly helpful.

2. Avoid taking on new debt

While it didn’t make sense to start the list off with this point, it’s still very important. Now that you’ve recognized you’re drowning in debt, don’t swim further into the deep.

Consider cutting up your credit cards or leaving them with a trusted friend who will hold you accountable. If the debt you’re drowning in is mortgage-based, avoid home equity loans and other types of borrowing that will only dig a deeper hole.

You might be surprised at how much more in control this step makes you feel – and we haven’t even started attacking your debt balances themselves yet.

3. Establish an emergency fund

At face value, the process of escaping debt may seem straightforward. Just throw every spare dollar at your loans, right?

Wrong.

If you take that approach, you’ll likely find any subsequent financial emergencies send you plunging back under the surface.

For example, let’s say your monthly payments currently total $1,000. Because carrying so much debt is stressful, you decide to pick up a part-time job and throw 100% of that income (plus the entire discretionary portion of your primary income) at your loans.

It might seem smart. But what if you lost your main source of income? Suddenly, you might find yourself unable to make even minimum payments on your debt. Interest and penalties would start accruing rapidly.

A smarter approach would’ve been to establish an emergency fund. While it may mean making less progress in the short term, the long-term benefits for your mental and financial health are tremendous.

Check out this article I wrote about establishing an emergency fund for various common unexpected expenses.

4. Use a proven strategy for eliminating debt

If your debt is spread out across multiple loans, you may have a hard time deciding which balances to prioritize. That’s where strategies like the debt snowball and debt avalanche come in.

Let’s look at the debt snowball method first. It involves prioritizing paying off your loans in order of smallest balance to largest. This has the effect of building momentum, which can be incredibly helpful if you’re currently drowning in debt and feeling defeated.

The debt avalanche method, meanwhile, entails prioritizing paying off your loans in order of highest interest rate to lowest.

With either method, you need to make minimum payments on all of your debt while throwing extra money towards one in particular (again, with the snowball method that would be the loan with the smallest balance while it’d be the loan with the highest interest rate if you go with the avalanche method).

Which method is better? It depends. Some people find it easier to stay motivated when following the debt snowball method since progress remains very apparent. The debt avalanche method’s benefit is that you’ll end up paying less in interest. That may not mean much if the method’s lack of momentum keeps you from staying on board, though, so weigh those two considerations.

5. Consider refinancing your debt if it’s high-interest

Before diving into this tip, I should definitely point out I’m not a financial advisor. Refinancing your debt is a major decision and you should absolutely consult a professional who isn’t trying to sell you some refinancing product.

With that in mind, I’ll briefly speak about refinancing from a high level. It generally involves taking out another loan at a lower interest rate and using it to pay off other high interest debt(s). The key here is that you must subsequently stop using the original loan/credit card. Otherwise, you’ll just end up with more debt than you initially had. You might even want to close the account altogether after transferring its balance elsewhere.

6. Negotiate with your lenders

You might be surprised to learn how willing many lenders are to help you out of a rut. Despite how it might seem at times, even the largest financial institutions are staffed with humans.

So my recommendation here? Pick up the phone and be upfront with your lenders. Tell them you’re having a tough time and would appreciate any assistance they can provide. Some lenders might defer payments (which means they’ll push your due dates back) while others may restructure your loan, offering reduced monthly payments or a lower interest rate.

You won’t know what they’re willing to do until you ask – so ask. You’re not the first person to struggle with debt. Most institutions have processes for granting customers flexibility, which ultimately increases their likelihood of being repaid.

Note: If your debt situation is so bad lenders are unwilling to negotiate, consider working with a credit counselling agency. Many are non-profit and have proven step-by-step programs that can help you get back on track.

7. Stop investing until your debt is under control

Investing is very important. As I discussed in this article, it’s how wealth gets created. Personal finance is all about prioritization, though. If you’re drowning in debt, address that before throwing more money into investments.

There’s a logical reason this is the best approach. After all, drowning in debt ultimately means you owe an amount of money so significant falling behind (i.e. missing payments) would unleash dire consequences (i.e. assets being repossessed). The threat of those consequences offsets any benefit you’d receive by investing instead of putting that money towards paying off debt.

Indeed, any sensible financial hierarchy (such as Dave Ramsey’s Baby Steps) prioritizes getting debt under control above investing. Once your debt is manageable, you can balance both. Until then, focus on catching up with your loan payments.

8. Increase your income

I’ve saved this tip for last because it doesn’t make sense until you’ve laid a solid foundation for escaping debt, which the aforementioned tips should help with.

Indeed, while you can’t earn your way out of poor financial habits, increasing your income certainly has its benefits once you’re on the right track. Check out this article for a list of legitimate ways to start earning more money fast.

My favorite ideas for the purpose of this article would be:

- asking for a raise at your current job

- freelancing

- finding a part-time job

- testing apps/websites

- selling old belongings on eBay

Any money you earn from these efforts should go towards either increasing your emergency fund (see my third point in this article) or paying off debt. You’d be surprised how far an extra even $100 per month can go towards improving your financial situation and building momentum.

Once you’re no longer drowning in debt, make a plan to keep things that way

Completing the steps I’ve mentioned above won’t necessarily be easy. After all, drowning in debt can be very demoralizing. You may lack the willpower to take even modest steps forward.

If you press on, however, you will eventually escape your crushing debt. For inspiration, check out my friend Adam Shoup on Twitter. He and his wife absolutely crushed $32,000 in debt. Two of my other friends on Twitter, The Financial Independence Couple, tackled $100,000 in debt.

Once you’re no longer drowning in debt, your job becomes keeping it that way. Here are some articles I wrote that should help in a variety of scenarios:

- The ultimate guide to living below your means

- 14 powerful tips for budgeting on minimum wage

- How to avoid (or overcome) being house poor

- Top 10 worst financial decisions (and how to recover)

- How to be “good with money”

You got this!