Saving and investing are two very important practices for anyone hoping to achieve financial independence. However, people often choose to prioritize one over the other depending on their circumstances. Keep reading to learn what factors influence this decision and how you can resolve the saving vs. investing debate for yourself.

This is a very important thing to get right, by the way. Making the wrong call can cost you a fortune. Don’t worry, though. By the end of this guide (and a chat with your advisor about what you’ve learned), you’ll be calling the shots like a pro.

Let’s begin by taking a look at saving and investing individually.

Note: This article contains Amazon affiliate links, which generate a small commission for me whenever you purchase through them. This helps me keep the site relatively free of ads.

The basics of saving

Saving is the act of putting money aside in a bank account or some other easily-accessible place. This is a very low-risk practice because the nominal value of your money is never going to decrease.

Consequently, you’re not going to achieve much of a return through saving alone. Even high-interest savings accounts typically only have rates in the ballpark of 2%. That’s fine, though, because making a ton of money isn’t really the point of saving. The point is to keep your money safe and accessible.

Pros of saving

Predictability: With a savings account, you can calculate exactly how much money you’ll be receiving.

Stability: You’ll never lose money in a federally-insured savings account.

Accessibility: Savings accounts allow easy access to your money at a moment’s notice.

Ease: You can set up a savings account and make your first deposit within a matter of hours.

Cons of saving

Mediocre returns: Even with the best savings accounts, you’re not going to make a whole lot of money.

Risk of inflation: The low rate of return within savings accounts exposes you to the risk of inflation eating away at your purchasing power over time.

Rates can change: Savings account rates depend on central bank policy. These institutions can lower rates as they see fit, pumping the brakes on your nest egg’s growth.

Easy to spend: Because your money is so accessible in a savings account, it can be very tempting to spend it. All it takes is a few mouse clicks!

The basics of invsting

Investing involves placing your money in riskier assets with the intention of maximizing your returns. This is where, unlike with saving, you can make a lot of money. Check out this post if you want an even deeper explanation as to what investing is and how people use it to generate returns.

Pros of investing

Growth: Investing can make you very wealthy over the long haul, unlike saving.

Excitement: Many people find savings accounts boring. As such, it can be hard to stay motivated. Investing, on the other hand, can be quite exciting.

Cons of investing

Risk: While investments can experience tremendous growth, they can also experience sharp declines in value. You may lose some or all of your money.

Complexity: It takes some time to get started with investing. You’ll need to set up the appropriate brokerage account, make your initial deposit, select the right assets, and then maintain your portfolio.

Similarities between saving and investing

As you’ve probably picked up on by now, there are more than a few similarities between saving and investing. Let’s lay them out.

Both are essential

It’s important to remember that the saving vs. investing debate doesn’t really have an either/or resolution. Both are absolutely essential for your financial health in the long term.

Both involve planning for the future

Rather than spending all of your money today, you can put it aside in a savings or investment account to fund a brighter future. For example, you might save or invest to buy a house or ensure a worry-free retirement.

You can sometimes utilize the same assets

Stuffing money in a bank account is very clearly saving while buying stocks is obviously investing. In between those two extremes, however, things can get blurry. For example, there are assets like bonds and certificates of deposit (CDs) that exhibit characteristics of saving and investing. You can also use a brokerage account like a savings account, just leaving your money to sit in cash there.

To be honest, though, mentioning this overlap is a bit pedantic. Going forward, I’ll just stick to the common definitions of investing (buying riskier assets like stocks) and saving (putting money in a savings account).

Neither requires a ton of money

While it’s true that some savings accounts and investment vehicles have minimum initial deposits, you can get started on either with very little money. That shouldn’t come as much of a surprise on the savings side. After all, you may have started saving in some capacity (even if just in a piggy bank) as a child. However, many people are surprised to learn that it’s also possible to invest with little money.

Differences between saving and investing

While saving and investing are similar in many regards, the differences really reveal why people often prioritize one over the other.

You’ll (theoretically) make more with investing

You can make a lot of money with investing, provided you manage your portfolio properly and it performs well. The stock market has historically earned an average of about 8% to 10% per year, making many people very wealthy. Those returns are not guaranteed, of course. You may even lose money depending on what you invest in and how it performs. However, a properly diversified portfolio is likely to achieve the aforementioned average.

With saving, on the other hand, you’ll make a relative pittance. As mentioned earlier, even the best savings accounts typically have rates around 2%, which won’t even protect your money from inflation.

Saving is predictable

If you know a savings account’s interest rate, you can precisely calculate your return years into the future. For some people, this is a major incentive to save, especially when contrasted with investing’s volatility. Said individuals are typically looking to preserve their money rather than grow it aggressively. Again, this is more suitable for some situations than others, which we’ll discuss shortly.

Account structures differ

Savings accounts aren’t rocket science. There are only a handful of variables (i.e. interest rates, minimum balances, and withdrawal restrictions).

Investment accounts aren’t overly complex either but you have many more factors to consider. First, you have to figure out what type of investment account you need. Then, you have to consider the types of assets you can purchase within your account and which of those best match your goals. Lastly, you have to actually go through the process of making the investment (i.e. buying the stock). It definitely requires more knowledge about finance than basic savings accounts.

Investing offers more choice

With investing, you have a truly staggering number of decisions to make. Stocks are just one of a few assets you can choose. There are also ETFs and mutual funds, real estate investment trusts (REITs), physical property, options, precious metals, and more. Saving, on the other hand, leaves you choosing between accounts based on the handful of variables I mentioned in the previous paragraph.

Now that you know the core similarities and differences between saving and investing, it’s time to figure out which of these financial practices makes the most sense for you. Let’s tackle this question by analyzing the scenarios in which investors choose to prioritize investing over saving, and vice versa.

I strongly recommend speaking to an advisor before assuming which of these scenarios you fall under. It’s easy to miscalculate as a new investor.

Prioritize saving when…

You have an inadequate emergency fund

If you have little to no money in your emergency fund, you may want to rectify that before you start investing.

Now, I know this can seem like a very boring thing to do.

In fact, I bypassed having an emergency fund for years and instead directed all of my savings to the stock market. That works great when you have a stable job and the markets are firing on all cylinders but it can turn into a nightmare very quickly. For example, just imagine if you lost your job amid the COVID-19 pandemic and then had no choice but to take money out of your investments as the market plunged.

Most financial advisors recommend that you set aside enough money to cover three to six months of your basic expenses (i.e. rent or mortgage, loan payments, car insurance, utilities, food, etc). This aligns with statistics indicating that laid-off Americans take an average of five months to find a new job. An emergency fund of this size will also protect you from large unexpected bills.

It helps to think of your emergency fund as a buffer that will allow you to keep the investments you’ll soon be quite optimistic about.

You’ll need the money soon

If you plan on using your funds within the next few years, saving is generally the better choice.

The problem with investing in this scenario is that assets can be very volatile on shorter timelines. While the S&P 500 has generated phenomenal returns over the long haul, there have been years in which it fell substantially. In 2008, for example, the index fell 37%.

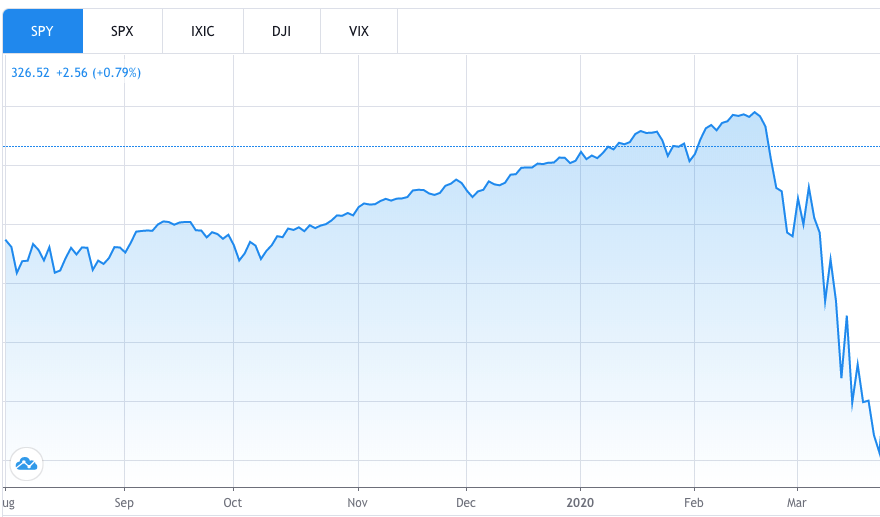

Individual stocks can be even more volatile. Just take a look at how Delta Airlines fared in early 2020:

Delta Airlines will probably come back stronger than ever at some point. But imagine if you purchased this stock in February 2020 thinking you’d get one last spurt of growth before cashing out and using the funds as a down payment on a house in February 2021. You’d most likely end up having to push your goal back, which is pretty demoralizing.

As a general rule of thumb, you should only invest money you don’t need for at least 10 years.

Why investing for short-term goals is such a bad idea

Let’s stick with the goal of investing some money in February 2020 to buy a house in February 2021. This time, however, you invest in SPY, the most popular S&P 500 ETF.

As you can see on the chart below, SPY basically fell off a cliff in March 2020.

It’s very likely you would’ve panic sold on the way down in this scenario. After all, buying a house is a major financial move people plan for years. As such, they develop attachments to money earmarked for a down payment. Panic selling here would’ve been a disaster, though, considering what happened next:

In addition to losing much of your down payment in this scenario, you would have to buy back into the market as it approached all-time-highs again. In other words, recovering from those losses would require a breathtaking economic boom. It goes without saying that this is pretty hard to envision happening prior to your imaginary goal of buying a house in February 2021.

Your money (and your mental health) would have fared much better in a regular savings account. Sure, you’d only make a boring 2% or so in the best-case scenario but that’s a lot better than losing 35%.

You have high-interest debt

When you have high-interest debt, your goal is to get rid of it as soon as possible. Investing is pretty much out of the question since no asset will reliably generate returns in excess of the double-digit interest rates charged on expensive loans like credit cards and payday advances.

Saving can still be useful in this scenario, however, as it will give you a cash buffer to fall back on. This will prevent you from having to set yourself back with more debt in case of an emergency.

I know, I know. Forgoing investing in this scenario can also seem like a pretty boring thing to do, especially when you read about people making 100x their initial investment in the stock market. As tempting as it can be to view investing as the solution to your debt, remember that your short-term goal when you have high-interest debt is to get rid of it. And, as we’ve already established, you don’t invest your money when you need it in the short-term.

What counts as high-interest debt?

This could easily be a whole article on its own. I’ll keep it short, however, and say that any loan charging greater than 8% is high-interest debt. That includes credit cards, payday loans, and non-essential personal loans.

Car loans tend to be fairly reasonable, as are mortgages. You can generally begin investing even if those aren’t paid off, as long as your rate is decent and you’re confident in your ability to keep making payments for the foreseeable future without withdrawing from your investments.

You don’t feel comfortable investing

Investing is like swimming the ocean: no big deal if you’re comfortable with what you’re doing but a really bad idea if you’re not. There’s no shame in saving while you learn more about the market and what to expect once you enter it. This is true at all times – even when you hear people screaming about how undervalued stocks are right now. There will always be more opportunities. Take your time.

Prioritize investing when…

Here are some things to consider in addition to ensuring the scenarios in the previous section don’t apply to you.

You’re looking to grow your money over the long term

Investing is a great strategy for growing your money over the long haul. In other words, it’s not a get-rich-quick play. It’s very important that you keep this in mind so you don’t get pulled into get-rich-quick schemes or any of the other traps that regularly befall impatient investors.

Being able to plan far into the future is a very privileged position, by the way. The vast majority of people live paycheck to paycheck. Pat yourself on the back if you can honestly answer “yep, that’s me” to this one.

You’re okay with losing money sometimes

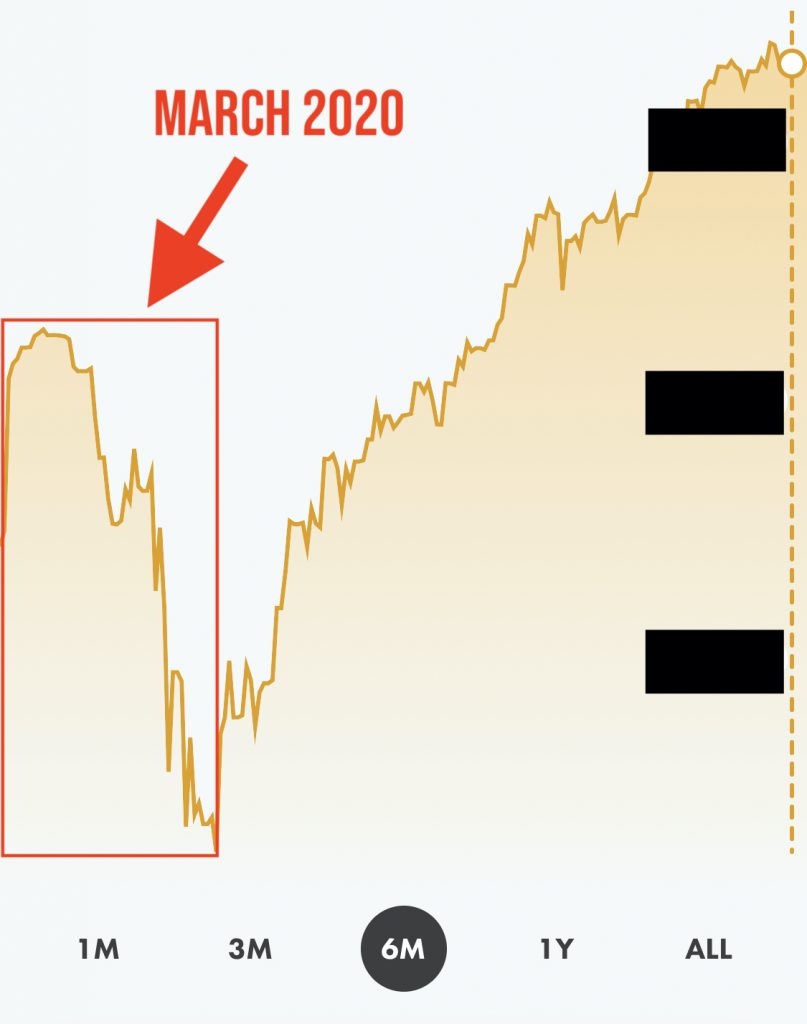

At some point, you’ll lose money as an investor. As long as you’ve chosen the right strategy, you’ll recover your money eventually. Here’s what happened to my Wealthsimple portfolio during the COVID-19 pandemic:

As wild as that sheer drop-off (highlighted in the red box) was to witness in real-time, I was fine with it. Why? Because I knew that by the time I needed my money in 20+ years, COVID-19’s economic impact would be a distant memory. To be honest, I’m surprised the market recovered so quickly – but that’s a topic for another day.

You’re ready to learn

Behavioral finance expert Robert Koppel had a great anecdote in his book Investing and the Irrational Mind. He bumped into a doctor in the elevator one day. The doctor went, “Hey, can you teach me how to invest sometime?” Koppel, annoyed, responded, “Sure, if you can teach me how to do surgery sometime.”

The point here is that investing isn’t something you just chat about with your neighbor for a few hours and then become good at. It’s a continual process of learning that takes even professionals years to master. Now, that doesn’t mean you should wait years until you know every little detail of the market to invest. Rather, it means you should be open to reading new books and learning new things on a constant basis.

You have leftover money at the end of each month

If you’ve got a solid emergency fund, no high-interest debt, are able to pay your bills on time, and still have enough cash left over at the end of each month, you’re in a really great spot. Even if that extra cash is just $100, you’re in a position to invest. If you can do it consistently, even better.

Conclusion

I hope this article has shown you that saving and investing are both important. It helps to think of saving (namely, establishing an emergency fund) as the foundation that you’ll ultimately build your wealth on. Investing is the process through which you build that wealth over the long haul.

Please remember to speak with an advisor before making decisions about your money. There are many nuances when it comes to personal finance and it never hurts to have a professional analyze your situation one-on-one.

Frequently asked questions

The simple answer is that saving is ideal when you’re establishing an emergency fund or setting money aside for a short-term goal. Investing is more valuable for growing your money long-term.

A common rule of thumb is to save until you have six to eight months of expenses stored away then switch to investing.

Investing is generally a riskier activity. While the right strategy can produce tremendous returns in the long run, you may lose money in the short-term. Saving, on the other hand, comes with pretty much no immediate risk when done through an insured financial institution. Just keep in mind that inflation will eat away at your purchasing power over time.

Yes. Bank runs (everyone rushing to withdraw their cash at once) have been a recurring theme amid recessions throughout U.S. history. There’s no real reason to engage in this behavior, though. Bank deposits are federally insured, which means your money is safe even if the financial institution holding it goes under. Read more here.