We all spend substantial portions of our lives pursuing money. This continues even long after we’ve earned enough to pay bills. But when does it end? How much money is enough to satisfy us forever?

That’s the topic of today’s article. I’ll start by looking at research into financial satisfaction before discussing how you can personalize the concept for yourself and arrive at an appropriate target.

As always, please remember my content doesn’t constitute financial advice. Rather, my goal is to help you think creatively about financial satisfaction and move towards achieving it for yourself.

How much money is enough? The scientific answer (sorta)

According to research by GOBankingRates, a salary of $88,935 is the minimum required to achieve “life satisfaction” in America.

As you might imagine, though, this number varies depending on where you live. Check out the map below with figures for each state. Darker colors mean a higher salary is required to achieve “life satisfaction” in that state.

[display-map id=’51501′]See table (expand)

| State | Minimum salary considered “enough” ($) |

|---|---|

| Alabama | 94,080 |

| Alaska | 134,820 |

| Arizona | 105,105 |

| Arkansas | 92,610 |

| California | 149,835 |

| Colorado | 108,360 |

| Connecticut | 130,410 |

| Delaware | 113,085 |

| Florida | 104,160 |

| Georgia | 94,500 |

| Hawaii | 207,480 |

| Idaho | 99,015 |

| Illinois | 94,185 |

| Indiana | 93,975 |

| Iowa | 95,970 |

| Kansas | 90,825 |

| Kentucky | 98,910 |

| Louisiana | 98,175 |

| Maine | 120,960 |

| Maryland | 134,400 |

| Massachusetts | 136,185 |

| Michigan | 94,605 |

| Minnesota | 106,260 |

| Mississippi | 88,935 |

| Missouri | 92,715 |

| Montana | 113,610 |

| Nebraska | 97,440 |

| Nevada | 114,240 |

| New Hampshire | 113,400 |

| New Jersey | 128,520 |

| New Mexico | 91,560 |

| New York | 163,695 |

| North Carolina | 100,275 |

| North Dakota | 101,325 |

| Ohio | 96,705 |

| Oklahoma | 91,035 |

| Oregon | 141,015 |

| Pennsylvania | 108,360 |

| Rhode Island | 124,530 |

| South Carolina | 100,275 |

| South Dakota | 104,685 |

| Tennessee | 94,500 |

| Texas | 96,285 |

| Utah | 101,745 |

| Vermont | 122,535 |

| Virginia | 106,470 |

| Washington | 117,810 |

| West Virginia | 97,020 |

| Wisconsin | 100,485 |

| Wyoming | 99,225 |

Of course, this isn’t the only study out there on financial satisfaction.

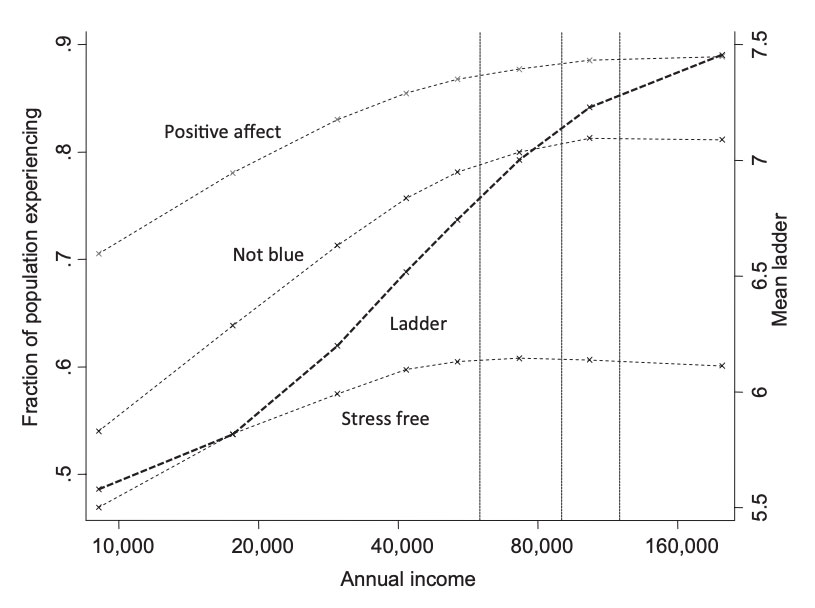

One notable (and of-cited) report is “High income improves evaluation of life but not emotional well-being” by Daniel Kahneman and Angus Deaton. It defines financial satisfaction based on two key concepts:

- Emotional well-being: This is a measure of how enjoyable your life is from day-to-day.

- Life satisfaction: This describes how you feel about your entire life on the whole (as opposed to merely from day-to-day).

Kahneman and Deaton found there’s no limit to the level of life satisfaction one can achieve with more money. Meanwhile, emotional well-being maxes out at an income of $75,000. They produced this graph demonstrating the effect:

One other piece of research I’ll mention is this article on 80000hours.org. In it, economist Robert Wiblin suggests minimal happiness arises from an income above just $45,000. He makes a few adjustments:

- add $20,000 for each dependent

- add 50% if you live in a high cost of living area

- subtract 30% if you live in a low cost of living area

- add 5% to 10% if you want to save healthy amounts of money towards retirement

The problem with universal assumptions about what constitutes “enough money”

Based on the aforementioned commonly-cited studies, you can see we end up with quite a wide range of values constituting enough money. Theoretically, the figure lies between $45,000 and $207,480 depending on where you live – and we haven’t even left the United States.

This is problematic if you’re looking for a meaningful figure. Someone earning $45,000 makes very different lifestyle and career choices than someone earning $207,480. Which path do you choose if either is supposedly the baseline for financial satisfaction depending on who you talk to?

There’s also the fact higher incomes don’t necessarily translate into wealth. Plenty of people earn six figures yet manage to spend every single penny and then some, ending up in debt. That won’t make for a very fulfilling life in the long run.

To address these and other nuances, let’s dive into a few prompts that will help you figure out how much money is enough to obtain your best life, which is what ultimately matters.

8 questions that will help you decide how much money is enough

1. Enough for what, exactly?

Many people who read this article will undoubtedly be looking for a specific dollar amount that will bring everlasting happiness, rainbows, and fulfillment.

That’s really sweet and philosophical. However, you need to determine your exact intentions for the money. Otherwise, you’ll never have enough.

According to Harvard Business School Professor Michael Norton, this is an issue many rich people face. The crux is that upward social mobility often accompanies wealth.

For example, a net worth of $10 million sounds great when you earn $60,000 and drive a 10-year-old Toyota. As you move up in society, though, the excitement fades. This is why money amassed for its own sake never feels like enough. We’re social creatures. Absent specific priorities, we revert to keeping up with the Joneses.

The solution? Start by figuring out what would make you happy in life. My list includes:

- becoming work optional by 50

- spending winters in warm parts of the United States

- covering my parents’ housing and medical expenses when they retire

Then, carefully research each goal and calculate its lifetime cost.

For example, spending six months in a sunny state every year would require two plane tickets, accommodations, travel insurance, and food. If this comes up to $20,000 in excess living costs per year and I incur it from age 50 to 75, approximately $500,000 would be my lifetime cost (aka “enough”) for this goal.

When you answer this first question, obtaining enough money goes from a potentially endless pursuit to one with very clear objectives.

You may even find yourself thinking more creatively about ways to achieve your ideal lifestyle. For example, I could find a way to make my annual migrations south much cheaper. It’s not always about earning more.

2. Do you need all of the money at once?

Just because you identify a certain figure as representing enough money doesn’t mean you need to amass it all at once.

Let’s say your dream life will cost $63,000 annually. You’d generally need an investment portfolio worth upwards of $1,575,900 to quit work and maintain that lifestyle comfortably for about 30 years based on the 4% rule. See my explanation in this article.

You could make do with a much smaller nest egg, though, if it only needed to cover half of your living costs each year. Upon crossing that threshold, you could shift into a lower gear and obtain what remains of the amount constituting enough over a longer period through part-time work.

Another idea involves achieving fulfillment in chunks throughout your entire life rather than waiting until you have a huge pile of cash.

Want to take a big overseas trip every year? Rather than stockpiling enough cash to cover that cost for three decades, why not focus on making it happen every single year starting now? You’d enjoy living in the moment while ultimately reducing pressure on your retirement account.

It all comes back to your goals. If quitting work forever is a major objective you identified while answering my first question, so be it. Just make sure you’ve considered the alternatives.

3. How much money do you have now?

Your current net worth provides valuable context regarding how much money is enough. It reflects your trajectory and will help you set realistic expectations.

Let’s say you decide $2 million is enough. That’s a great target! However, the median net worth of all households in America is $121,700, according to Federal Reserve data. In fact, your target net worth would place you roughly in the 93rd percentile, based on DQYDJ’s calculator.

Your current assets and timeline say a lot about whether you’re on pace to achieve such extraordinary results.

For example, let’s assume you’re worth $200,000 and have 25 years to grow that nest egg into $2 million. We can glean two key pieces of information from these facts:

- You have 25 years of compound growth and additional contributions to achieve your goal.

- You’re already doing substantially better than the typical American household.

This suggests your goal of $2 million is feasible.

If you have $100,000 and 10 years to accumulate $2 million, though, it’s a different ball game. You’d need to start performing significantly better than you have been.

Further, because your timeline is much shorter, compound growth at any feasible rate (8% is a good benchmark as it’s the stock market’s average annual return) won’t be the primary driver of your success. You’ll need to boost your earnings and savings contributions significantly.

If you can pull it off, great! Otherwise, you may want to adjust your goals and recalculate how much money is enough.

There’s no shame in this. It’s much better than building expectations for years only to fall short. Make your compromises in advance. They’ll sting a lot less.

4. What is your asset allocation?

Many people view “obtaining enough money” as being synonymous with “achieving a particular net worth.”

The critical thing to note regarding your net worth, however, is that it offers a very high-level financial overview. Whether it translates into financial fulfillment depends on your asset allocation.

In Toronto, for example, many people are millionaires on paper because they own homes. In fact, with average house prices here expected to top $1 million in 2021, one could soon have absolutely nothing else to their name and still break into the two comma club.

The problem? That concentration of wealth may not be suitable for your goals. In other words, if you decide $1 million is enough to live your dream life but your home gobbles up all of it, that’s no good.

Let’s say you plan to retire after obtaining enough money. While you may be able to tap home equity, few people fund their entire retirements that way. Downsizing is also nice in theory but still won’t free up 100% of that cash since you’ll always need housing.

In other words, you may find yourself feeling house poor.

Keeping all of your money in cash can also pose problems thanks to inflation. Every dollar you put in a savings account today will be worth substantially less down the road, which is why people typically invest in long-term assets. Give this article a read for more information about the difference between saving and investing.

I’m not saying you shouldn’t set a net worth target, mind you. It’s a relevant benchmark. Just think carefully about how that number is divvied up and spread out. Check out this article for a breakdown of the various assets investors often use to achieve financial fulfillment.

5. How do you earn money?

While some people view obtaining enough money in terms of net worth, others focus on income. This is risky.

For example, let’s say you earn $200,000 per year through traditional employment. That’s a pretty good salary throughout most of North America. You’ll likely always have enough money to pay bills and enjoy a fulfilling life.

Well, until you retire or get laid off, at which point the cash will stop flowing in your direction.

This is why saving and investing money from your salary is so important. Rather than relying solely on assets you don’t own (i.e. the company that employs you) to provide enough money, build a portfolio. You’ll reap the gains in perpetuity, even when you’re not working.

Whether you achieve this through stocks, real estate, or your own business, it’s crucial for reaching a place of financial fulfillment.

6. Are you willing to relocate?

Geoarbitrage is the practice of relocating to a cheaper country. This can dramatically reduce the amount of money constituting enough to live a fulfilling life.

Imagine you’re making $100,000 in San Francisco. Given how expensive that city is, your money won’t go very far. But what if you could keep your job and relocate to Taiwan? There, $100,000 would provide a very high standard of living while allowing you to save most of your income.

Alternatively, imagine you’ve accrued $500,000 in retirement savings. After doing some math, you realize that’s not enough to fulfill your goals. In Thailand, however, you could likely have lots of fun.

These are two common geoarbitrage scenarios.

Of course, geoarbitrage isn’t for everyone. Your employer may not be keen on letting you relocate halfway around the world. You may not be keen on relocating halfway around the world, even in retirement.

It’s worth considering, though. Many people in developed nations justifiably have a hard time saving at all, let alone on a scale capable of producing financial fulfillment. If you’re among them, geoarbitrage could completely overhaul your understanding of what enough money looks like.

If moving across borders and oceans is too big a leap, consider a cheaper state or province. Check out this post for an exploration of just how much living costs can vary within a single country.

7. What are your other priorities in life?

While money affects all areas of your life one way or another, amassing more probably isn’t the only thing that matters. You likely also value spending time with loved ones, staying healthy, having free time after work, etc.

It’s very important to keep these other priorities in mind when deciding how much money is enough. While you may need a gazillion dollars to pay for your dream life and all its luxuries, will getting there require giving up on everything else you value? If so, you may be willing to adjust your goals and financial targets.

It’s all about maximizing fulfillment in life. That doesn’t always mean more money. If it did, financially savvy people would never have kids, for example, considering they cost an estimated $233,610 apiece to raise on average.

But you know what? Kids add tremendous non-monetary value to life. People are willing to forgo fortunes to have them.

Not everyone thinks their priorities through this carefully, though. Some think they can have kids, live in mansions, drive luxury vehicles, and still retire with millions of dollars invested despite being average earners.

By carefully listing your priorities, you can avoid severe miscalculations like this.

8. How do you handle uncertainty?

Some people can’t stand financial uncertainty. This can manifest in a few ways.

First, they might avoid aggressive investments such as stocks. At the same time, they may need a steady stream of cash to feel confident about their finances. These desires are often at odds with each other. Stable investment vehicles don’t produce much cash flow.

For example, you’d need a very large balance to earn meaningful amounts of money in bonds or a savings account. I’m talking $6 million to produce $60,000 annually at current 10-year government bond rates of about 1%. That’s an improbable amount of money – especially for someone so risk-averse in the first place.

Meanwhile, you’d need just $1,500,000 in stocks to reliably earn $60,000 at the recommended safe withdrawal rate of 4%.

Now, there are valid reasons to be financially conservative. As with every other question in this article, my goal isn’t to funnel you in a particular direction. I’m merely pointing out that you may need to work harder to obtain enough money without compound growth at a meaningful rate (which is invariably accompanied by risk) to help you out.

How to obtain enough money

Invest early and often

Compound growth, which you can achieve through investing, is exponential. The sooner you can get it working for you, the more money you’ll have.

Check out this article (specifically my point about why waiting to invest is so devastating) for a look at the numbers. They’re pretty wild; every decade of inaction costs you millions of dollars.

Suffice to say, begin investing sooner and you’ll dramatically reduce the amount of effort involved in obtaining enough money. You’ll likely never have to settle on an underwhelming sum as people who wait too long often do.

In this post, you’ll find some tips on investing even if you don’t have much money. This is as much about tapping into compound growth as it is building habits for when you eventually earn more.

Live well below your means

Living below your means is central to the concept of getting ahead in life. If you don’t spend less than you earn and keep the difference, you’ll simply never make meaningful progress.

It’s as simple as that. Yet, consumer debt can keep you feeling like you’re moving forward. As long as you make payments on time, you’ll be “able” to purchase increasingly luxurious goods now and pay for them later. This is a trap. It ensures you’ll never obtain enough money in life.

Don’t confuse appearances with reality. View your wealth as an iceberg. Only a very small portion of it should be visible to onlookers. The rest should be tucked away in assets that move you closer towards financial freedom.

Develop good financial habits

For most people, the process of obtaining enough money is relatively slow. It takes years. This is a good thing. It gives you time to develop solid financial habits.

When people get rich too quickly, bad things happen. Just look at lottery winners, most of whom go broke – even when the prize is astronomical. When you build your wealth brick-by-brick, however, this is far less likely.

Of course, it’s still entirely possible you might bring poor habits into retirement and squander years of hard work. Check out this article to learn about 25 signs of financial irresponsibility you should look out for and address promptly. If you dedicate yourself to building good habits, you’ll significantly reduce the likelihood of making painful mistakes when it’s too late.

Make wise career moves

Until your asset portfolio reaches critical mass and starts earning significant interest, you’ll likely earn most of your income through work. Therefore, you should absolutely take your career seriously.

Don’t fall into the trap of assuming it’s impossible to get rich while working a traditional job. It simply isn’t true, despite what countless personal finance “gurus” say.

No matter how you earn money, the key is to keep some of it and build equity. That’s when your money starts earning more of itself. Employment will allow you to keep fueling the machine and propelling yourself towards obtaining enough money.

What does having enough money feel like?

Unemployment will no longer represent an existential crisis

According to reports, anywhere from 63% to 78% of workers live paycheck to paycheck. When people in this situation lose their jobs, everything falls apart. They can’t cover housing costs or put food on the table. As a result, they live under tremendous pressure even while employed.

This existential dread goes away for life once you’ve obtained enough money (assuming you continue to manage it correctly). Even if you work part-time to supplement your investment income, you’re not relying fully on employment. You’d have flexibility.

On its own, more money likely won’t excite you

All research into the psychology of wealth suggests something interesting. Beyond a certain point, more money in and of itself doesn’t excite people. Earning more money in meaningful ways, however, does.

For example, one report in the Wall Street Journal suggests that while people with $10 million or more are substantially happier than those with just $1 million, that’s only true when the wealth was obtained through their own effort. Marrying into money or inheriting it some other way doesn’t produce the same effect.

While studies propose varying benchmarks for financial satisfaction, the good news is that all are far below the level of income required to obtain $10 million. Whatever benchmark you settle on for yourself, beyond that point you’ll likely find greater happiness through focusing on other goals (such as establishing a meaningful career).

You’ll know you’ve reached this point when those other goals excite you more than the prospect of more money in the absence of achieving them.

Your worries about money will shift to hypotheticals rather than imminent threats

Once you obtain enough money, your financial worries will likely relate to hypotheticals such as the market staying flat for 30 years or hyperinflation kicking in.

These are distinctly different from the concerns most people have prior to obtaining enough money, which relate to imminent threats such as job loss or unexpected expenses.

Earning money will become incredibly easy

Money makes money. For most people, the amount constituting enough is so substantial the interest it accrues in a well-managed portfolio will be significant. The passivity of this growth is a far cry from the level of involvement most people have in their earnings phase prior to obtaining so much money.

Conclusion

To summarize, the ideal figure constituting enough money is different for everybody. It all depends on what you’re looking for in life. I hope the prompts in this article have helped you think creatively. For more thought-provoking personal finance articles, visit my blog here.