Financial challenges rarely exist in a vacuum. Often, they’re directly caused – or at least accompanied – by irresponsible behavior. Keep reading as I break down 25 signs of financial irresponsibility to look out for and address as soon as possible.

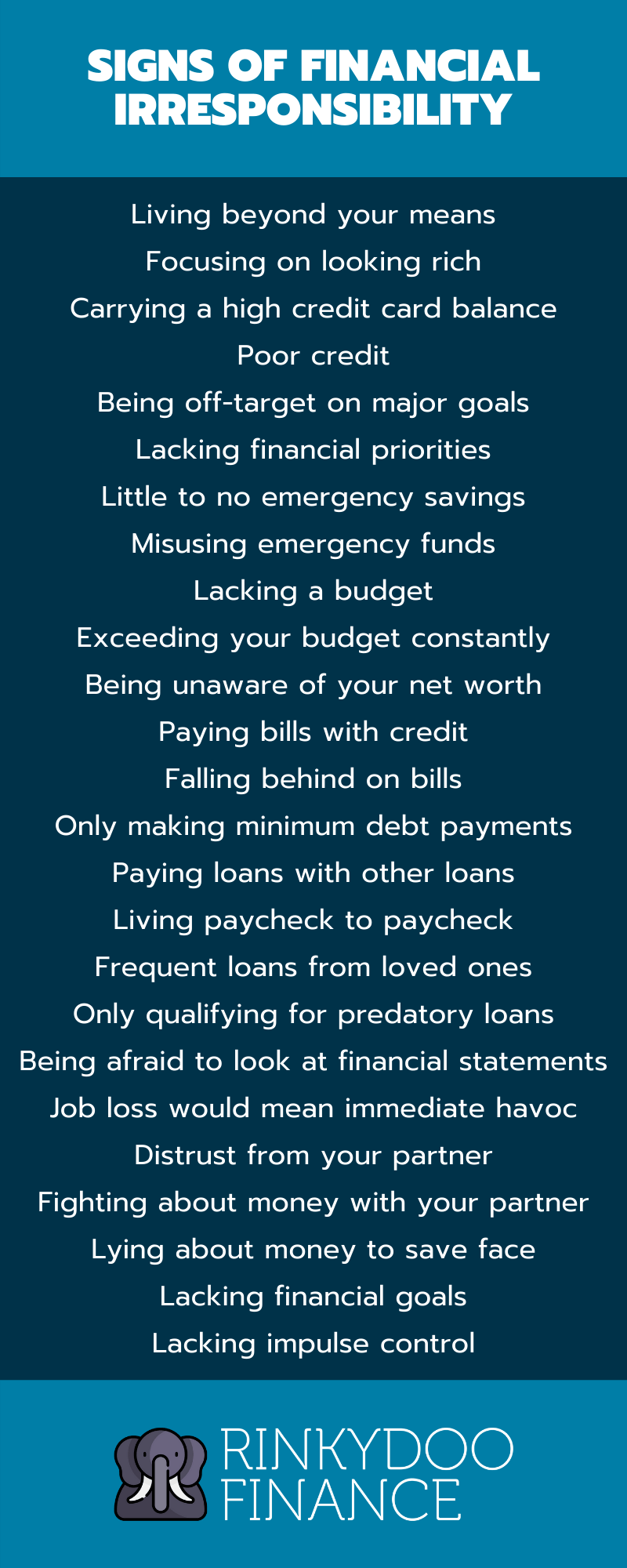

25 signs of financial irresponsibility

1. You live beyond your means

Living beyond your means is among the clearest signs of financial irresponsibility.

This behavior involves spending more than you can comfortably afford to. It’s not limited to obviously frivolous purchases like excessive vacations and designer clothing, either.

In fact, the most damaging manifestations of living beyond your means often entail buying more house or car than you can afford. Yes, these are essential items. However, overextending yourself to buy them can cause incredible stress and financial difficulty.

Additionally, living beyond your means suggests flaws in your understanding of money’s purpose. You may be more interested in impressing others than building wealth. This leads nicely to my next point.

2. You care more about looking rich than becoming rich

Being more passionate about conveying wealth than actually building it is a hallmark of financial irresponsibility.

Why? Well, status symbols like luxury cars and fancy clothes are rarely great assets. More often than not, they depreciate rapidly.

Meanwhile, possessions that build wealth (like stocks and privately-owned businesses) are typically invisible to onlookers.

It’s not that you shouldn’t buy status symbols. Believe me, I’m the last person to make that argument considering I wear a Rolex.

However, I paid cash for the watch without breaking a sweat. Its value is increasingly irrelevant to my net worth, which grows substantially each year. In other words, my watch is the tip of the iceberg.

If the bulk of your iceberg consists of status symbols, however, you’re undoubtedly being financially irresponsible.

3. You see no problem with carrying a high credit card balance

Routinely racking up a credit card balance you can’t pay off within the month is another sure sign of financial irresponsibility.

This is unfortunately common. According to NerdWallet, the average American household carries a revolving credit balance in excess of $7,000. At the average credit card APR of 14.65%, that amounts to thousands of dollars in annual interest payments alone – simply for the dubious honor of borrowing money.

If you read those numbers and shrug, I’m ringing the alarm bell right now.

Those numbers may be typical. However, as is often the case in personal finance, what’s typical is not healthy. It’s certainly not responsible.

Substantial consumer debt severely impacts your ability to build wealth. It will almost always be more beneficial to pay off high-interest debt (which includes credit cards and most personal lines) than invest.

I’d describe it as being akin to putting out a fire rather than building a safe, sturdy home. It’s certainly necessary but it’d be nice if you didn’t have to.

Check out this article for a deeper look at determining how much credit card debt is too much.

4. You have poor credit

The credit rating system is fairly straightforward. If you minimize debt and make payments on time, you’ll have a decent score. Keep it up for the long haul and you’ll soon have a great score.

According to Equifax, credit scores generally fall into these ranges:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Excellent: 800-850

You’d typically only end up with a poor rating as a symptom of financial irresponsibility. Behaviors that can tank your credit score include:

- using an excessive percentage of your available credit (30% is generally the rule, according to Experian)

- applying for numerous loans within a short timespan

- falling behind on payments

- defaulting on loans

Note that, as confirmed by Capital One, no credit and poor credit are two very different things. This is especially true from the perspective of responsibility.

No credit means you simply don’t borrow money. Perhaps you’re young and don’t have much of a credit profile yet. Or maybe the credit cards are in your spouse’s name and you’ve never needed your own. In either of these scenarios, you aren’t being irresponsible.

Poor credit, on the other hand, means you’ve exhibited clear signs of financial irresponsibility. In addition to your low score, lenders will see specific red flags on your report, which isn’t the case with no credit.

5. You’re way off target regarding major financial goals like retirement

Financial procrastination is a very real (and well-studied) phenomenon. Millions of North Americans insist they’ll “figure it out later” and ultimately fail to confront poor habits until any hope of achieving their goals has all but slipped away.

One financial goal that often falls victim to this scenario is retirement. According to a FinanceBuzz survey, 35% of Americans have nothing saved for retirement. Zilch. Nada.

A GoBankingRates survey, meanwhile, indicates a whopping 64% of Americans will retire with less than $10,000 to their name. The really wild part? Nearly half of respondents saw no problem with this.

That’s the genuinely irresponsible behavior I’m highlighting here.

There are many reasons people find it difficult to save money. Responsible people are not immune to wage stagnation and other modern economic realities.

To make no attempt at overcoming the odds is incredibly reckless, though.

Here’s another way to look at it. The financial hurdles you face may not be your fault. Dealing with them will always be your responsibility, however.

6. You lack practical financial priorities

Not all expenses carry the same importance in life. Failing to acknowledge this is among the textbook signs of financial irresponsibility.

Check out the second point in this article for a chart displaying the generally-accepted hierarchy of financial priorities.

While you’ll likely make subtle changes based on your financial situation, some aspects of the chart are just common sense. For example, it would never make sense to buy a luxury vehicle or go on vacation if you couldn’t afford essentials like debt repayment or rent. In fact, it’d be downright irresponsible.

In other words, don’t put the cart before the horse. Arrange your financial priorities in a way that minimizes risk and helps you build wealth.

7. You have little to no emergency savings

We all experience financial emergencies at some point. This is a fact of life. Nonetheless, according to Bankrate, most Americans could not produce $1,000 to cover the cost of an emergency without borrowing.

Being among this majority and making no attempt to fix it is a clear sign of irresponsibility.

Again, I understand saving money can be a challenge. If you’re budgeting on minimum wage, $1,000 may seem like an astronomical sum.

If you break it down over the course of a year, though, you just need to save about $77 per month. Still can’t pull it off? Set a target of two years, in which case you’ll need to save about $38 monthly.

My point? As with many other signs of financial irresponsibility on this list, I’m not shaming you for being in unfavorable circumstances. I’m encouraging you to make an effort. Inaction is where irresponsibility comes into play.

Check out this post from my friend Ashley at Common Cents Lifestyle on the topic of building an emergency fund. If you want some specific scenarios to save for, check out my post on planning for unexpected expenses.

8. You use your emergency fund for non-emergencies

If you have an emergency fund yet regularly raid it for discretionary purchases, I have news for you. Financially irresponsible, you are.

Tapping your emergency fund unnecessarily suggests you aren’t correctly budgeting for those discretionary purchases. You’re also likely prioritizing fun and convenience above financial security, which defies common sense (see the sixth item on this list).

Note that a deal on your favorite stock doesn’t constitute an emergency worth jeopardizing your rainy day fund for. This is an example of behavior that may seem financially prudent but is actually anything but.

After all, investments involve risk. Purchasing them with money intended to mitigate risk (aka your emergency fund) is illogical.

9. You have no budget

Going through life without a budget is like driving around with your eyes closed. You’re gonna have a bad time.

You may fail to budget for a variety of reasons, including:

- not wanting to spend the time required

- being too afraid to confront bad habits

- believing you don’t have enough money to bother

- thinking it’s too complicated

Each reason – and just about any other related to not budgeting – suggests financial irresponsibility. You’re essentially hoping everything will work out on its own rather than taking the wheel yourself, which is never a good thing.

Check out my article about organizing your finances for some simple steps in the right direction.

10. You constantly exceed your budget

Of course, having a budget is no good if you don’t actually stick to it. In fact, this is probably the more irresponsible behavior of the two given anyone with a budget should know better.

If this is a recurring problem, consider automating your finances. In other words, turn your budget into a system that keeps you in check automatically. Set clear rules based on your priorities and let a computer handle the rest.

11. You’re unaware of your net worth

Your net worth is among the most important numbers to keep track of. Without it, you’re flying blind.

Again, you may have many reasons for exhibiting this behavior, including:

- believing the concept of net worth only applies to “rich” people

- not wanting to confront the fact your net worth is negative

- lacking awareness of your overall financial picture

Whatever the case may be, this blind spot leaves you unable to monitor your financial progress and make informed decisions.

Calculating your net worth is often even simpler than budgeting, by the way. Just sum the value of your assets (savings, investments, etc), subtract liabilities (loans), and voila.

Your net worth should grow over time. This shows financial growth rather than stagnation or decline.

12. You pay bills with credit (and not just for the points)

If you pay bills with credit out of necessity, something’s gone wrong. One way or another, you’re managing money poorly. You may even be living beyond your means.

This is among the most dangerous signs of financial irresponsibility. It suggests your money situation is like a house of cards waiting to tumble. Relatively minor trouble could leave you unable to keep up with credit card payments, in which case you’d just continue racking up a balance to stay on top of expenses.

This should be deeply concerning. It’s not a situation you want to be in for long.

13. You’re behind on bills

Falling behind on bills places you squarely in the danger zone. This is especially true if you haven’t contacted your creditors to discuss a solution. Make no mistake; the problem of unpaid bills will not go away on its own. It’ll only get worse as creditors take action.

There are also arguably moral problems with falling behind on bills and making no attempt to rectify the situation. You entered a contract and (presumably) received what you requested. Uphold your end of the bargain. It’s the decent, responsible thing to do. If you’re not happy with the arrangement, negotiate your way out of it once you’re caught up.

Check out this article for tips on getting those unpaid bills under control. Each step places you firmly in the driver’s seat and will get even the most bloodthirsty creditors off your back.

14. You can only afford minimum credit card payments

Your credit card’s minimum payment is directly proportional to its balance. According to NerdWallet, it typically amounts to either about $25 or 1% to 2% of your balance.

Why so low? Well, credit card companies are perfectly content with letting you chip away at your debt over the course of several years. That’s how they make tons of money.

So if this bare minimum is all you can afford, you’re in trouble. Whatever sense of security you may feel while making those minimum payments on time is an illusion. Without serious effort, you’ll be tied to that debt for years.

15. You make loan payments using other loans

There’s a common phrase used to describe this irresponsible behavior. It’s called robbing Peter to pay Paul. While you can certainly maintain the illusion of manageable debt with this strategy, it essentially amounts to spinning your wheels.

Unless you have some plan for getting your debt under control and breaking the cycle soon, you’ll never actually make meaningful financial progress. You’ll only buy time, which presents more opportunities for financially irresponsible behavior (i.e. opening a new credit card to conduct a balance transfer then promptly resuming spending on the original, now “paid off,” card).

16. You make a decent wage yet live paycheck to paycheck

If you earn a good wage yet never have any money to save, chances are you’re being irresponsible in some way.

Perhaps you bought too much house or car instead of using the opportunity presented by your solid wage to get ahead. Whatever the case may be, this is among the clearest signs of financial irresponsibility.

Keep in mind, the concept of a “decent” wage varies drastically by location. You can live like a king on $100,000 per year in rural Kansas. San Francisco? Not so much. Don’t let generic assumptions about how people in your tax bracket behave lead you astray.

Check out this article for insights into what a six-figure salary means across North America.

17. Friends and family members have to bail you out regularly

Financial irresponsibility never affects just one person. It can also impact family members who feel obligated to help out. When that assistance becomes an ongoing necessity, relationships are often strained and the recipient’s financial responsibility justifiably comes into question.

This should be one of those particularly alarming signs of financial irresponsibility if you find it in yourself to purchase luxuries while accepting help for essentials.

18. The only loans you qualify for are predatory

Traditional financial institutions have strictly-enforced lending standards. They aren’t insurmountable for people with a solid grip on their money. If you exhibit severe signs of financial irresponsibility, though, you’ll almost always be denied.

Some lenders say yes to just about anyone, though. These include institutions often considered predatory, such as payday lenders, which charge exorbitant interest rates in exchange for looking past irresponsible behavior.

If the only loans you qualify for are from companies like these, take a good look at your credit report for hints regarding areas to improve.

19. You’re afraid to look at your financial statements

It’s possible to go through life without ever really confronting your spending habits. Credit cards and other loans will always be there to clean up after impulsivity and recklessness.

Even if you manage to pull this off without accumulating alarming levels of debt, you’re being irresponsible. Your financial statements contain lots of valuable information that can help you become better at managing money.

Responsible people don’t hide from these facts. They face them head on.

By the way, reviewing statements is important even if you’ve decided to automate your finances. There will always be opportunities for improvement. You’ll also be able to spot unauthorized transactions with greater ease. Don’t assume your bank is doing a good job at this!

20. Job loss would mean absolute havoc financially

According to Career Sidekick, it generally takes workers between three and six months to find employment after being laid off. Your financial plan should be capable of carrying you through this period – perhaps longer if you think finding new employment would be more challenging than for the average person.

Don’t get me wrong. Losing your job sucks. You’ll likely need to cut back and hunker down. If you’re neurotic like me, you may drive yourself insane with doomsday scenarios. It should never cause an actual immediate and existential financial crisis, though.

If it would, you’re not using your resources wisely. Check out this article for some guidance on saving money from your salary.

21. Your partner doesn’t trust you with money

Signs of financial irresponsibility tend to really make themselves known in relationships. After all, your partner likely knows you better than most. If they doubt your ability to make sensible financial decisions, pay attention.

Of course, nobody sees eye to eye with their partner all the time. I’m not referring to occasional disagreements about whether it makes sense to splurge on organic food. Rather, I’m talking about things like your partner fearing you might spend money behind their back.

If these concerns are well-founded (and you’ll know deep down if they are), treat it as a serious red flag.

22. You fight about money with your partner often

If financial distrust boils over into full-blown arguments as a result of your actions, it’s likely you’re behaving irresponsibly.

Keep in mind, financial irresponsibility is somewhat of a different beast in relationships. Once you merge financially with someone, money is no longer a strictly personal thing. Responsibility means making decisions that align with your shared goals.

This different set of rules makes it possible to be irresponsible while doing things you see in the opposite light. This could include, for example, investing money meant for an imminent house down payment in the stock market without your partner’s knowledge.

Given the circumstances – and large sum of money involved – this reckless action could justifiably cause a major blow-up.

23. You lie about money to save face

Having to lie about money because reality contradicts your outwardly-expressed understanding of responsible behavior is never a good thing.

Chances are you also exhibit the second warning sign on this list (caring more about appearing rich than becoming rich).

Pay special attention to lies such as:

- exaggerating your earnings

- inflating your net worth

- habitually downplaying your spending to avoid confrontations

- telling lenders you’ll repay them by a certain date you know is infeasible

Some of the worst financial lies are told in an effort to rope people into scams. In this scenario, you’re being irresponsible with other people’s money, which is just plain terrible.

24. You lack financial goals

Any good financial plan revolves around goals. These can range from immediate (i.e. taking a vacation this year) to long-term (i.e. retirement).

The absence of concrete goals leaves you with little reason to save and invest. You’ll almost certainly stop doing those things once something shiny beckons for your dollars.

Make no mistake. There are many applicable financial goals you can set in every stage of life. Failing to identify any simply means you aren’t thinking hard enough, which suggests other flaws in your approach to handling money.

25. You lack impulse control in other areas as well

Research by the University of Western Australia has shown that, unsurprisingly, our values habits typically affect how we handle money. For example, if you have hedonistic tendencies, guess what? Chances are you spend money freely on vices as well.

This is one area in which recognizing the signs of financial irresponsibility can lead to lasting personal growth and development.

I’m a naturally impulsive person. Confronting this issue has produced tremendous benefits for my finances. Seeing my net worth grow as a result has, in turn, motivated me to do even more personal development work.

That’s the power of confronting irresponsible behavior. Your entire life will improve.