Featured image for “How to automate your finances” created by Vectorjuice

Handling money manually is so last year. In this article, I’ll show you how to automate your finances for less stress and greater wealth.

Now, I haven’t always been a fan of automation. Previously, I had concerns regarding security and feeling out of the loop. However, the strategies and tips I’m about to share have addressed these worries for me. I’m sure they’ll do the same for you.

What does it mean to automate your finances?

Before we dive into specific strategies, let’s briefly define financial automation.

It’s simply the practice of telling an algorithm (or several) what you’d like to do with your money and then letting it run.

You don’t need to be a programmer to do this, though. Modern banking applications have made automation quite simple. Often, you can even set it up from your phone.

Whatever device you use, a good financial automation strategy should require as little maintenance as possible. Money should just flow where it needs to on a monthly basis.

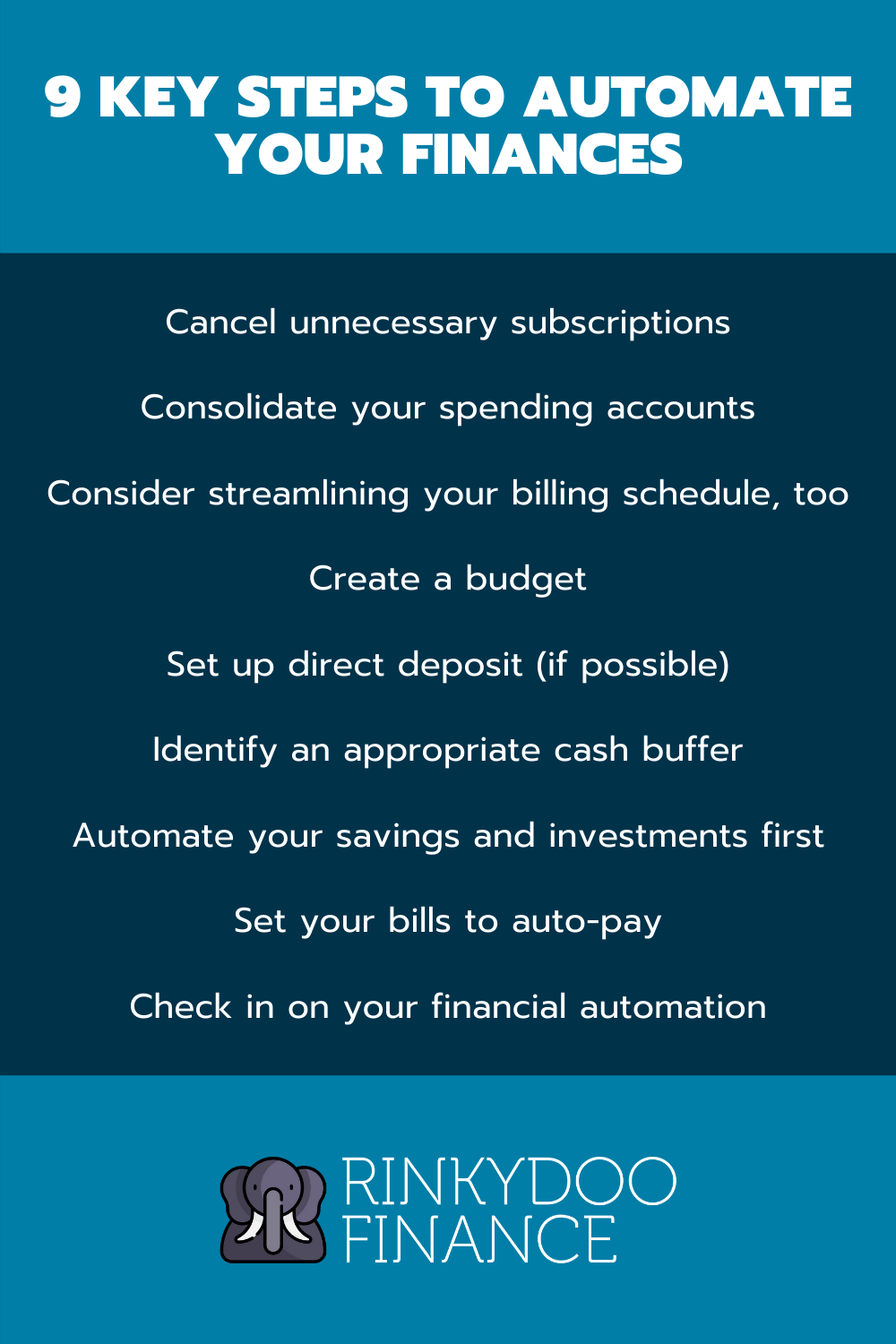

How to automate your finances: 9 key steps

1. Identify and cancel unnecessary existing subscriptions

This is a crucial first step.

Without it, automation will become a massive headache. You’ll lose track of who’s charging what, turning your monthly expenses into an amorphous cluster of frustration.

Avoiding this is easy. Before moving onto the subsequent automation steps, analyze existing subscriptions and cancel anything you don’t need.

If you have relatively few expenses, this should be painless.

Comb through last month’s transactions and highlight unnecessary payments. These may be accounts you don’t use at all or didn’t realize cost so much. Once you’ve identified them, cancel.

If you’re like most people, though, you probably have tons of little subscriptions spread out across various accounts.

That’s where an app like Truebill comes in handy. It will sort through transactions, alert you of any subscriptions, and provide options for canceling. According to Truebill, the average user saves $512 per year with their service. Not bad!

However you choose to identify and eliminate unnecessary subscriptions, do it before proceeding. Trust me, you’ll be glad you did.

2. Consolidate your spending accounts

Another important foundational step involves consolidating your spending accounts. The idea is to eventually run your expense automation through as few accounts as possible.

In doing so, you’ll retain a sense of control over your money. You won’t have to worry about automatic withdrawals placing your accounts into negative balance territory because you didn’t move money around on time.

This may help you save money, too. According to one study, participants with a single bank account spend nearly 10% less.

Closing accounts you no longer need is also an important security measure.

Automation inherently involves granting various third parties access to your money and information. That comes with risks, which you can mitigate by limiting the number of points through which hackers can potentially enter your financial world.

I recommend limiting yourself to one checking account and as few credit cards as possible.

Note: Investment accounts are a different beast. I have several, with each one allocated to a different goal. I’ll touch on investing later in this article. For now, just know I don’t recommend consolidating investment accounts unless you have some other specific reason for doing so (i.e. taxes).

On the credit card front, use your discretion. If you carry a balance, canceling cards – particularly old ones – could tank your credit score if your utilization ratio climbs above 30%. Check out the first point in this article for more information.

If you decide to keep more cards than you use, I recommend signing up for a credit monitoring service. Even a free one like Credit Karma will alert you of suspicious activity. You can also monitor each card’s balance for unauthorized transactions.

Pro-tip

When choosing which accounts to keep, prioritize those with unlimited transactions and minimal fees. Remember, you’ll be running more expenses through them – keep administrative costs to a minimum!

3. Consider streamlining your billing schedule, too

You may find it easier to handle automation if your bills and other withdrawals come due around the same time. Once that date passes, you’ll know any money left in your account is for discretionary spending.

Streamlining your bills in this manner is much simpler than you might think. Most service providers (including auto finance companies) are willing to shift due dates around if you ask. They’ll just prorate your next payment as needed based on the adjustment.

If you get paid biweekly, consider scheduling exactly half of your investment account contributions and bills around the time each paycheck lands. If you get paid monthly, take care of everything on a particular date as early in the month as possible.

Pro-tip

If you have multiple loans, consider consolidating a few of them if that would be financially advantageous.

This is well into the realm of “speak with a financial advisor first,” territory, mind you. I’m only mentioning it because having a single monthly payment rather than several can be quite helpful from the perspective of automation.

If you can secure a lower effective interest rate on your debt via a consolidation loan, even better.

4. Create a budget

Setting up financial automation without a budget is a recipe for disaster.

Thankfully, budgeting really isn’t that difficult. In the first three points of my article about organizing your finances, I provide some detailed tips.

Here’s the quick and dirty approach if you’re looking to automate your finances promptly.

Budgeting for financial automation

1. Determine your monthly income

Budget using your take-home pay net of taxes. That’s what you have to play with on a monthly basis. Your pre-tax income is a less relevant number from that perspective.

2. Set a savings target based on your financial goals

Be as specific as possible regarding your goals, including the amount of money required and your timeline. With these two pieces of information, you can calculate how much you need to save per month.

Don’t have any particular financial goals? Here’s a general hierarchy of priorities based on Dave Ramsey’s 7 Baby Steps.

| Priority | Action |

|---|---|

| 1 | Building a basic emergency fund |

| 2 | Paying off all non-mortgage debt |

| 3 | Building a more robust emergency fund with enough cash to cover three to six months of expenses |

| 4 | Investing in tax-advantaged accounts |

| 5 | Saving money for your children’s education |

| 6 | Paying off your mortgage aggressively |

| 7 | Investing in taxable accounts |

Figure out where you are in this hierarchy and allocate savings towards getting to the next level.

For example, let’s say you’ve completed the second step, which is eliminating non-mortgage debt. Your next goal, based on this hierarchy, would be building a robust emergency fund.

Carefully consider how long it would take you to amass enough cash to cover between three and six months of expenses. Then, allocate an appropriate portion of your monthly budget to achieving that goal.

3. List your typical expenses (including variables like groceries)

Now that you know your income and savings target, see where your expenses fit into the picture.

Determine whether these costs will hold you back from achieving your financial goals. If so, you have some more negotiating (and perhaps even downsizing) to do.

If that’s not possible, you’ll need to reduce your monthly savings target. Treat this as a last resort. The less you save per month, the longer it’ll take to reach your goals.

4. Make sure you’re not spending more than you earn

Combined, your expenses and savings should be either equivalent to or less than your income. This is a sign you’re living below your means, which is the optimal scenario for introducing financial automation.

5. Use a financial tracker to stay on top of your budget

Mint has always been a favorite of mine. Recently, my bank also implemented a pretty good financial tracker I’ve been using to keep an eye on things daily.

It’s particularly useful once you start running automation across multiple accounts since the app will serve as a dashboard for monitoring all transactions.

5. Set up direct deposits (if possible)

Automating your finances is much easier when you get paid via direct deposit. Funds will arrive in your account on a predictable schedule. You won’t have to worry about money not being there when your automation kicks in.

Setting up a direct deposit is quite simple. Most banks offer forms you can download and present to your employer (or any other organization you’re looking to collect direct deposits from, such as the Internal Revenue Service). They’ll handle everything from there.

Now, not all employers offer direct deposit. If yours doesn’t, you’ll need to time your automation carefully and maintain a cash buffer, which is my next tip.

6. Identify an appropriate cash buffer to keep at all times

Automating your finances can be nerve-wracking if your bank account only ever contains the exact amount of money needed to cover your expenses before the next payday.

Instead, maintain a cash buffer in your primary checking account at all times. It will protect you from occasional mishaps, such as delays in your direct deposit clearing.

Generally, one week’s worth of pay is the minimum buffer to keep.

If you’re a particularly cautious person, though, there’s nothing wrong with keeping a much larger buffer. NerdWallet recommends one to two months’ worth of expenses plus 30%.

Just keep in mind checking accounts don’t pay much interest. In other words, your cash buffer will inevitably lose value to inflation. Don’t keep a larger buffer than required to offset risk.

Pro-tip

Your cash buffer is not your emergency fund.

Think of it more like the first line of defense against ordinary mishaps like forgetting to deposit a check before a major expense is due.

Your emergency fund, meanwhile, should be kept for extreme situations like prolonged periods of unemployment.

7. Automate your savings and investments first

Many people take an expenses-first approach to automating their finances. They set bills to auto-pay then “wait and see how that goes” before automating savings and investments.

In my opinion, this puts the cart before the horse. It promotes the idea that someone else’s wealth is more important than your own. With this mindset, you’d likely cut back on investing instead of reducing bills at the first sign of financial difficulty.

So when it comes to automating your finances, start off on the right foot and set up those recurring savings and investment deposits first.

If you have an employer-sponsored retirement plan, consider setting up payroll deductions. That way, a portion of each paycheck will be invested before it even hits your bank account.

When it comes to saving outside an employer-sponsored account, you have many options.

The simplest would be setting up automatic transfers from your primary checking account to savings or investments at the same financial institution.

I like to keep my nest egg far away from accounts meant for daily spending, though. While this requires some extra steps, it’s still quite easy.

Automating savings and investments across multiple institutions

1. Choose a financial institution

Start by identifying a financial institution that meets your needs. If you’re looking to invest, popular options include:

- Wealthsimple (my brokerage of choice)

- Fidelity

- TD Ameritrade

- Interactive Brokers

I strongly recommend choosing a brokerage capable of automating not just your contributions but also the actual investment transactions themselves. You shouldn’t have to step in and purchase the stocks, index funds, or whatever else you’re buying.

Popular options for saving include:

2. Open the right account based on your goals

Once you’ve identified a suitable financial institution, open an account that aligns with your goals. If you’re based in the United States, check out this article for a rundown on various types of investment accounts.

Not sure which account is right for you? Most decently-sized firms have advisors on hand to help. Give them a call. Don’t be nervous about asking “dumb” questions, either. Helping you is in their best interest; they want your business.

3. Set up automatic transfers to your new account

Once you have a new account ready to go, set up automatic contributions.

This is usually handled on the receiving institution’s side. You’ll give them your main checking account information along with the amount they’re authorized to withdraw on a recurring schedule.

8. Set your bills to auto-pay

Once you’ve scheduled your savings and investment transactions, it’s time to automate those bills!

This should also be quite simple, particularly if you followed the third step and streamlined your billing schedule. Just get in touch with your service providers and arrange for automatic payments.

They may require banking information to set things up on their end. In some cases, they may simply give you transfer details and request that you set payments up via online banking.

Pro-tip

I strongly recommend taking a look at your bills and invoices every month even if they’re set to auto-pay. Companies have a habit of sneaking extra charges in and raising rates, which you won’t notice if you’re not paying attention.

It’s also not a bad idea to pay certain bills (i.e. those from a provider you’ve had issues with in the past) using your credit card. This will offer greater recourse in the event of a dispute.

You’ll just need to take the extra step of automating your credit card payments as well.

9. Make a plan for checking in on your financial automation and adjusting it as needed

Once you’ve completed the eighth step, your financial automation should run smoothly for a while – but not forever.

At some point, you’ll probably get a raise, reach a major financial goal, or experience some other change. This may necessitate adjusting the amount of money flowing into various buckets.

Until computers become smart enough to analyze changes in your financial situation and act accordingly, that’s your job. Take it seriously. Otherwise, you’ll soon be following an outdated strategy.

I do a “soft” check-in on my finances every month. I look at my account balances and automation to make sure everything is running smoothly and fix what’s needed.

Once a year – or in correlation with any major financial change, such as a big purchase or raise – I’ll conduct a more comprehensive review and adjust my automation as required.

This schedule works well for me. However, don’t be afraid to choose a different strategy that’s preferable for you. The bottom line is that you must check in on your finances and adjust automation rules as needed.

Pro-tip

When you get a raise, consider using it to achieve financial goals faster rather than increasing your discretionary spending.

In other words, avoid lifestyle creep and increase the size of your savings and investment buckets.

Mistakes to avoid when automating your finances

In showing you how to automate your finances, I’ve touched on a few good catastrophe prevention measures such as consolidating your accounts to increase security and ease of tracking.

Before I wrap things up, though, let’s look at a few stray pitfalls I’d be remiss to ignore in an article about how to automate your finances.

Never looking at your finances again

If you’d like to automate your finances because you believe you’ll never have to look at a bill or bank statement again, I’m afraid you’re misguided.

You certainly won’t have to bury yourself in financial paperwork as often. However, it’s still good to look once in a while and make sure everything’s running smoothly. Otherwise, you’ll get eaten alive by little fees and may even fall victim to serious security breaches.

Forgetting about self-control

Even once you’ve automated your finances, you remain in the driver’s seat. Lapses in self-control (i.e. spending more discretionarily than you were supposed to) can derail your financial automation strategy and require frequent manual adjustments, which defeats the purpose.

I actually didn’t automate my finances until I’d already developed a strong sense of self-control. This wasn’t intentional, mind you. It was just a coincidence in timing. I’m happy it worked out that way, though.

Turning your automation off to make a major discretionary purchase

If you ever need to stop your financial automation for a major discretionary purchase, you didn’t plan properly. You should’ve been saving for that purchase the whole time.

What’s the big deal, you ask? Well, whenever you stop your automation, you run the risk of falling off the path. You’ll have to set everything up again, which takes effort.

It’s very easy to talk yourself out of getting back on track if you haven’t yet observed significant benefits through managing money wisely relative to the joy of discretionary purchases.

Conclusion

I hope this guide has shown you how to automate your finances easily and securely. As mentioned earlier, I was once a skeptic regarding financial automation. It wasn’t until I learned to address the security and cash flow concerns that I warmed up to the idea.

For more personal finance tips, check out my other articles here.